Europe Dumping US Bonds? Trump’s Tariff Threat Sparks "Sell America" Panic

Trump's latest tariff bomb just lit the fuse. Markets are bracing for a transatlantic financial firestorm.

The Domino Effect

It starts with steel and aluminum. Then it spreads to Treasuries. European capitals aren't just talking retaliation—they're reportedly running the numbers on a mass sell-off of US debt. Why hold the bonds of a country actively taxing your exports? The math gets ugly fast.

Liquidity vs. Leverage

Dumping bonds floods the market with supply. Yields spike. The US government's borrowing costs? They skyrocket. It's the ultimate leverage play, turning America's own debt market into a weapon against it. A classic case of the borrower suddenly fearing the banker.

The Digital Safe Haven Whisper

While traditional finance clutches its pearls, a parallel narrative is gaining volume. This kind of geopolitical fracture is exactly why decentralized assets were built. No central treasury to weaponize. No border to tariff. The flow just... continues. Funny how the 'barbarous relic' crowd gets quiet when real barbed wire goes up on trade.

Washington's trillion-dollar IOU just got a lot more interesting—and a lot less friendly. The 'full faith and credit' of the United States now hinges on a trade war tweet. As one cynical fund manager put it, 'They taught us diversification. They just never said we'd need it from our own allies.'

This is dangerous because the United States economy depends heavily on foreign money. Once that trust weakens, everything from stocks to crypto can shake.

Europe US Trade War Update: What Does the “Sell America Trade” Means

The trigger came from politics. On January 17, Donald Trump posted on Truth Social that European countries like Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland WOULD face a 10% tariff from February 1.

He also added that from June 1, this tariff would rise to 25%. These taxes would stay until a deal was reached for the “complete and total purchase of Trump Greenland.” This has added fuel to the US Europe tension narrative.

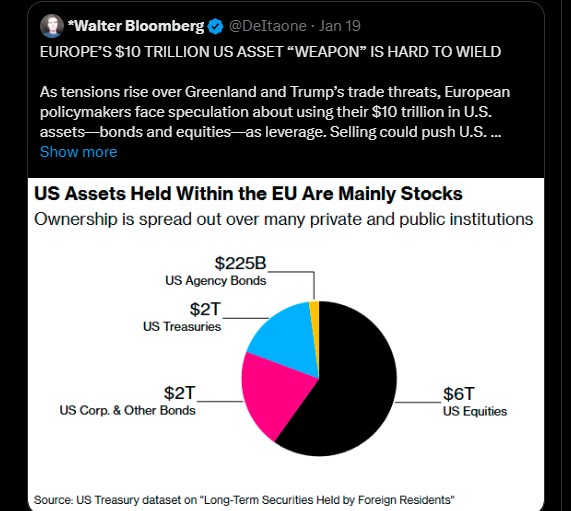

After this news, Walter Bloomberg recently highlighted that the EU owns between $8-$10 trillion in US bonds and equities. This is almost twice as much as the rest of the world combined.

This is why analysts call it the “Sell America trade weapon.” If news of Europe selling of US bonds comes true, the United States borrowing costs will rise,along with bond yield, and the dollar will weaken.

But Walter Bloomberg pointed out these assets are owned by private investors, not governments. Any forced selling would hurt both the countries equally. That is why strategists say the chance is low, but the risk is real.

The Europe Selling US Bonds Reaction? Cryptocurrency Goes All Red

The reaction has already started as crypto crashed around 3% today. Nearly $150 billion was wiped out. bitcoin slipped back to $89K after failing at $91K.

Ethereum lost its $3,000 level and is now trading NEAR $2,959. XRP also fell around 2% in the last 24 hours. This shows how sensitive the financial industry is to global political and money flow risks.

This blood-red reaction is just from fear. No assets have been sold yet. Imagine what happens if Europe Selling US Bonds becomes real.

Europe America News After Effects: What More To Come in Crypto?

If European countries begin to sell U.S. securities, global liquidity will shrink. Investors will pull money from all risky assets, including crypto.

Bitcoin could drop 8–12% quickly. That places BTC in the $80K–$82K zone. If panic deepens, $76K becomes possible before real support appears.

Ethereum is weaker than Bitcoin right now. It already lost the $3,000 level. ETH could drop 12–18%, which brings the bearish level around $2,300. Altcoins usually fall harder. XRP’s 2% drop today is just the start of a panic phase.

Even Deutsche Bank analysts warned that America depends deeply on foreign capital. Once that stops, the dollar’s power becomes weak. This is why the Trump Europe tariff trade war is not just a market story. It is a structural risk to the global financial order.

Conclusion

Europe Selling US Bonds and the Sell America trade are real tail risks, not market rumors. First comes panic, falling prices, and lost liquidity. Then comes a shift in trust, weaker dollar strength, and Bitcoin’s return as a hedge. Cryptocurrency remains a short-term risk asset and a long-term protection tool against weakening confidence in traditional financial systems.