Ondo Finance Tokenized Assets on Solana Hit 200+ Launch: A New Era for Real-World Assets

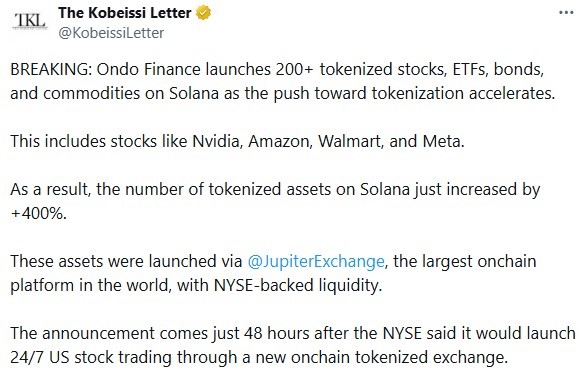

Real-world assets just got a major blockchain upgrade. Ondo Finance has crossed a significant threshold, launching over two hundred tokenized assets directly on the Solana network. This isn't just another protocol deployment—it's a direct challenge to the traditional, slow-moving machinery of asset management.

Bypassing the Old Guard

The move cuts out layers of legacy infrastructure. By leveraging Solana's high throughput and low fees, Ondo is positioning tokenized Treasuries, bonds, and funds not as niche experiments, but as viable, daily-use financial products. It's a play for scale that traditional finance can't ignore—or easily replicate.

Why the Number Matters

Hitting 200+ launches isn't about vanity metrics. It signals deep, operational liquidity and a mature product suite. For institutions and DeFi natives alike, it transforms abstract potential into tangible choice. The network effect kicks in: more assets attract more capital, which in turn stabilizes and validates the entire model. Suddenly, the old way of moving paper looks like a costly antique.

A Cynical Nod to Tradition

Let's be honest—Wall Street has been 'digitizing' assets for decades, often just meaning a new column in an Excel spreadsheet. Blockchain tokenization actually does the job, providing transparency and accessibility that would give a traditional custodian heart palpitations. It turns out, real innovation happens when you stop asking permission from the very institutions you're trying to disrupt.

The final take? Ondo's milestone is more than a press release. It's a market signal. Tokenization is moving from promise to pipeline, and the race to define the future of finance is officially on. The old guard can adapt, or get left holding the (paper) bag.

This development underscores how blockchain technologies are increasingly becoming a part of the broader financial terms and connecting traditional to modern.

What Tokenized Assets Mean and Why It Matters?

Ondo Finance tokenized assets move on Solana means that the users can now trade traditional financial products, like stocks and bonds, on distributed networks directly. Jupiter exchange, Solana’s largest onchain trading platform, worked as the launcher for these assets using NYSE-backed liquidity.

Importantly, the New York Stock Exchange (NYSE) recently announced the plans to support 24/7 trading of U.S. stocks through a new on-chain exchange. This means investors will get more liquidity options, low slippage, and fast settlements. This also contributed to Ondo’s MOVE by building confidence.

Solana’s Demand: Driving Tokenized Real-World Assets

After launching several products on BNB and Ethereum, the firm now expands on Solana, due to its growing popularity.

Solana-chain is seeing rapid growth over the time, and has become a strong hub for real-world assets (RWAs). By early January 2026, digitized RWAs on Solana crossed the $1 billion mark, excluding stablecoins.

Holders of RWA tokens on the network have also increased by 18%-25% on the monthly basis. Here, high speed, low fees, and advancing stability contributed to growth by continuously attracting users and institutions.

Adding on, Ondo’s expansion to Sol pushed it as the third-largest blockchain for non-stablecoin RWAs, with roughly 4.5% global market share. ONDO has also become the largest real-world asset issuer on Solana-network by asset variety.

Why Does This Tokenization Matters Now?

Tokenized markets, especially real-world asset (RWA) represented, are important because they connect traditional finance with blockchain.

Tokenization means converting a real-world asset, whether it’s metal, property, copyright, or share, into a digital coin, which can be traded, managed and owned online on distributed networks.

Investors like the easy access, fractional ownership, low fees, and constant market availability. Here they get everything from investing in RWAs – instant settlement, reduced costs by the elimination of middlemen, and automations with transparency. Currently the market is soaring and build a $362.55B market cap, as per RWA.xyz data

However, some concerns remain, including regulatory limits and blockchain technology's past outages. At the same time, with upgrading infrastructures and increasing institutional demands, the sector continues to hold confidence.

In overall, putting all together, Ondo finance tokenized assets roll out intensifies the trend of traditional finance moving on-chain. If support continues and rules get clearer, Solana-chain could merge as a key player in the future of investing.

This article is for informational purposes only and is not financial advice. Crypto investments carry risks, do your own research before investing.