TENEO Roadmap Hits Phase 5: Is the Teneo Protocol Listing Date Set for Q1 2026?

Phase 5 unlocked. The countdown begins.

The Final Stretch

Teneo's roadmap just hit its most critical milestone. Phase 5 activation signals the home stretch for a protocol built to dismantle traditional yield mechanics. This isn't an upgrade—it's a launch sequence.

Q1 2026: Mark the Calendar

All development roads now point to a single quarter. The first three months of 2026 emerge as the projected window for the main event: the Teneo Protocol's official listing. The team is staking its reputation on this timeline, moving from theoretical tokenomics to real-world market pressure.

Architecture Over Hype

Forget the vaporware and empty roadmaps clogging the space. Teneo's final phase focuses on exchange integration, liquidity bootstrapping, and compliance checks—the unsexy, essential plumbing that separates concepts from tradable assets. It’s the kind of groundwork that usually gets skipped in the rush to pump a token.

A New Market Catalyst

A successful Q1 2026 launch doesn't just add another ticker. It injects a fully operational yield-redistribution engine directly into the DeFi bloodstream. The protocol actively redirects fees from major blue-chips back to its own stakers, creating a self-sustaining economic loop that bypasses traditional fund management entirely. Talk about cutting out the middleman.

The stage is set. The timeline is public. The crypto world now watches to see if Teneo delivers a working product or just becomes another ambitious entry in the graveyard of 'next big things'—a fate as common as a banker's forgotten promise.

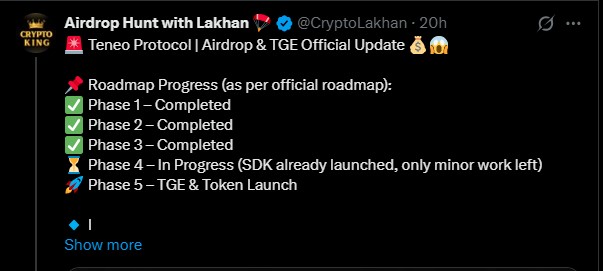

First, an unofficial X account post said the project has already finished 3 out of the 5 roadmap steps, which was later confirmed by the official website roadmap data.

They also launched their SDK, raised $3 million, and built a system where people can run nodes right in their web browser. All of these major updates show the project is getting very close to launching its own token and getting listed on big exchanges.

What Is the Teneo Protocol and Why Does It Matter?

It is basically a decentralized AI Agent network that allows users to earn rewards just by sharing the unused extra computer power. To join, users just need to use a browser node and follow three easy steps: Install

“There is also a referral system that increases rewards and boosts community participation, which directly supports the airdrop system.”

Teneo Protocol Listing Date and TGE Close? Roadmap Say Yes

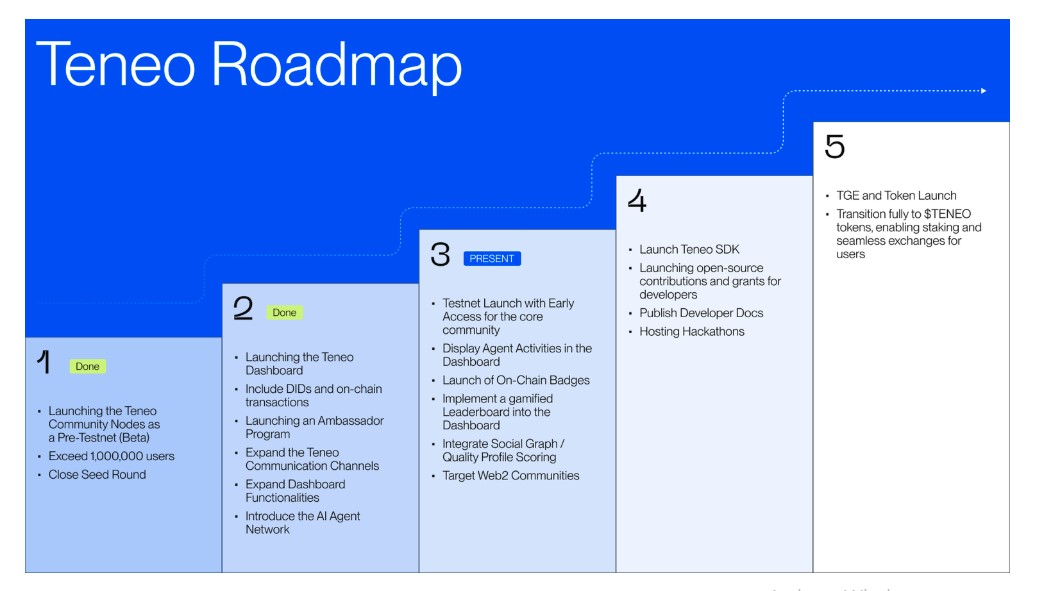

The official Teneo Protocol Roadmap Data confirms the Q1 2026 timeline is closer than anyone thinks.

According to the roadmap:

Phase 1: Completed

Phase 2: Completed

Phase 3: Completed

Phase 4: In Progress (SDK already launched)

Phase 5: Teneo TGE Date Q1 2026 and Token Launch

Since the SDK is already live and Phase 4 is almost done, the project is technically ready for Phase 5. This supports the Teneo Protocol listing date Q1 2026 timeline.

The project is not just another crypto airdrop token, but the main currency that runs the entire ecosystem. Latest updates also say that even in slow conditions, final confirmation should come by March or April.

Strong Funding and Verified Partners Support Project Stability

On February 13, the project raised $3 million in funding. It is backed by big-name companies, including Rockway, Borderless Capital, Generative Ventures, CertiK, Outlier Ventures, and Moonrock Capital. These solid partnerships reduce risk and increase investor trust.

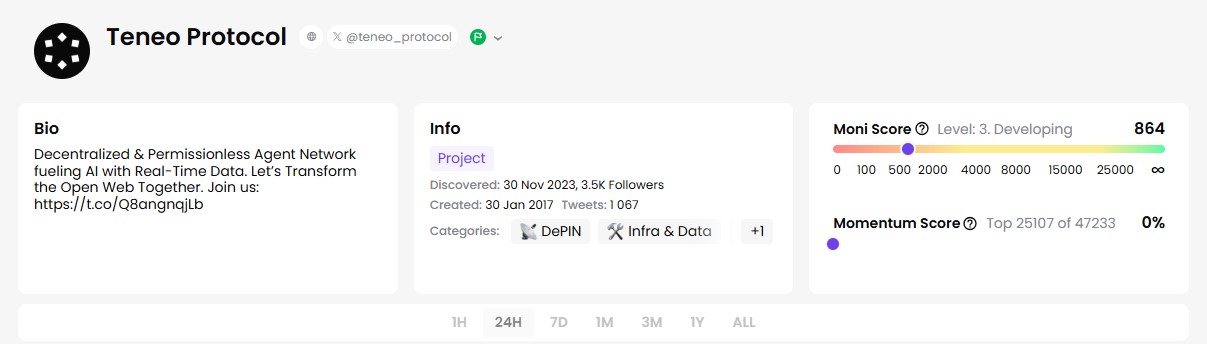

On top of that, Getmoni.io, a platform which tells whether a project is promising or not, gave airdrop token a Level 3 (Developing) rating with a high score of 864.

This is a great sign because it shows the asset is not a random new token listing but a real product under serious development. It definitely helps ease any worries about it being a scam.

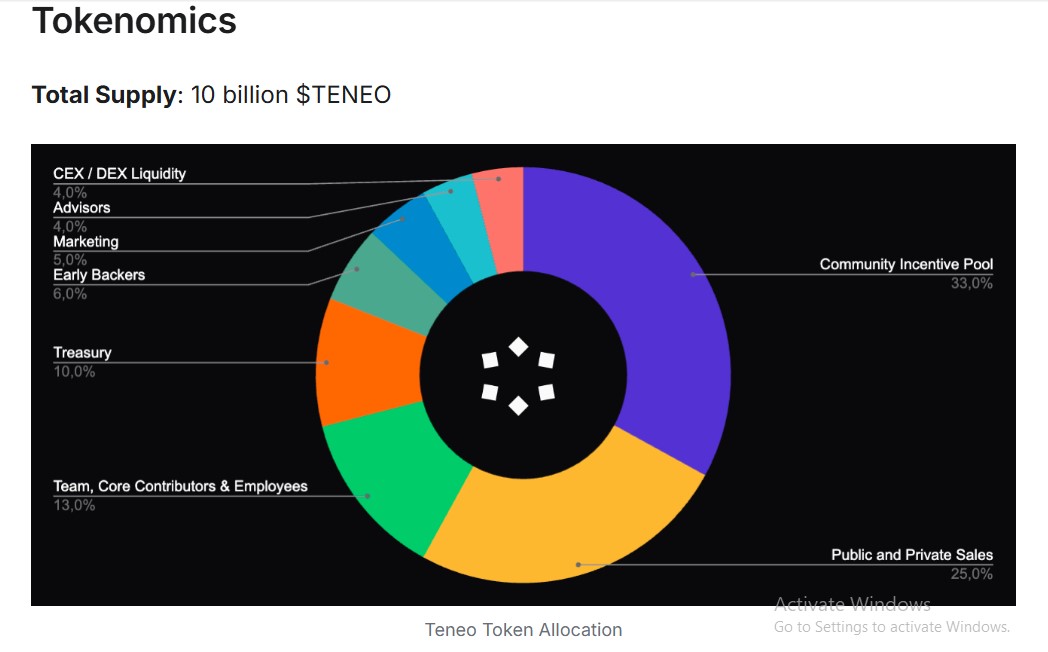

Tokenomics: How the Distribution Model Works

The token distribution shows a balanced and community driven design. There will be a total of 10 billion tokens, and they are split up like this:

Rewards for the Community: 33%

Public and Private Sales: 25%

The Team and Staff: 13%

The Treasury (Savings): 10%

Early Supporters: 6%

Marketing and Ads: 5%

Advisors (Helpers): 4%

Exchange Trading (Liquidity): 4%

In short, 58% of all the coins go directly to regular users and the open market. This is great because it makes the distribution fair. It is also a big deal for the Teneo protocol airdrop listing date and price because it helps decide a fair value when the coin starts trading.

Conclusion

The Teneo Protocol Listing Date and airdrop are supported by real data: $3M funding, trusted partners, SDK launch, completed roadmap phases, and clear tokenomics.

These facts show that it is now entering its launch stage, where TGE and exchange listing are the next big steps.