Crypto Bill Delay: Brian Reveals "Serious Issues" in Senate Draft - What’s Really Holding Back Digital Asset Regulation?

Washington's crypto legislation hits another snag—and insiders say the problems run deeper than partisan politics.

The Regulatory Roadblock

Senate staffers worked through the holidays on the digital asset framework, but multiple sources confirm the draft contains fundamental flaws. One provision creates conflicting jurisdiction between the SEC and CFTC. Another attempts to redefine "security" in ways that contradict decades of case law. "They're trying to fit decentralized protocols into regulatory boxes built for centralized entities," says a former CFTC advisor. "It's like trying to regulate email using telephone laws."

The Compliance Conundrum

Industry leaders point to specific technical issues: the bill's custody requirements would force most DeFi protocols offshore, its reporting standards demand blockchain analytics capabilities that don't exist yet, and its market manipulation definitions fail to account for automated liquidity protocols. "We're looking at compliance costs that would make traditional finance blush," notes a crypto exchange CEO. "Wall Street spends billions on compliance—crypto startups would need to match that on day one."

The Political Calculus

Behind closed doors, lawmakers face pressure from both sides. Banking committees want consumer protections that satisfy traditional regulators. Tech committees push for innovation-friendly frameworks. The result? A Frankenstein bill that pleases nobody. "Every senator gets to add their pet provision," explains a Capitol Hill staffer. "We've got anti-money laundering requirements that would track every micro-transaction next to clauses protecting developer anonymity."

The Bottom Line

This delay isn't about politics—it's about fundamentals. Regulators want crypto to behave like traditional finance. Developers built systems that fundamentally aren't. Until someone bridges that conceptual gap, legislation will keep hitting the same walls. The cynical take? Maybe that's the point—keep crypto unregulated long enough for traditional institutions to build their own versions. After all, nothing moves slower than government except maybe legacy banks trying to innovate.

Source:X(formerly Twitter)

The Core issue? Banks are terrified of stablecoins. Brian Moynihan, CEO of Bank of America, recently noted that nearly $6 trillion in deposits could potentially flee traditional accounts for stablecoins. Why? Because stablecoins offer higher rewards. Brian argued that instead of trying to ban the competition through a "bad bill," banks should simply pay their customers more interest to stay competitive.

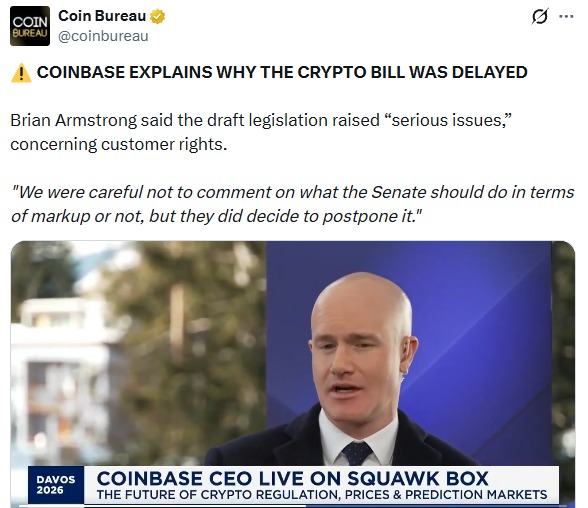

The "Midnight Draft" and the Red Lines

The Crypto Bill Delay wasn't planned; it was a reaction to a last-minute ambush. Armstrong revealed that Coinbase only saw the final text at midnight on a Monday just hours before it was due for a vote. After a quick review, the team found 3 or 4 "red line" issues that they couldn't ignore.

When D.C. lawmakers told Armstrong that these issues couldn't be fixed later, he pulled the plug. "I have zero tolerance for banning competition," Brian said. He believes Americans deserve a level playing field where they can choose the best financial products, whether that’s a bank account or a digital wallet.

Banks vs. Crypto: The Fractional Reserve Fight

One of the most interesting parts of the Davos interviews was Armstrong’s response to bank CEOs who claim crypto companies should have bank licenses. Armstrong's argument is simple: Coinbase isn't a bank because they don't play by "fractional reserve" rules.

Traditional Banks: They take your money and lend it out. If everyone wanted their cash at once, it wouldn’t be there. That’s why they have a high regulatory burden.

Crypto (Coinbase): Armstrong insists on a 100% reserve model. Your money is always there, which eliminates the risk of a "bank run" and, in his view, the need for a traditional bank license.

Market Impact: The $90,000 Tug-of-War

The "blow up" in Washington didn't just stay in D.C.; it sent a shockwave straight through the charts. As news of the CLARITY Act delay hit the wires, bitcoin took a tumble, slipping under the $90,000 mark as traders reacted to the sudden legislative drama.

It was a classic "buy the rumor, sell the news" moment, but with a regulatory twist. Despite the short-term dip and the "risk-off" mood in the air, Brian Armstrong isn't sweating it. He’s staying loud and proud as a massive bull, sticking to his guns with that bold prediction: Bitcoin is headed for $1,000,000 by 2030. For him, this week's price drop is just a small speed bump on a very long, very profitable road.

What’s Next? "Everyone is Still at the Table"

Despite the drama, the Crypto Bill Delay isn't the end of the road. Armstrong noted that this is a CORE part of Donald Trump’s crypto agenda and that bipartisan support remains strong. He spent his time at Davos meeting with bank CEOs to find a "win-win" outcome.

For now, the message to Washington is clear: the industry wants a bill, but they won't accept one that protects the "old guard" at the expense of the American consumer.