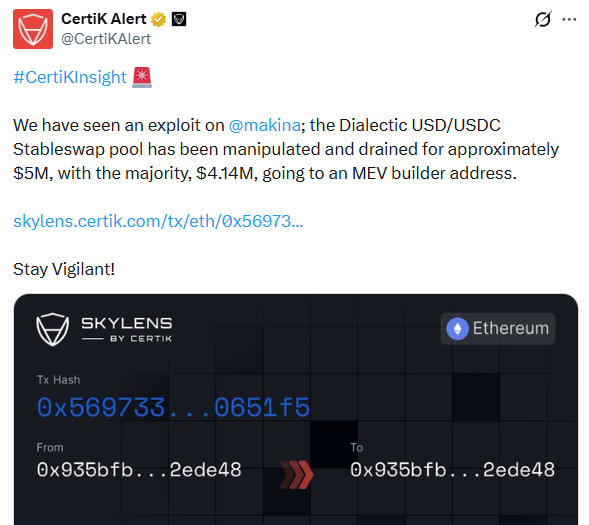

Makina Finance Hit: $5 Million Vanishes in Flash Loan Exploit

Another day, another protocol left holding the bag. Makina Finance joins the not-so-exclusive club of DeFi platforms to get a multimillion-dollar lesson in smart contract security.

The Attack Vector: Flash Loan Flaw

The exploit leveraged the classic flash loan mechanic—borrow massive, uncollateralized sums, manipulate protocol pricing, and repay the loan all within a single transaction block. It’s the digital equivalent of a smash-and-grab, leaving no trace but an empty vault. The attackers identified a pricing oracle vulnerability, allowing them to artificially inflate the value of certain assets within the system before draining liquidity.

The Aftermath: $5 Million Gone

The damage is quantified at a clean $5 million. Funds were swiftly bridged out and laundered through mixing services, following the now-standard playbook for such heists. The protocol's token took an immediate nosedive, punishing loyal holders for the team's oversight—a classic case of 'your keys, your coins, but our bug, your problem.'

A Pattern, Not an Anomaly

This incident isn't an innovation; it's a repetition. It highlights the persistent gap between complex financial engineering and bulletproof code. While teams race to build the next yield-generating lego piece, security often feels like an afterthought—the boring compliance department of the crypto world.

The takeaway remains grimly consistent: in the high-stakes casino of decentralized finance, the house doesn't always win. Sometimes, a sharper player finds a crack in the rules and walks away with the jackpot. Until the industry prioritizes robust audits and formal verification over hype and TVL growth, these multi-million-dollar tutorials will keep on coming.

The most fascinating part of this story isn't just the theft it’s that the original hacker actually got "mugged" mid-heist. As they were trying to pull off the job, a specialized MEV (Maximal Extractable Value) bot spotted the transaction in line, jumped ahead, and snatched $4.14 million of the loot for itself. Essentially, the hacker did all the hard work, but a bot walked away with the majority of the prize.

The "Oracle Trick": How the Millions Vanished

So, how did they actually do it? The attacker used a classic, albeit complex, "oracle manipulation" trick. They started by taking out a massive $280 million flash loan in USDC. They didn't need any collateral to do this; they just had to promise to pay it back within seconds.

With that mountain of cash, they flooded the system to trick the MachineShareOracle the digital "price tag" the protocol uses to know what its assets are worth. By skewing the numbers, they made the protocol believe its shares were way more valuable than they really were. Like a glitch at a grocery store making a $1 loaf of bread look like it’s worth $100, the attacker used that fake value to drain the DUSD/USDC Curve pool of over 1,299 ETH.

Market Context: Ethereum Navigates Volatility

Amidst the news of the Makina Finance exploit, the broader market is feeling the heat. As of January 20, 2026, Ethereum (ETH) is currently trading at $3,111.04, reflecting a 3.4% dip over the last 24 hours. This localized turbulence on Makina Finance comes at a time when the global crypto market cap has slid by roughly 3% to $3.21 trillion, driven by a wider "risk-off" sentiment in the financial world. Despite being approximately 37% below its all-time high of $4,953.73 reached in August 2025

Where the Money is Now

Right now, the funds are sitting in a few specific digital wallets that security firms like CertiK and PeckShield are watching like hawks. About $3.3 million is sitting in one address, while another $880,000 is parked in a second.

Makina Finance has officially hit the "panic button," activating a Security Mode across all their automated vaults. The team was quick to point out that the damage seems to be limited only to the DUSD liquidity positions on Curve. If you have money in other parts of their system, they say those "underlying assets" are still safe, but they aren't taking any chances.

A Wake-Up Call for 2026

This hit comes at a time when the crypto world was hoping for a quieter year after the billions lost in 2025. It’s a stark reminder that in the world of DeFi, code is law but if that code has a single crack, someone (or some bot) will eventually find it. Makina is currently asking anyone with funds in the DUSD Curve pool to withdraw immediately while they figure out the next steps for a potential recovery.