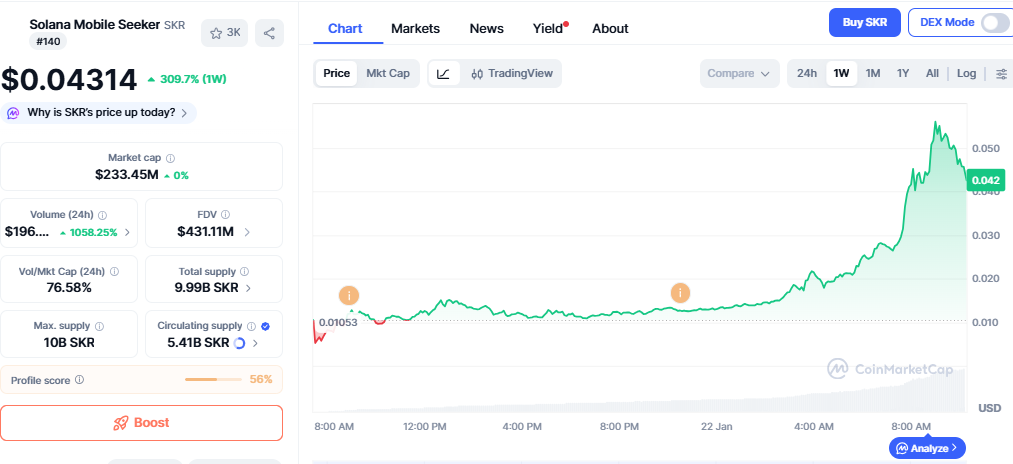

Solana Mobile’s SKR Token Skyrockets: Airdrop Frenzy & Staking Launch Fuel Meteoric Rally

Forget the flagship phone—Solana Mobile's real power move just printed in your wallet. The SKR token isn't just up; it's on a vertical tear, fueled by a perfectly timed one-two punch of airdrop distribution and a live staking launch. This isn't mere speculation; it's a liquidity event that turned token holders into overnight beneficiaries.

The Catalyst: Airdrop Meets Staking

The mechanics are simple, yet devastatingly effective. First, the airdrop flooded eligible wallets with free SKR, creating instant demand and ownership. Then, before the market could even catch its breath, the staking gates swung open. Suddenly, holding SKR wasn't just about potential price appreciation—it offered immediate, yield-generating utility. The market reacted with the subtlety of a sledgehammer, buying pressure overwhelming any initial sell-off from airdrop recipients looking for a quick exit.

Why This Rally Has Legs

This surge feels different from a typical pump. The staking mechanism creates a natural sink, locking tokens away and reducing circulating supply. It incentivizes holding, transforming passive recipients into active network participants. It's a classic, if brilliantly executed, playbook: create scarcity, then reward those who help maintain it. The community isn't just watching the chart; they're actively staking into it, creating a reflexive feedback loop that traditional finance can only dream of—usually after paying a 2% management fee for the privilege.

The Mobile-First Frontier

SKR's explosion underscores a broader thesis: the future of crypto interaction is mobile-native. Solana Mobile's bet on hardware as a gateway for token distribution and engagement is paying off spectacularly. It bypasses app store gatekeepers and brings the action directly to the device in your pocket. This rally proves that when you lower the barrier to entry and directly reward users, adoption isn't just possible—it's explosive.

A New Model or a Clever Gamble?

The SKR saga is a masterclass in tokenomics-driven growth. It demonstrates how aligning incentives between project and community can ignite a fire. But let's be real—sustaining this altitude requires more than clever distribution. The long-term value hinges on Solana Mobile building tangible, daily utility beyond the staking dashboard. For now, though, the market has voted with its capital. It's a bullish signal for the entire mobile crypto stack, a reminder that the most powerful airdrops are the ones that give you a reason to stick around. Just ask your portfolio.

Source: X (formerly Twitter)

This rally happened because three things came together at once: a huge airdrop, high staking rewards, and fast exchange listings. All three created strong demand while keeping selling pressure low.

Airdrop Created Massive Interest

The Solana Mobile Price Surge began with the SKR airdrop. Solana Mobile distributed about 1.82 billion SKR tokens to more than 100,000 Seeker phone users and 188 developer teams. That alone is nearly 20% of the total 10 billion supply.

Users could claim their tokens directly from the Seed Vault Wallet on their phones. Some people sold quickly to make a profit. Others decided to hold or stake. This mix caused heavy trading and pushed daily volume beyond $190 million. It showed that people were seriously interested in Seeker.

Staking Locked Most of the Supply

Staking is one of the biggest reasons the Solana Mobile Price Surge stayed strong. It launched with staking rewards of up to 28% APY. There are no fees, rewards come every 48 hours, and they automatically compound.

Because of this, more than 64% of the circulating supply, around 3.6 billion Seeker, was locked into staking almost immediately. When so many tokens are locked, fewer remain available to sell. This reduces selling pressure and helps prices stay high. It also shows that users believe in the project for the long term.

Exchange Listings Added More Fuel

The price surge got even stronger after it was listed on Kraken, BingX, and Solana-based DEXs like Raydium and Orca. These listings made it easy for traders to buy and sell this token.

BingX also launched a $100,000 trading reward campaign, which increased activity. Liquidity improved fast, and large traders could enter without moving the price too much. This added trust to the rally.

What the Technical Indicators Suggests

It made a sharp upward MOVE and then pulled back slightly. This is normal after a big rally. It usually means people are taking profits, not that the trend is broken.

Source: CoinMarketCap

If the price stays above $0.036, the Solana Mobile SKR Token Price Surge is still healthy. A bounce from here could push it toward $0.050 again. If it breaks above $0.052 with volume, $0.060 becomes possible.

SKR Token Price Prediction

The price rally can continue if staking stays above 50%. That keeps supply locked and reduces selling.

Source: X (formerly Twitter)

Short-term outlook:

Bullish Case: $0.050 to $0.060

Neutral: $0.035 to $0.045

Bearish Case: Drop toward $0.028

As long as staking stays strong, the bullish case has better chances.

Why SKR Is More Than Just Hype?

Seeker is not just for trading. It is the governance and staking token of the Solana Mobile ecosystem. Holders can vote on important decisions and support “Guardians” who help manage the platform.

The Seeker phone already has over 150,000 pre-orders. That gives it real-world use, not just market hype.