Grayscale NEAR Trust Targets NYSE Arca Listing as Crypto Markets Churn

Grayscale makes another power play—this time with NEAR. The digital asset manager is pushing to list its NEAR Trust on the NYSE Arca, a move that would throw open the doors for traditional investors to get exposure to the protocol without the headache of self-custody. It’s a classic institutional gateway move, timed for when retail sentiment is shaky.

The Regulatory Gauntlet

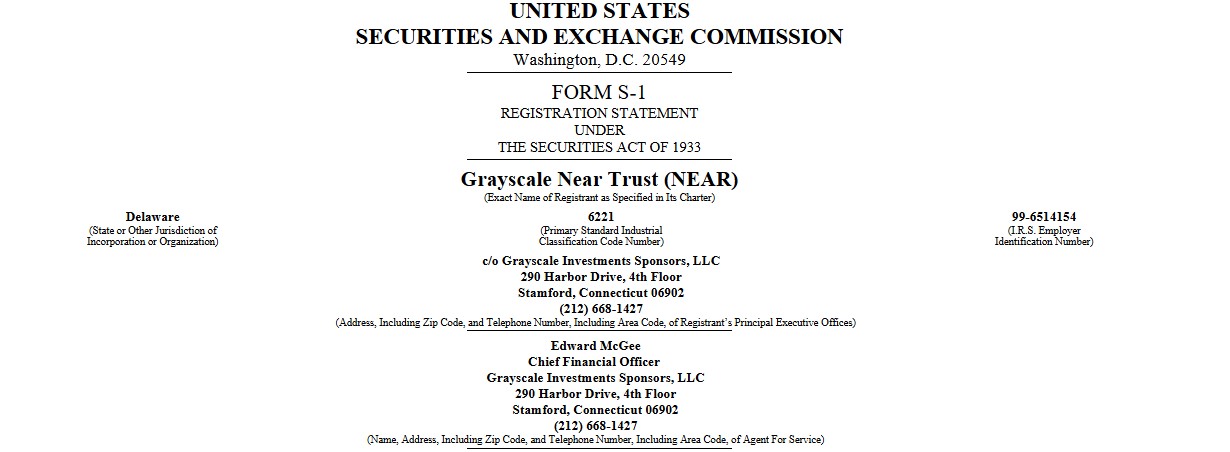

Getting the green light from the SEC is never a given—it’s a marathon of filings, reviews, and enough legal jargon to make your eyes glaze over. Grayscale’s betting its established track record and the sheer force of precedent will see it through. After all, they’ve done this dance before with other trusts.

Why This Matters for NEAR

A listed trust isn’t just another fund; it’s a legitimacy stamp. It signals to the broader market that an asset is mature enough for a regulated wrapper. For NEAR, it could mean a fresh wave of capital from investors who’d rather have a ticker symbol than a seed phrase. Liquidity begets liquidity.

Timing is Everything (Or Is It?)

Launching into a volatile market looks gutsy—or desperate, depending on which finance bro you ask. But for the long game, establishing the infrastructure during the dip means being ready to catch the updraft. It’s a calculated bet that regulatory approval will take longer than the current market malaise.

The bottom line? Another brick is being laid in the wall between crypto’s wild west and the manicured lawns of traditional finance. Whether that wall protects investors or just corrals them for easier shearing is, as always, a matter of perspective.

The filing comes as crypto exchange-traded products are gaining continuous momentum, following multiple U.S. approvals for spot crypto ETFs. Importantly, altcoin investment products are increasingly used by institutions, with Grayscale’s latest layer-1 exposure being the newest addition.

So, could this be the push altcoins are needed in 2026, especially when the market is currently facing high volatility?

Grayscale NEAR Trust: Expanding Access

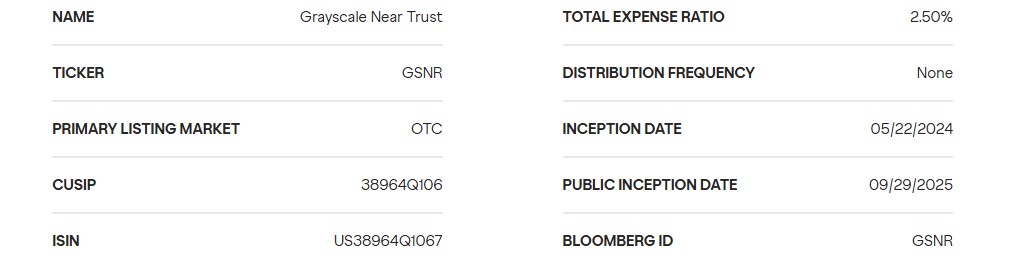

The trust was originally launched in May 2024 under private investment mechanisms. The product later became publicly quoted on over-the-counter (OTC) Markets in September 2025 under the ticker GSNR, allowing comparatively broader access.

OTC Markets Group is a U.S. financial marketplace where securities are traded through broker-dealers instead of centralized exchange, which provides public market exposure, though transparency standards remain more limited, as it’s outside the regulated one.

Currently traded on OTC markets, the Grayscale NEAR trust reported a net asset value (NAV) of $2.19 per share, with assets under management near $900,000. However, like several products of the firm, GSNR has traded at notable premiums and discounts compared to its NAV.

Now, Grayscale NEAR trust seeks to expand by listing on NYSE Arca. This step WOULD significantly improve liquidity, visibility, and accessibility for institutional investors who prefer major U.S. exchanges.

This filing underscores the similar approach that the firm followed for Solana and Cardano products as well. It also highlights how institutional interest is building around new chains and supporting them.

NEAR Protocol: Technology Strengthens Investment

NEAR Protocol is a layer-1 blockchain built for scalability and speed. The infrastructure mainly achieves its scalability through two major systems:

Nightshade sharding system: It allows parallel transaction processing.

Doomslug consensus mechanism: It delivers near-instant finality.

In 2025 and 2026, NEAR positioned itself as an infrastructure for AI agents and cross-chain execution, focusing on intent-based transactions and seamless user experience.

Currently, the token is facing pressure following the broader crypto market downtrends due to geopolitical tensions. At the time of writing, it traded around $1.54, showing a 2.56% decline in the past 24 hours, with a market cap of $1.95 billion (-2.56%).

The market experts, however, expect that development like this filing, aligning with growing institutional interest in blockchain infrastructures could support its price rally, by integrating real-world, high-frequency application in near future.

Community Sentiments

Supporters view the step as a significant vote of confidence from one of the largest crypto asset managers during this period of volatility. Critics, on the other hand, argue on $NEAR’s price performance, which is not only down on weekly status, but showing a large gap on yearly data.

Despite skepticism, Grayscale’s expansion efforts suggest that institutional appetite for diversified altcoin exposure remains firm in 2026.