Galaxy Doubles Down: Launches $100M Crypto Hedge Fund to Capitalize on Market Volatility

Institutional heavyweight Galaxy isn't just weathering the crypto storm—it's betting big on the turbulence. The firm just unveiled a new $100 million hedge fund, a direct play on the wild price swings that define the digital asset space.

Why launch now?

Forget the cautious whispers from traditional finance. Galaxy's move screams conviction. The fund targets sophisticated strategies—long-short plays, arbitrage, derivatives—designed to profit whether markets soar or crater. It's a tool built for the chaos, not in spite of it.

The volatility playbook

This isn't about buying Bitcoin and hoping. It's about active, aggressive management. The fund will leverage Galaxy's deep market infrastructure and data analytics to navigate the very conditions that scare off retail investors. Think of it as a volatility harvesting machine.

A signal to the skeptics

While pundits debate 'crypto winter,' institutions are quietly building. A nine-figure commitment during uncertainty sends a clear message: the smart money sees long-term opportunity in the short-term noise. It's a classic hedge fund move—find inefficiency and exploit it, even if it means wading into what traditional finance still views as the Wild West. After all, what's a little market mayhem compared to the steady, predictable losses of a 2% management fee on underperforming legacy assets?

The launch underscores a pivotal shift. The narrative is evolving from speculative gambling to sophisticated risk management. Galaxy's bet isn't just on crypto's future—it's on its present volatility as the ultimate asset class.

This strategy emerges when cryptocurrency exchange-traded funds (ETFs) and other hybrid models are on the rise, providing investors with greater safety while preserving potential benefits associated with volatile cryptocurrency markets.

Billion Dollars Giant Galaxy Expands into Cryptocurrency World

Founded in 2018, Galaxy Digital has expanded into a $17 billion asset manager, trading, lending, asset management, and venture services for digital assets. Both organizations also have a history of connecting the traditional financial system with cryptocurrencies and are continuing with this tradition with the launch of the hedge fund.

Under this, the crypto hedge fund will allocate up to 30% directly in cryptocurrencies like Bitcoin, Ethereum, and other selected tokens. The remaining 70% will go into equities linked to the cryptocurrency ecosystem, such as miners, exchanges, blockchain infrastructure firms, and financial service companies influenced by digital assets.

Galaxy’s approach balances risk with tokens and equity exposure, and that’s how the funds work – offers a more balanced risk profile than traditional crypto-only investments.

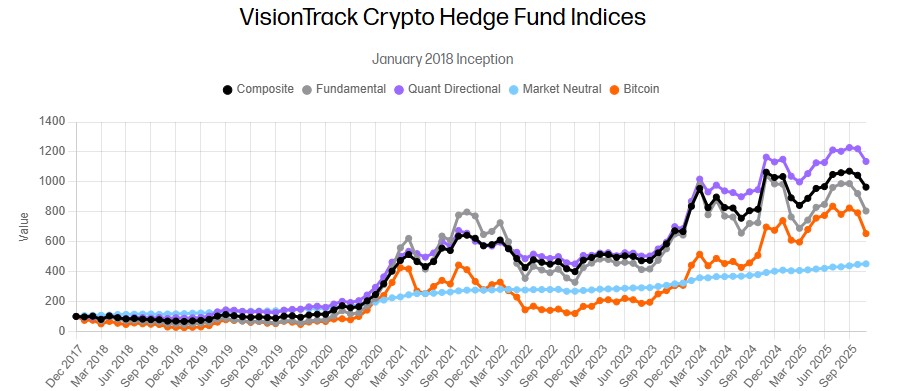

Trending in Markets: Understand Crypto Hedge Funds

Crypto hedge funds are investment vehicles that combine cryptocurrencies with equities, derivatives, or venture investments in pursuit of risk-managed returns. Most funds still keep direct crypto allocation below 50%, reflecting caution among institutional investors.

In the latter half of 2025, there are in excess of 400 active hedge-funds operating worldwide, with the overall money under management estimated to range between $82-$136 billion. This is an average of $132 million each per fund. More so, traditional hedge-funds have increased exposure to digital assets, as presently, 55% hold some cryptos and intend to increase the allocation over time.

Other Major Players in the Space

While the acceptance and trend is this much high in the marketplaces, many other major firms are already in it, leading the space a way before. Some of the famous similar launches include:

BlackRock – Cryptocurrency investment products combining digital assets with blockchain-related equities.

Pantera Capital – Multi-strategy fund blending liquid tokens and venture investments in blockchain startups.

Multicoin Capital – Venture-hedge hybrid with early-stage tokens and public equities in ecosystem players.

BlockTower Capital – Quantitative strategies mixing DeFi tokens, liquid cryptos, and equity stakes.

As in the Galaxy case, these funds are institutional in focus, seeking to provide diversification between direct crypto investment and equity or infrastructure investments.

Conclusion

This development has brought about positive reactions on social platforms. Investors perceive Galaxy’s fund as an element of indirect capital entry into the cryptocurrency market. This MOVE symbolizes confidence in the digital currency market despite the volatility that the market is facing.

Though a small fraction of the $5 trillion overall hedge funds market, virtual assets have increasingly adopted exchange-traded funds, exchange-traded products, or hybrid strategies which pair cryptocurrencies with equity or mining.