Silver Soars to $90 Milestone as Industrial Demand Sparks Historic Rally

Silver just smashed through the $90 barrier—a price level that seemed like a distant fantasy just months ago. Forget gold's sleepy ascent; this is industrial metal catching fire.

The Green-Tech Engine

What's fueling the surge? Look at the assembly lines, not the jewelry stores. Solar panel manufacturers are gulping down silver paste. EV makers are wiring up with it. Every 'net-zero' pledge from a Fortune 500 CEO translates into another industrial purchase order. The metal's role flipped from a monetary relic to a critical component in the energy transition—and the market is pricing it in, hard.

Market Mechanics Gone Wild

Traders watched the charts break, one resistance level after another. The usual paper markets got overwhelmed by physical demand. Warehouses reported draws, premiums spiked, and the backwardation in futures told a simple story: get the metal now, at any cost. It's a classic squeeze, amplified by a structural shift in what the asset actually represents. (A friendly reminder that the last time everyone agreed a trend was 'structural,' the dot-com bubble was about to pop.)

What's Next for the White Metal?

The $100 psychological mark is now in sight. But sustainability is the real question. Can industrial consumption alone support these heights, or is speculative froth building? One thing's clear: silver has rewritten its own narrative. It's no longer just gold's volatile sibling—it's the market's bet on a wired, solar-powered, electrified future. Whether that future arrives on schedule, or gets delayed by the usual parade of economic realities and overpromises, is another matter entirely. For now, the charts scream momentum. Just ask any fund manager suddenly scrambling to explain their underweight position.

The continuous rally is empowered by limited supply, increasing demand from industrial sectors, and its dual play in investment and practical usability. As needs in solar panels, electric vehicles, and the electronic marketplace give the WHITE metal its strength, investors are now speculating whether this momentum will influence the digital assets market as well.

Industrial Demand Powers Silver Price Historic Surge

Industrial consumption accounts for 50–60% of global silver use, making it a key factor in the 2026 rally.

Solar photovoltaics (PV): Silver paste is essential in panels. Despite efforts to reduce usage per panel due to high prices, expanding global solar capacity keeps demand strong.

Electric Vehicles (EVs): EVs require 67–79% more silver than traditional vehicles in batteries, wiring, and electronics. Automotive demand is projected to grow ~3.4% annually through 2031, with EVs overtaking conventional cars by 2027.

Electronic and AI Infrastructure: Silver’s top conductivity supports semiconductors, circuit boards, and AI server components, as well as 5G and grid infrastructure upgrades.

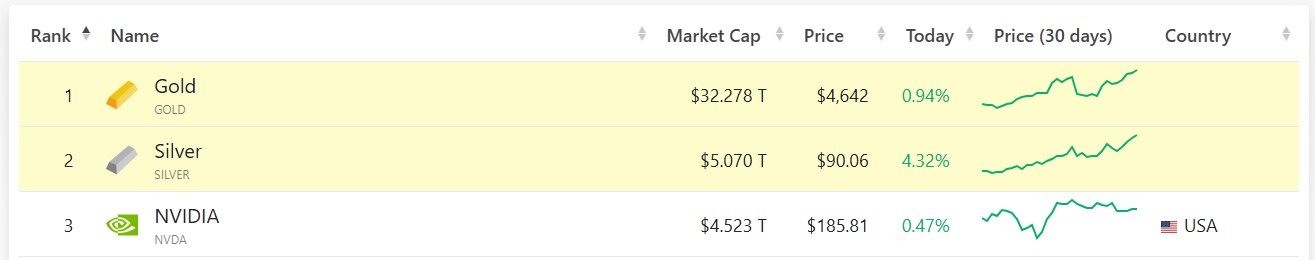

This structural tightening, demand surpassing mining and recycling power, has positioned silvers’ as the second largest asset, outpacing NVIDIA, with a spot market cap of $5.05 trillion. The white metal is now only below the dominating gold.

Analysts note that green energy and tech growth will continue supporting the hard asset into 2026.

Gold-Silver Ratio: Decreasing Gaps Saying More Than Hype

Gold is currently trading around $4,620–$4,630 per ounce, up roughly 0.67% today, while enjoying a significant growth of about 72% year-on-year. Even with strong increments, its percentage is still lower than silvers'.

The gold-silver ratio has come down to about 51:1, from extreme gaps in early 20205 with 100:1, reflecting silver’s catch-up rally and relative strength that too in a short period.

While gold still dominates as a traditional safe-haven asset and choice among investors, silvers' multi-role in both monetary and industrial space provides it with a potentially higher upside demand cycle.

Crypto Correlation and Market Outlook

Cryptocurrency like Bitcoin doesn’t show any direct relation with the metals rally, instead it follows a mixed sentimental way. In the most recent case of 2025, precious metals surged significantly on demand for industrial and safe heaven, while Bitcoin along with the broader crypto market faced a major dip, due to some geopolitical tensions.

Until now bitcoin trades in the $90K–$94K range, far down from mid-2025 ATH of $126K.

Metals often act as leading indicators for real-asset sentiment, and a continued silver rally could renew investor’s interest in digital coins, particularly in the environment of frequent market volatility or inflation concerns.

In a Summarized Way

Silver’s rise underscores the increasing importance of physical, industrially driven assets. With accelerating demand in electronics, solar, and EVs’ space, metals are likely to remain in focus for traders looking for both growth and safe-haven protection.

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Readers should conduct their own research or consult a licensed professional before making any financial decisions.