RollX Soars 32% in Single Session - OWL & NIGHT Follow with 7% and 12% Gains

Altcoins defy broader market lethargy with explosive moves.

While blue-chip cryptocurrencies trade sideways, a trio of digital assets just posted double-digit gains that caught every chart-watcher's attention. The moves highlight the relentless, speculative energy still pulsing through crypto's smaller capillaries.

RollX Leads the Charge

RollX didn't just climb—it moon-shot. A 32% surge in a single day is the kind of volatility that creates and destroys portfolios before lunch. It suggests either a major protocol update just hit the wires, or a coordinated group of traders decided today was the day. In crypto, the reason often comes after the price move.

OWL and NIGHT Join the Rally

Not to be outdone, OWL posted a solid 7% gain. It's the kind of steady, respectable climb that project founders point to during AMAs. Meanwhile, NIGHT delivered a more aggressive 12% uptick, showing there's still plenty of appetite for risk in the hunt for the next breakout star. These aren't rounding errors; they're deliberate capital allocations in a market that's supposedly 'waiting for the ETF.'

The Takeaway: Speculation Never Sleeps

Forget the macro narratives about interest rates and institutional adoption. Days like this are raw, unfiltered crypto. They're a reminder that while Wall Street tries to fit digital assets into its existing models, the actual market is still driven by narratives, momentum, and the timeless pursuit of a quick multiplier—often with the strategic depth of a lottery ticket. The action might be in the altcoins today, but the underlying game remains the same.

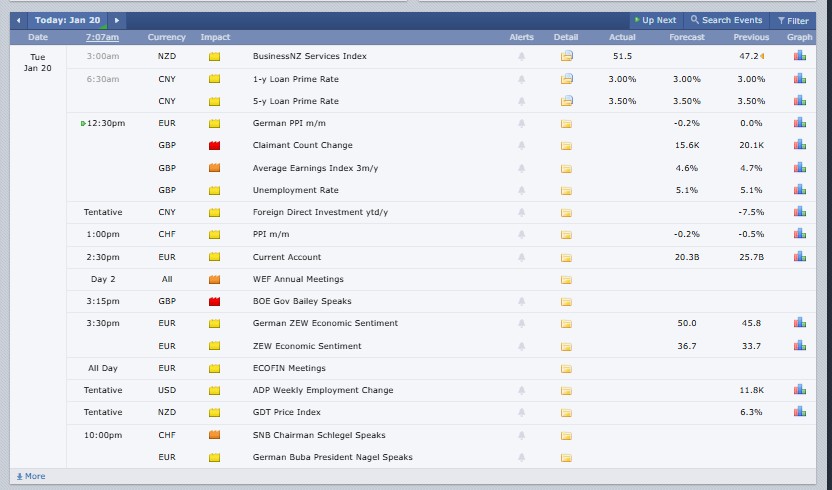

Major Crypto Market Events Today

Source: Forex Factory

Crypto Market Last 24 Hours Update: Prices, Volume & Trends

The global cryptocurrency market today reached a capitalization of $3.22 trillion, noted no change in the last 24 hours whereas Total trading volume recorded at $102 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.5%, while Ethereum (ETH) carries 11.9%. The largest gainers of industry are Polkadot and XRP Ledger Ecosystem in the past day.

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $92723.49, rose 0.16% in the last 24 hours, with a trading volume of $31.22 billion and a market cap of $1.85 trillion.

Ethereum (ETH) is priced today at $3192.44, dips 0.64% in 24 hours with a trading volume of $21.64 billion and a market cap of $385.31 billion.

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

RollX price (ROLL): $0.1549, soars 32.01%, trading volume (TV): $2.51B.

Owlto Finance price (OWL): $0.09344, surge 7.21%, TV: $242.86M.

Bitcoin price (BTC): $92,784.63, rise 0.21%, TV: $31.48B.

Ethereum price (ETH): $3,193.60, down 0.59%, TV: $21.73B.

XRP price (XRP): $1.98, up 1.56%, TV: $2.98B.

(Ranked by 24-hour percentage gain)

NIGHT price today (NIGHT): $0.06209, jumps 12.11%, trading activity $43.11M.

Tezos price today (XTZ): $0.6016, climbs 7.11%, trading activity $57.47M.

Quant price today (QNT): $82.74, up 6.25%, trading activity $46.92M.

(Ranked by 24-hour percentage loss)

Story price today (IP): $2.33, down 12.55%, trading activity $97.26M.

Dash price today (DASH): $74.61, dips 6.07%, trading activity $500.20M.

Aster price today (ASTER): $0.6156, down 3.86%, trading activity $232.43M.

Stablecoins reflects 0.1% negative change over the past 24 hours, with a market capitalization of $313.97 billion and trading volume of $76.85 billion.

The Overall (Defi) Decentralized Finance market declined 2.4% over the last 24 hours, recording a market cap of $110.98 billion and trading volume (TV) at $4.4 billion. Defi dominance globally marked 3.4%.

Bitcoin Fear and Greed Index Today

Source: Alternative Me

The Crypto Fear and Greed Index turned fear at 32 today, less effective than yesterday's fear of 44. It ROSE from 26 last week and extreme fear 20 last month, showing easing panic, stabilizing prices, and improving short-term investor confidence.

Latest Crypto Market News Today, January 20

(Note: All of these updates affect traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

Tokenized gold surges in 2026 as Tether Gold and Paxos Gold market cap hits $4.48B, up 18%, while transfer volume jumps 61% and active addresses near 30,000 this month data

On-chain analyst Specter warned that TroveMarkets launched at a $20 million valuation, added minimal liquidity, unlocked millions of tokens, and saw new wallets rapidly dump TROVE, raising scam concerns.

Short seller CapitalWatch accused Nasdaq-listed AppLovin of systemic compliance risks, alleging its main shareholder laundered illicit funds from China and Southeast Asia into U.S. markets. AppLovin has not responded yet.

Russia’s State Duma deputy proposed fines for illegal crypto mining, targeting individuals, officials, and companies, with higher penalties for repeat offenses, following Justice Ministry plans for tougher criminal punishment nationwide.

Venezuela’s USDT price fell about 40% since January 7, sliding from 880 to near 500 bolívares, as optimism over recovery and dollar liquidity triggered an overshooting correction, analysts say locally.

Grant Cardone said Cardone Capital will invest $10 million more in Bitcoin, strengthening its real estate and BTC hybrid strategy focused on long-term holdings of institutional-grade property and digital assets.

Comparative Insight

While Bitcoin and ethereum showed low volatility, smaller-cap tokens like RollX and NIGHT delivered sharper gains. Meanwhile, losses in Story and Dash highlight continued rotation of capital toward trending and speculative assets.

What This Means for Cryptocurrency Users

Crypto users should expect short-term volatility as capital shifts between major assets and high-momentum tokens. Stable capitalization suggests consolidation, but regulatory updates and institutional moves may quickly influence prices and liquidity.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on the investment.

CoinGabbar’s Opinion

Based on the 24-hour update, crypto investing remains risky but selectively beneficial. Large-cap assets offer relative stability, while trending tokens carry higher reward potential with elevated risk, making cautious and research-driven participation essential.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.