Why Is Crypto Crashing Today? Key Reasons Behind BTC, ETH Price Drop

Crypto markets tumble as Bitcoin and Ethereum lead a broad sell-off. What's driving the sudden plunge?

Market-Wide Pressure

A perfect storm of macro fears and sector-specific tremors rattled digital asset portfolios. Global risk assets faced headwinds, and crypto—still viewed as a high-beta play by traditional finance—caught the chill. The correlation isn't coincidental; it's a reminder that when Wall Street sneezes, crypto often gets a cold.

Liquidity Squeeze

On-chain metrics flashed warning signs. Exchange outflows spiked as holders moved to cold storage, but new buying demand failed to materialize. The order books thinned, amplifying price moves on relatively modest volume. It's the classic crypto liquidity crunch—when everyone wants an exit, the door suddenly feels very narrow.

Leverage Unwinds

Overcrowded leveraged positions triggered a cascade. Margin calls forced liquidations, which pushed prices lower, triggering more liquidations. The perpetual futures funding rate flipped negative across major exchanges, signaling extreme short-term pessimism. Another round of traders learned the expensive lesson that 100x leverage works both ways.

Narrative Fatigue

The 'digital gold' and 'decentralized finance' stories faced a reality check. With no immediate catalyst on the horizon, momentum traders headed for the sidelines. Even the most ardent believers paused their dollar-cost averaging, waiting for clearer signals. Sometimes the market doesn't need bad news—it just runs out of good news.

Regulatory Shadow

While no new crackdowns emerged, the lingering uncertainty from global regulators kept institutional money hesitant. The 'wait-and-see' approach from major asset managers became a self-fulfilling prophecy for lower volumes. Traditional finance's favorite game: praising innovation in theory while withholding capital in practice.

This isn't crypto's first downturn, and it won't be its last. The technology continues to build, protocols keep operating, and adoption metrics grind forward—even when the price chart screams panic. History suggests these shakeouts clear speculative excess, leaving stronger foundations. But for now, buckle up; volatility is the price of admission for the greatest financial experiment of our time.

Why is Crypto Crashing Today: Major Reasons Explained

Fear of Trade War Causes Investors to Seek Safe Assets

The reason for the weakness in the market is the trade war concerns that are prevailing in the current market. Experts explain that the capital flow has shifted to safe assets such as gold and silver due to the threats by U.S. President Donald TRUMP to the EU nations with regard to imposing tariffs. The nations that are mentioned in the threats include Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland.

The tariffs will begin at 10% from February 1st and increase to 25% by June if there are no agreements. The European Commission refers to this as "blackmail" and is lining up its own tariffs of $101.4 Billion (€93 billion) against U.S. exports.

History illustrates that these tensions have harmed risk assets in the past. During the U.S.-China tariff dispute last year, bitcoin decreased by almost 25%, and the worldwide market cap decreased by 32% to $2.96 trillion.

Although today’s decline is not as severe, a lack of resolution can create a compounding effect that can cause a further decline.

Regulatory Delays Contribute to Market Uncertainty

Second reason for why is Crypto Crashing Today is a lack of progress in crypto regulation in the U.S. The Senate Banking Committee has pushed back its markup of the CLARITY Act. This is after a withdrawal of support for the bill by Brian Armstrong, the CEO of Coinbase.

However, the U.S. Supreme Court justices questioned the constitutionality of Trump’s tariff powers as well. The matter is pending in court as of the moment. These two developments make investors less willing to take on risks due to the uncertainties surrounding these two matters.

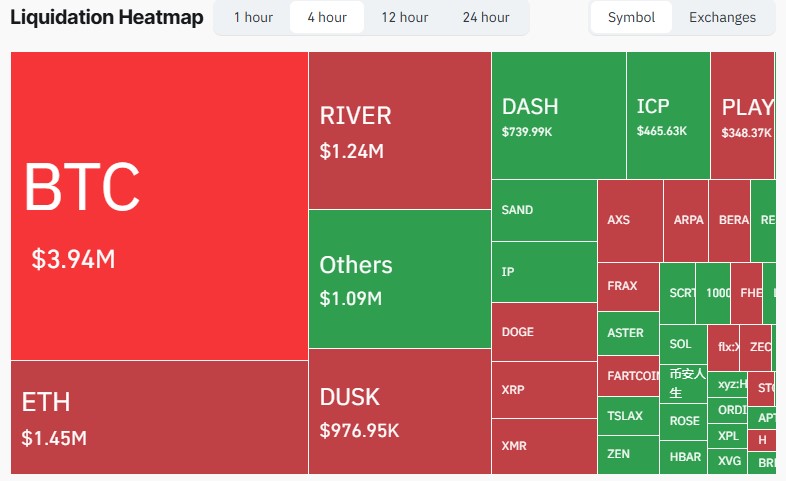

Liquidations and Whale Panic: Adding Depth to the Crash

Leverage contributed significantly to what happened today. According to data from CoinGlass, 248,203 traders were liquidated in 24 hours, with a total of $874.80 million being liquidated. The largest single order was in Hyperliquid: BTC-USDT, with $25.83 million.

Whale activities also represent fear. Lookonchain found that whale 0x10ea's 113M DOGE long position worth 14.56M USD was completely unwound, resulting in a 2.7M USD loss. Whale Ci8jH5 withdrew 20,466 SOL but reinvested 20,466 SOL back into Kraken after its value depreciated from 4.1M USD to 2.83M USD, thus actualizing its 1.27M USD loss. Such panic selling leads to an increase in supply and further reduces prices.

Market emotion mirrors this change. The Crypto Fear and Greed Index fell to 44, entering the “Fear” area.

What's Next for the Crypto Market?

Why is Crypto Crashing Today may seem alarming, but it is important to note that this is merely a correction in the wake of a strong rally. Experts like Arthur Hayes, Tom Lee, and Robert Kiyosaki are also predicting a strong bullish cycle in the coming years of 2026.

Conclusion

Why is Crypto Crashing Today has to do with trade anxieties, regulatory slowdowns, forced sales, and whale panic. These factors are undermining confidence, not undermining fundamentals. The market is adjusting, not imploding. If past trends repeat, this correction may lay the foundation for the next major bullish cycle.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.