Crypto’s 24-Hour Ticking Clock: Trump Tariffs & Fed Speech Collide Today

The next day could reshape digital asset markets—two political and economic juggernauts are set to speak.

The Double-Edged Sword of Policy

Markets hate uncertainty, and they're about to get a double dose. First, fresh rhetoric on tariffs threatens to roil global trade flows—capital often flees to digital havens during geopolitical spats. Then, the Federal Reserve takes the mic. Every syllable on interest rates and inflation gets parsed by algorithms holding billions in crypto.

Liquidity on the Line

It's not about direct mentions of Bitcoin. It's about the tone. Hawkish signals could strengthen the dollar, pressuring risk assets. A dovish tilt might unleash the animal spirits. Traders are watching order book depth like hawks; thin liquidity magnifies every swing.

The Cynical Take

Remember, this is the same finance world that treats macroeconomic prognostication as a sport—accuracy optional, confidence mandatory. Today's 'critical narrative' might be tomorrow's forgotten headline.

Buckle up. Volatility isn't just coming; it's practically scheduled.

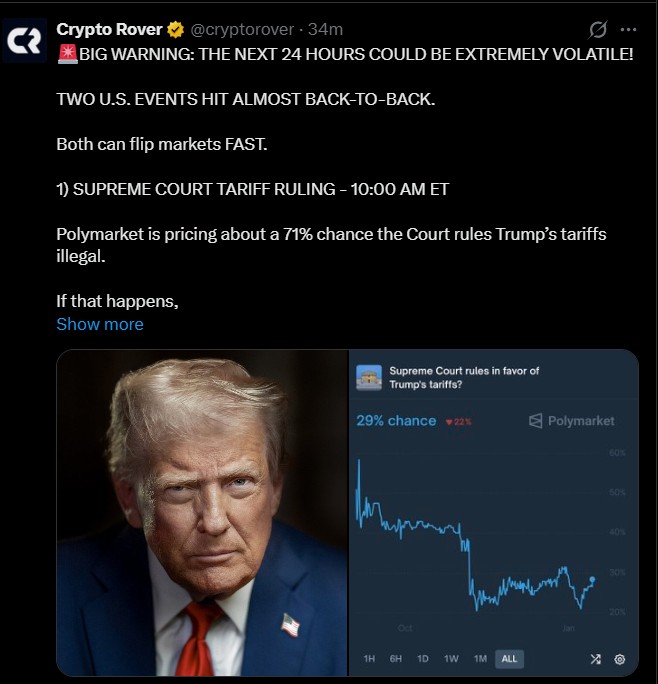

Supreme Court Trump Tariffs Ruling Looms at 10:00 AM ET

The first major catalyst is the U.S. Supreme Court’s ruling on President TRUMP global tariffs, expected at 10:00 AM ET.

Prediction markets are signaling serious risk. Polymarket currently assigns a 71% probability that the Court rules Trump’s tariffs illegal, leaving only a 27% chance they are upheld.

The case stems from November 2025 arguments, which challenged Trump’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA).

Source: CryptoRover X

If the tariffs are struck down, markets may immediately begin pricing in refund uncertainty on more than $600 billion in tariff revenues Trump has repeatedly cited. Trump himself has warned that such a ruling WOULD be a “complete mess,” potentially disrupting trade negotiations and fiscal expectations.

This binary outcome creates headline risk, especially for Leveraged traders in crypto and equities.

Three Fed Presidents under Jerome Powell Investigation.

The second volatility trigger is even more sensitive. The three Federal Reserve presidents will speak, and their remarks will come after increased questions of Fed Chair Jerome Powell, following noise over investigations in the previous month.

In the current environment, even subtle changes in tone around inflation, rates, or economic confidence can move markets sharply. Once expectations around interest rates shift, risk assets—from bitcoin to tech stocks—tend to react immediately.

Crypto analyst Crypto Rover warned that these combined events create a “liquidation trap,” where traders get wiped out reacting to headlines rather than positioning strategically.

Source: X

Everything Is at Record Highs — A Warning Signal?

Adding to market unease, The Kobeissi Letter highlighted a striking macro reality: nearly everything is at a record high simultaneously.

Why crypto market up today? Along with Stocks, gold, silver, copper, platinum, home prices, money market funds, U.S. debt, deficit spending, and household debt are all sitting at historic peaks. According to Kobeissi X, this is not a coincidence but evidence that fiat currencies are depreciating.

Their blunt message: “You do not own enough assets.”

Source: X

Trump vs. Powell: Tensions Fuel Market Uncertainty

President has reignited his long-standing criticism of Fed Chair Powell, stating that when markets rise, the Fed should lower interest rates, not raise them.

Trump accused Powell of “killing every rally” and recently escalated his rhetoric by calling him “either incompetent or crooked.”

These remarks come after December CPI data showed inflation cooling, with headline CPI at 2.7% and core CPI at 2.6%, both flat for the month.

Nevertheless, the rate cuts will likely be held at the January Fed meeting, which will only heighten the political and market tension.

Markets have already responded: Bitcoin has already surged to around $95,000, and gold has reached new record highs, indicating a drop in confidence in the stability of policies.

Source: CoinMarketCap

Lesson Learned: Don’t Fall into the Headline Trap.

Volatility is not an option; it is a certainty with a Supreme Court decision and several speeches by the Federal Reserve crammed into one day. The traders are encouraged to handle risk prudently, minimize over-leverage, and not act based on the breaking headlines.

In this environment, patience and positioning matter more than prediction. The next 24 hours could reshape market direction—fast.

YMYL Disclaimer: This content is for informational purposes only and is not financial advice. Crypto and financial markets involve risk. Always conduct your own research or consult a licensed advisor.