CLARITY Act in Jeopardy as White House Battles Coinbase Over Crypto Regulation

The landmark crypto legislation faces a sudden, brutal headwind—a direct confrontation between the Biden administration and America's largest exchange.

Policy Collision Course

Sources close to the negotiations describe a White House posture that's shifted from cautious engagement to outright hostility. The CLARITY Act, designed to create a federal framework for digital asset markets, now looks like a casualty of that fight. Administration officials are reportedly drafting a formal opposition memo, arguing the bill gives too much ground to an industry they view as inherently risky.

Coinbase's Counteroffensive

Not backing down, Coinbase has mobilized its legal and lobbying teams for a full-court press. Their argument? The Act provides the regulatory certainty that institutions—and the Treasury—have demanded for years. They're framing the White House's stance as a move that protects legacy financial gatekeepers, not consumers. A classic Beltway power struggle, just with digital assets on the line.

What's Really at Stake

This isn't just about one bill. It's a proxy war for the soul of American crypto policy. A White House veto threat could kill CLARITY, leaving the industry in a prolonged state of regulatory ambiguity. That means more business drifting offshore to clearer jurisdictions—ironic for an administration that claims to prioritize innovation and competition. Sometimes, the most profitable trade in finance is betting against political coherence.

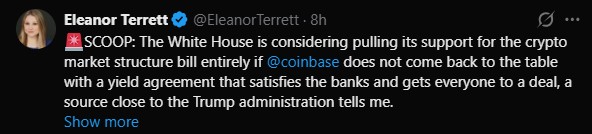

Sources say the WHITE House may pull its support for the CLARITY Act entirely after Coinbase stepped away from negotiations. Could this delay U.S. crypto regulation once again?

The Act's Dispute Centers on Stablecoin Yield Rules

At the center of the CLARITY Act debate is stablecoin rewards, also called yields. The bill aims to bring regulatory support by defining SEC and CFTC oversight and setting rules for stablecoins, tokenized assets, and DeFi.

Taking the new rule as base, traditional banking groups want to restrict crypto platforms from offering yields on stablecoins like USDC. The CEO of Bank of America, Brian Moynihan, explained that the concern is over maintaining financial stability. He noted that yield-bearing stablecoins could shift large, up to $6 trillion, deposits away from banks, significantly affecting lending and credit availability across the economy.

In response, Coinbase strongly opposes these limits. The exchange currently offers about 3–4% yield rewards on USDC deposits, which works as a major rewarding system for users and a key revenue stream for the platform. Coinbase argues that restricting rewards WOULD hurt the crypto community, limit competition, and damage the sovereignty of the innovation.

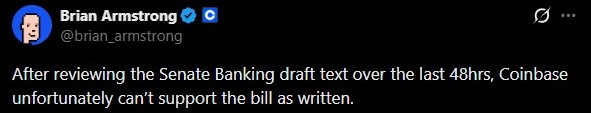

Earlier this week, Coinbase CEO Brian Armstrong publicly withdrew support for the CLARITY Act, calling the draft a “bad bill.” He said he would rather have no law than a harmful one, accusing banks of protecting outdated business models.

White House Pushback Raises Uncertainty

According to sources close to the TRUMP administration, the White House was furious over Coinbase’s move, calling it a “unilateral rug pull.” Officials stressed that the CLARITY Act is “President Trump’s bill,” not one company’s decision.

The White House is now pressuring the exchange to return to talks and agree to a compromise on stablecoin yields that satisfies banks. Until then, Senate Banking Committee action on the new bill has been postponed indefinitely.

If the bill fails, this would leave the country under continuous regulatory uncertainty, which could MOVE digital asset investors to offshore, places where clear rules make things easy. It could also bring volatility in the broader digital assets’ market especially when stablecoins already surpass the $310 billion market cap.

So, the outcome of the CLARITY Act debate matters in different ways, and could also shape the future of US crypto policy in 2026.