Paradex Bitcoin $0 Glitch Triggers Liquidations and Rollback: A $0 Price Tag That Cost Traders Millions

A single, impossible number just sent shockwaves through a crypto derivatives platform—and forced a stark choice between chaos and a full reset.

The $0 Glitch That Broke the Ledger

Imagine logging in to see Bitcoin, the digital gold standard, priced at a crisp zero dollars. For users on the Paradex perpetual swaps exchange, that wasn't a thought experiment—it was a temporary, system-shattering reality. The platform's price oracle, the external data feed that determines asset values, briefly reported BTC at $0. In the hyper-leveraged world of crypto derivatives, that kind of error doesn't just raise eyebrows; it triggers automated financial carnage.

Liquidations En Masse and the Rollback Dilemma

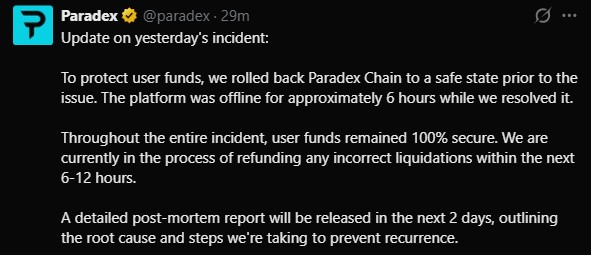

The immediate consequence was a wave of forced liquidations. Margin calls fired instantly, closing out leveraged positions at a 'value' of nothing and vaporizing trader collateral. The glitch created a ledger of transactions that reflected a market reality that never existed. Faced with this, the Paradex team made the controversial call: a full state rollback. They effectively rewound the platform's transaction history to a point before the oracle failure, undoing all trades and liquidations stemming from the faulty data.

Trust in the Machine—Now with an Asterisk

The incident throws a harsh light on the fragile plumbing of decentralized finance. Oracles are critical infrastructure, single points of failure that bridge off-chain data to on-chain smart contracts. When they hiccup, the 'trustless' system stumbles. The rollback, while arguably necessary to correct an egregious error, also contradicts the immutable 'code is law' ethos. It proves that when enough money is on the line, even decentralized platforms can hit Ctrl+Z. A sobering reminder that in crypto, your gains are only as solid as the weakest data feed—and that sometimes, the only thing moving faster than a bull market is a team of devs reversing a multi-million dollar mistake. Just another day where the 'future of finance' has to pause and reload its last save.

Following the incident, services on the platform were halted for around six-seven hours. In order to counter the losses, the engineering team rolled back the chain to block 1,604,710 to reverse impacted transactions and removed pending trades that users had placed but that were not executed due to the error.

Risks in DeFi Perpetual Markets: Reason and Result

The glitch occurred during routine maintenance when Paradex’s internal pricing system got de-synced with on-chain data. This caused bitcoin and possibly other assets to display $0 temporarily.

This raised concerns about how “decentralized” exchanges are also under off-chain dependency risks. Community perceptions are also varied where some appreciate the rapid recovery process, while others are nervous on the rollback move, stating it damages blockchain’s natural sovereignty.

$STRK (Starknet token) dipped slightly by 3–4%, the broader crypto market remained mostly unaffected. Experts note that high-leverage trading combined with automated liquidations and reliance on data feeds creates unique risks in DeFi.

Starknet native token, STRK, dipped 3–4% with the whole crypto market’s 2% downtrend. However, the broader market mainly suffered due to Trump tariffs news rather than Paradex Bitcoin $0 glitch.

Similar Cases in DeFi and Crypto

There are a few instances in the past where the price mistakes or oracle issues resulted in a trigger for a liquidation. These are:

October 2025 Flash Crash: A problem with oracles in Cosmos (ATOM) resulted in a crash where its native token price dipped closer to $0 along with other tokens, unleashing

Mango Markets Exploit (2022): The attackers were able to withdraw ~$117M by manipulating oracle pricing.

bZx Flash Loan Attacks (2020 - present): The flash loans were exploited by attacking oracles, causing millions in liquidations.

Although Paradex’s glitch was an internal problem, still, these incidents put light on the risks that can eventually affect the autonomous DeFi space.

Why It Matters

The Paradex glitch of $0 BTC matters because it highlights the hidden concerns in Decentralized trading platforms, even in advanced infrastructures. Many users consider DeFi as a well-secured and autonomous space, which it actually is, but some off-chain parameters like databases, maintenance scripts can break this position, as we have seen in some of the above cases.

The rollback also triggered some questions about the finality of the blockchain. An essential benefit of the blockchain technology concept is the fact that transactions are Immutable and permanent. However, if the platform reverses the blocks to correct an error, it is almost like “centralized override.”

Knowledge about updates on trading platforms and off-chain dependencies is as essential as market research. Although Paradex compensated for these issues, this is not a feature on all DEXs. Therefore, caution is essential for those trading on high-leverage trading applications and newly created DEXs based on application-chains.