RLUSD Binance Listing: Will This Ripple News Propel XRP Back to $2?

Ripple's stablecoin RLUSD just landed on Binance—and the XRP army is buzzing. Could this be the catalyst that finally breaks the multi-year resistance and sends the price soaring back to its former glory?

The Listing Mechanics

Binance adds RLUSD trading pairs, injecting immediate liquidity and visibility. The move signals institutional-grade validation for Ripple's ecosystem—something XRP maximalists have been craving since the SEC lawsuit cloud lifted.

Liquidity Bridges & Price Pressure

Every RLUSD transaction on-chain burns a fraction of XRP. That built-in deflationary mechanic—paired with fresh capital inflows—creates a textbook supply shock scenario. Thin order books above $1 could get vaporized if momentum kicks in.

The $2 Psychological Barrier

XRP hasn't touched that level since the 2018 mania. Breaking it requires more than hype—it needs sustained volume from both retail FOMO and real-world adoption. RLUSD's utility in cross-border settlements might just be the missing link.

Regulatory Tailwinds

Clearer frameworks are emerging globally. Japan's FSA already green-lit RLUSD for trials. When regulators play nice, traditional finance money follows—usually late, but in overwhelming amounts.

The Cynical Take

Let's be real: another 'Ripple news pump' would surprise exactly no one in crypto. The pattern is older than some altcoins themselves—announcement, speculation, volatile spike, then the slow bleed while everyone waits for the *actual* adoption to materialize. This time feels different though—the infrastructure's finally built.

Will history repeat, or will RLUSD be the piece that finally completes Ripple's puzzle? The charts don't lie—and right now, they're whispering about a liquidity surge waiting to happen.

Source: X (formerly Twitter)

This will allow users to trade pairs like RLUSD/USDT and XRP/RLUSD. Trading will start at 8:00 a.m. UTC, with deposits already open on ethereum and withdrawals beginning on January 23. Support for the XRP Ledger (XRPL) is coming soon, which means users will soon be able to use the stablecoin directly on Ripple’s own blockchain.

Why does the Binance Listing Matters?

This puts Ripple’s stablecoin in front of millions of traders worldwide. Binance brings huge liquidity, global access, and strong trust. This makes the stablecoin easier to use for trading, payments, and financial applications.

The exchange is also offering zero trading fees on select pairs. This will enable more activity and make the stablecoin more attractive for short-term traders and long-term holders.

It was launched in December 2024 and is fully backed 1:1 by U.S. dollars, short-term U.S. Treasuries, and cash equivalents. Today, it has crossed a market cap of $1.3 billion, proving that demand is growing fast.

Built for Ethereum and XRPL

One special feature of this stablecoin is its multichain design. It already runs on Ethereum and will soon be live on XRPL. The listing supports Ethereum first, with XRPL integration coming shortly after.

Ethereum gives it access to smart contracts and DeFi tools. XRPL will offer faster transactions and lower fees. This makes it flexible and useful for both developers and institutions.

More Utility Inside Binance

The listing is not limited to trading. Binance plans to add this to:

Portfolio Margin

Binance Earn

Other financial products

This means users can earn yields, use the stablecoin in strategies, and hold it as a stable financial asset. It increases RLUSD’s real-world use beyond simple buying and selling.

Ripple’s Push for Stablecoin Adoption

The organisation has been pushing stablecoins strongly on the global stage. At Davos 2026 WEF Ripple took part in major discussions about digital finance. The company believes regulated stablecoins will improve cross-border payments and bring speed and transparency to banking systems.

Can the RLUSD Binance Listing Help XRP?

Right now, xrp price is under pressure due to the broader crypto market.

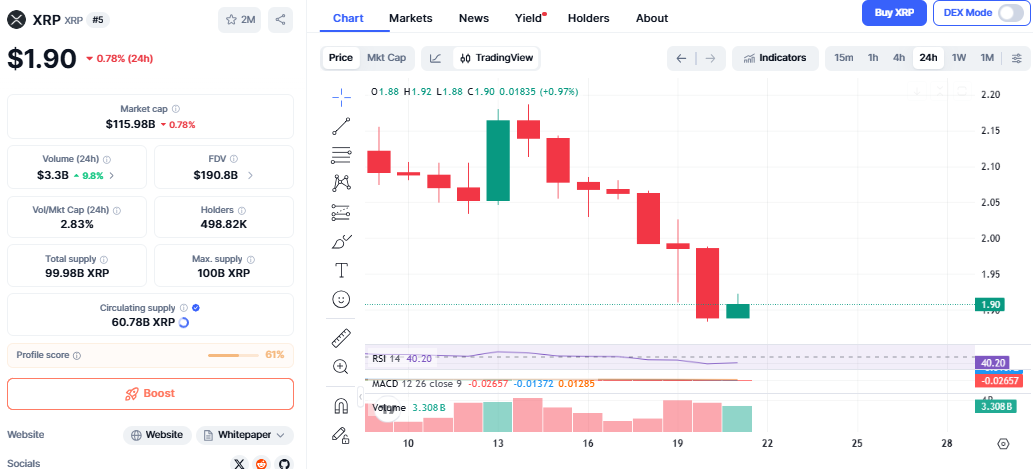

The RLUSD Binance listing can improve sentiment for XRP, but the chart still shows caution.

Source: CoinMarketCap

It is trading NEAR $1.90, down about 0.78% in 24 hours, while volume is rising, which shows active trading.

In the 1-hour chart, the RSI is at 45, implying neutral momentum. MACD is still weak. The altcoin requires strong buying forces for it to move higher.

On the 24-hour chart, RSI is close to 40, close to oversold, but a possible minor bounce is anticipated. MACD is negative, but selling pressure appears to be weakening.

If buyers intervene, XRP can MOVE to $1.95. A break above $1.95 can provide a pathway to $2.00.

If it loses $1.88, price could drop toward $1.81.

In short, the listing supports Ripple’s ecosystem, but XRP still needs to reclaim $1.95 to turn bullish.

Conclusion

This is a big boost for Ripple with the RLUSD binance listing. This is because the move will see the regulated and enterprise-grade stablecoin reach a wider market.

Although XRP is experiencing market pressure, this development shows the organisation is looking towards the future. By listing on the largest crypto exchange, it is clear that Ripple is more concerned about the future of finance rather than the short-term market price moves.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.