Fight Token Listing Date Set for Jan 22: Dive Into the Tokenomics and Launch Price

Mark your calendars. The countdown begins. Fight token hits the exchange floor in two days—January 22. The market's about to get a new contender.

Tokenomics: The Blueprint

Forget vague promises. The real story is in the supply, distribution, and unlock schedule. This is where projects make or break investor trust—or just follow the well-trodden path of hype and gradual dumps. Scrutinize the allocations. Who gets what, and when do they get to sell?

Launch Price: The Starting Bell

Every new listing is a bet against the market's mood. The initial price isn't just a number; it's a statement of ambition, a gauge of pre-launch demand, and the first data point in what will become a volatile chart. Will it hold, pump, or get swallowed by the sell pressure? That's the multi-million dollar question.

It's not about enabling a new ecosystem; it's about cutting through the noise. The tokenomics either build a fortress or a house of cards. The launch price either bypasses early doubt or confirms it. Watch the order book, not the headlines. After all, in crypto, the 'fundamentals' often just mean who's left holding the bag when the music stops.

Fight Listing Date Marks Turning Point for Combat Web3

According to the recent X update, January 22, 2026, is the expected day for trading to begin. Although the team has yet to publish the names of the exchanges, market patterns indicate the process of token listing is already ongoing.

The current exchanges list includes Binance, MEXC, KuCoin, Bitget, and Gate.io. Normally, when a number of exchanges are in line, the project waits to announce them all at once. This is a good strategy for building more liquidity on launch day.

Importantly, the date of the first fight is where development activity shifts to participation in the open market. This is where price discovery starts. This is where actual demand is determined.

Fight Tokenomics and Distribution

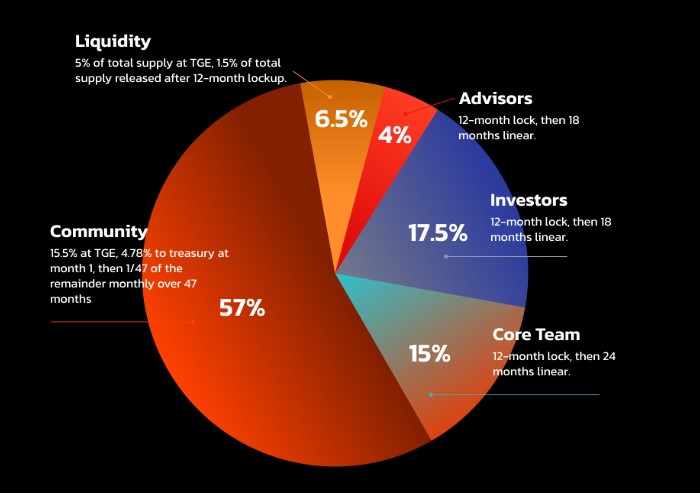

The total supply has been fixed at 10 billion units, but only 20.5% of it will be supplied at the time of launching, which amounts to 2.5 billion units. The controlled supply at the time of launching will counter any selling pressures exerted on its price at this stage. The distribution is as follows:

Community holds 57% of total supply, showing strong focus on decentralization, user rewards, ecosystem growth, and long term network participation.

Investors receive 17.5% with a 12 month lock and 18 months linear vesting to prevent dumping.

Core Team gets 15% with 12 month lock and 24 months linear release for commitment.

Advisors hold 4% locked for 12 months then unlocked over 18 months steadily.

Liquidity gets 6.5%, supporting trading stability and smooth price action after launch.

This is broken down to 15.5% unlocked during TGE, 4.78% unlocked one month later for treasury, and the remaining unlocked over 47 months. Five percent is released at TGE, and 15 percent after twelve months, hence a good balance between growth and preservation.

Fight Token Price Prediction: Listing Price?

Taking into consideration the market conditions and allocation structure, it has been estimated that the initial launch price and price prediction range will likely fall between $0.05 to $0.20.

If leading exchanges such as Binance join, then there might be a sudden rise in momentum. Analysts believe there will be more visibility and more volume and faster price discovery in this case. There are also forecasts which state that reaching $1 might be possible in future cycles.

Conclusion

The Fight listing date is expected to be January 22, 2026, and this is a milestone for this Web3 ecosystem which is designed specifically for fighting games. The tokenomics are excellent, and there are big exchanges lined up, and there is also a realistic price expectation.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.