Gold Surges as Tariffs Bite: Will Bitcoin Explode or Implode Under EU-US Trade War Pressure?

Trade tensions are back with a vengeance. The latest tariff salvos between the EU and US have sent traditional safe-haven assets like gold into a sharp rally. But all eyes are now on the digital frontier—where Bitcoin sits at a critical inflection point.

The Flight to Safety—Or Is It?

When geopolitical fists start flying, capital traditionally runs for cover. Gold’s spike is the textbook play. Yet this isn’t 2008. We have a new, volatile contender in the ring: decentralized digital assets. Bitcoin doesn’t trade on industrial demand or central bank whispers. It trades on narrative, liquidity, and a growing reputation as ‘digital gold.’ A reputation now facing its sternest stress test.

Bitcoin’s Bifurcated Path

Two stark scenarios emerge. In one, Bitcoin gets dragged down with risk assets—tech stocks, speculative plays—as fear freezes all but the most essential capital. In the other, it fulfills its promise as a sovereign, borderless hedge, attracting a flood of capital fleeing currency manipulation and capital controls. The trigger won’t be the headline tariff rate; it’ll be the downstream chaos—currency devaluations, supply chain breakdowns, and that classic political move: blaming everyone else while printing more money.

The Cynical Take

Let’s be real. The same institutions now quietly accumulating BTC are the ones whose policies created the demand for it. Nothing fuels crypto adoption like watching traditional finance set its own house on fire—then charge you a fee for the water.

The verdict isn’t in. Watch the charts, but more importantly, watch the policy responses. When governments start throwing sand in the gears of global trade, smart money starts looking for a gearbox they can’t break. The next few weeks will show if Bitcoin is just another speculative toy, or the escape hatch it claims to be.

Source: Investing.com X (formerly Twitter)

President Trump's threats of heavy tariffs against a number of European countries sent shockwaves through investor confidence.

The rally gained speed after TRUMP threatened heavy export rates on European countries, including a possible 200% tariff on French wine after Emmanuel Macron reportedly refused to join the so-called “Board of Peace.”

As risk rises, money leaves volatile assets and finds its way into the SAFE havens like gold and silver.

Gold Rally Amid Tariffs Shows Strong Safe-Haven Demand

The Gold hitting all time high during Trump Tariffs threat is not just a short-term spike.

XAAUSD is up nearly 78% in the last 12 months and already up 9% in the first weeks of 2026 as per the Kobeissi Letter.

Silver has jumped more than 30% this year alone.

In market value terms, XAUSD has added about $2.7 trillion since the start of 2026, while silver has gained nearly $1.2 trillion.

Just today, XAUSD added roughly $787 billion and silver added $160 billion.

These numbers show how powerful this MOVE is. Investors are not buying XAUSD only because of inflation. They are buying it as protection against global instability, rising tariffs, and geopolitical tension.

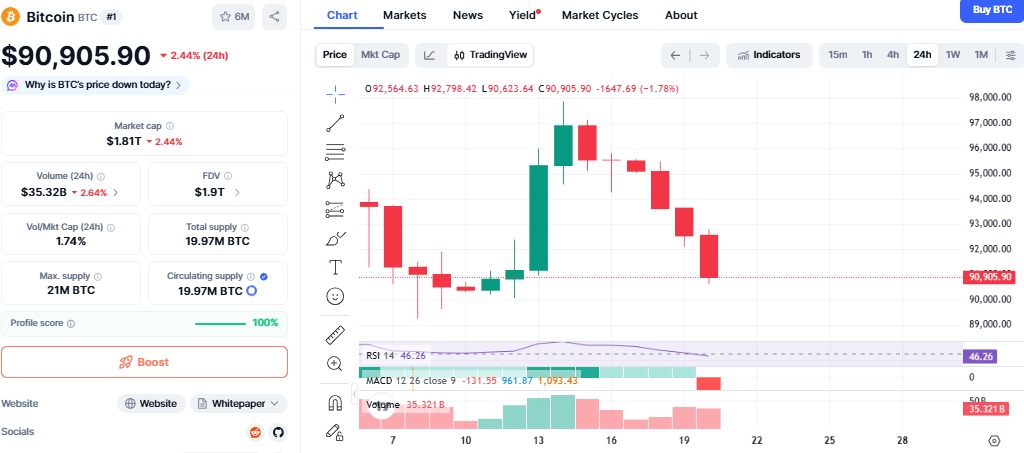

Bitcoin Falls as Gold Rally Gains Strength

While precious metals rise, Bitcoin is struggling. BTC has dropped below $92,000 and is down nearly 1% in the last 24 hours. The broader crypto market crashes about 1.23%.

Source: CoinMarketCap Data

The US-EU trade tensions spotlights the risk-off environment. With increasing fear, the market sees fewer traders taking positions in high-risk assets like BTC.

865 million BTC long liquidations

$400 million from ETF outflows

Crypto Fear & Greed Index: decreased to 42 (Neutral)

This is an indication that “confidence is cooling,” but BTC is “still strong overall looking at the long-term rally.”

Trade Wars Are Driving the Shift

The current Gold price surge is directly tied to political pressure. Trump announced 10% tariffs on 8 European countries starting February 1, rising to 25% by June. The demand that Europe supports U.S. control over Greenland has added another LAYER of tension.

European leaders have called these moves economic coercion. Emergency talks are underway in Brussels. Markets fear retaliation, trade slowdowns, and damage to global growth.

History shows that when trade wars rise, physical metal assets usually performs well.

What Does This Means for Bitcoin?

The Gold Rally Amid Tariffs does not spell the end for Bitcoin. But in the short run, it certainly indicates that bitcoin is acting like a risk asset.

If tariffs continue to rise and stocks plummet, pressure on Bitcoin might rise further. In the case of a stock market crash, crypto is bound to get hurt first.

However, some analysts believe BTC is oversold while the yellow metal asset is becoming overbought. This could lead to a reversal once panic cools. Bitcoin still benefits from long-term narratives like digital scarcity and decentralization.

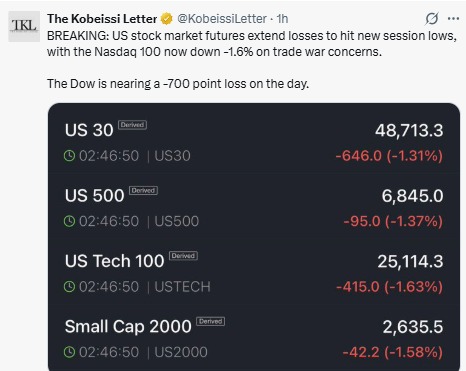

Stocks Also Under Threat

The US stock market is flashing warning signs. Charts suggest another tariff-driven crash may be forming. If equities fall, Bitcoin could follow due to liquidity pressure.

Source: The Kobeissi Letter

Final Thoughts

The Gold Rally Amid Tariffs is a loud signal from global markets. Fear is rising. Investors want safety. Gold and silver are winning that race today.

Bitcoin is facing short-term pressure, but its story is not over. If XAUUSD continues climbing while stocks weaken, crypto may soon find itself at a major turning point.