XPIN Plunges 15% Today: Where Will $XPIN Token Land in 2026?

XPIN token takes a nosedive, shedding 15% of its value in a single trading session. The sudden drop sends shockwaves through its holder base and raises urgent questions about the project's immediate trajectory.

Decoding the Freefall

Market sentiment turned sharply against XPIN, with sell orders overwhelming buy-side liquidity. The move highlights the token's volatility and the market's fickle appetite for narratives that haven't yet translated to sustained utility or adoption—a classic crypto tale of hype meeting reality.

The 2026 Horizon: Rebound or Bust?

Looking toward 2026, the path for XPIN hinges on execution. Can the development team deliver on its roadmap and create tangible, used-by-real-people products? Or will it join the graveyard of projects that promised disruption but only delivered dilution? The coming months are critical for rebuilding trust and demonstrating progress beyond the whitepaper.

The Speculator's Dilemma

For traders, this crash presents a high-risk, high-reward scenario. Is this a panic-driven overreaction, creating a prime buying opportunity? Or is it the first crack in the foundation, signaling deeper issues? The answer depends on whether you believe in the team's ability to execute—or just in the greater fool theory of finance, where someone else will always pay a higher price for your digital hope.

One thing's certain: in crypto, a 15% drop is just another Tuesday for some and a life-changing loss for others. The only prediction that's ever safe is that the market will find new and exciting ways to separate the optimistic from their capital.

What’s Behind the XPIN Network Price Crash Today?

According to Binance Wallet official X account, users with at least 233 Binance Alpha Points can claim 14,600 $XPIN airdrop tokens on a first-come, first-served basis. Claiming the rewards consumes 15 Alpha Points. If rewards are not fully claimed, the score limit drops by 5 points every 5 minutes. Users must confirm within 24 hours, or the reward is lost.

This structure increases fast distribution. In simple terms, it adds more free tokens into the market. History shows that airdrop events usually increase sell pressure because many users dump rewards immediately.

XPIN Price Crash Today: Chart Confirms Real Selling

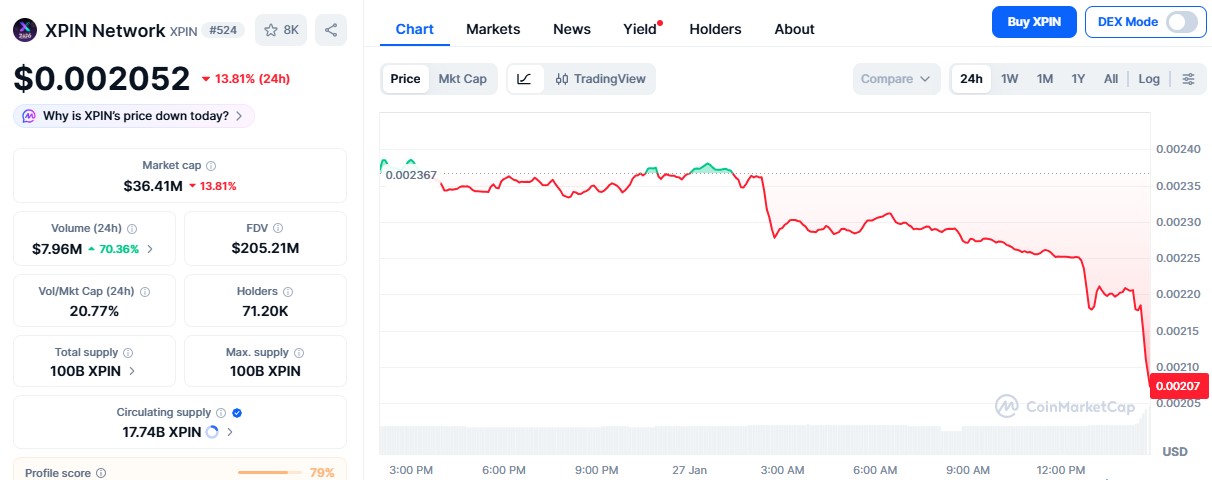

CoinMarketCap data shows the asset’s price dropped to $0.002052, down around 15% in 24 hours. Market cap fell to $36.41M, proving real value loss, not just small moves. Trading volume jumped to $7.96M, up 70.36%.

Rising volume with falling price means distribution, not buying. Big holders are selling while smaller traders absorb losses. The chart shows a slow bleed first and then a vertical dump, which signals panic selling or a liquidity shock.

What traders should watch now:

XPIN price crash broke the key support at $0.00220. Once that level failed, buyers disappeared. Now the $0.00200-$0.00190 level is the last psychological support.

Resistance: $0.00220–$0.00225

Extreme Reward Plans Triggered Fear, Not Confidence

The project also launched its 2026 Freedata Plan. It offers 245% APR, plus 41% extra compounding, and free global eSIM rewards. Deposit tiers include:

-

20,000 coins → 1GB data ($12)

-

200,000 tokens → 10GB data ($95)

-

1,000,000 → 50GB data ($300)

-

5,000,000 → 100GB data ($533)

The event runs from January 19 to January 31, 2026. Such extreme rewards often signal emergency liquidity needs. Instead of building trust, they raise doubts. That is one major reason behind the today's crash.

Price Prediction 2026: More Fall or Recovery Soon?

In the short-term, the XPIN price crash shows weak momentum. As per TradingView chart on-chain price structure and data, RSI is around 14, which shows panic selling. MACD is deeply negative, proving strong downside momentum. If $0.00200 breaks, $0.00190 is possible. Any bounce is likely temporary unless $0.00220 is reclaimed.

Long-term, recovery depends on supply control and trust rebuilding. If inflation slows and real usage grows, it could MOVE back toward $0.00250–$0.00300. The only strong positive XPIN news today is its partnership with zkPass, which will strengthen its privacy, identity, and trust among investors.

If it fails to recover $0.00220 support, the trend stays bearish. Binance airdrop supply can push it lower if demand does not rise fast.

Conclusion

The price is falling because trust is breaking faster than rewards can support it. Binance airdrops and extreme APR schemes add pressure, not stability. Only supply control, and real adoption can repair investors' confidence. Until then, it remains in a damage phase, not recovery.