Eric Adams NYC Memecoin Rug Pull Scandal: The Untold Truth Behind the Crypto Chaos

New York City's cryptocurrency scene just got a political twist—and investors are left holding empty digital bags.

Mayor Eric Adams finds himself tangled in allegations surrounding a memecoin project that vanished overnight, taking investor funds with it. The incident exposes the wild west nature of municipal-themed crypto ventures and raises urgent questions about regulatory gaps.

Anatomy of a Digital Disappearance

Rug pulls aren't new in crypto, but this one stings differently. A token branded around NYC's leadership promised community rewards and urban innovation. Then—poof—liquidity vanished, social accounts went dark, and the price chart flatlined. Early backers watched gains evaporate in a classic exit scam, wrapped in a political veneer.

Why This One Hits Different

It’s not just another anonymous dev team cutting and running. The association with a sitting mayor—whether authorized or not—adds a layer of real-world credibility that bad actors exploited. Investors bet on the perceived endorsement, a reminder that in crypto, trust is the riskiest asset of all.

The Regulatory Void

No SEC filings, no prospectus, just a website and bullish tweets. Memecoins operate in a gray zone where hype outweighs fundamentals—and where accountability often dissolves faster than liquidity pools. Politicians dabbling in crypto narratives should tread carefully; the line between innovation and grift is thinner than a layer-1 transaction.

One cynical take? It’s almost poetic—a finance jab at the system where speculative tokens and political promises both tend to overpromise and underdeliver.

Until clear rules emerge, caveat emptor isn’t just a warning—it’s the only rule in town.

Source: X (formerly TwItter)

What Triggered the NYC Memecoin Rug Pull Claims?

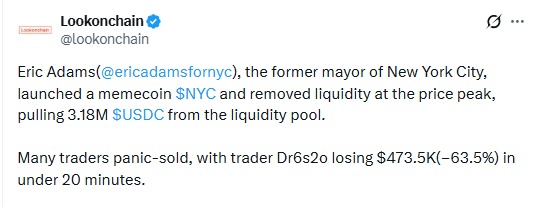

Blockchain trackers like Lookonchain found that a wallet linked to the token’s deployer removed around $3.18 million in USDC liquidity NEAR the price peak.

Source: X (formerly Twitter)

In crypto, liquidity is what allows traders to buy and sell safely. When it is removed suddenly, people cannot exit their positions without heavy losses.

That is exactly what happened here. Some traders reported losing hundreds of thousands of dollars in just minutes.

This type of behavior is one of the strongest warning signs of a rug pull.

Why On-Chain Data Raised Serious Red Flags ?

One reason this situation became serious so fast is because blockchain data is public. Anyone can see what happened. When traders saw liquidity being removed right at the top of the price, trust collapsed immediately.

Token launches with hype

Price rises quickly

Liquidity is pulled

Price crashes

Small traders get trapped

The memecoin followed this pattern closely, which made investors lose confidence.

Token Supply Was Highly Centralized

The other major concern was supply management. Approximately 70% of the total 1 billion NYC Tokens were held within a reserve wallet. The top wallets accounted for the total supply.

This is dangerous because a small group can MOVE the price anytime they want. Healthy projects usually lock large token amounts or distribute them widely. That did not happen here, which made the NYC memecoin Rug Pull concerns even stronger.

Lack of Transparency Hurt Trust

Eric Adams said the token WOULD support causes like fighting antisemitism and anti-Americanism. But no details were shared. There was no name of a nonprofit, no explanation of how funds would be handled, and no clarity on who controlled the wallets.

During interviews Eric Adams' explanations about blockchain and the project were unclear. In crypto, trust comes from transparency.

Is It Really a Rug Pull or Just Poor Planning?

Legally, it is safer to say this is an alleged NYC memecoin Rug Pull. Proving intention takes time. But for traders, the result matters more:

Liquidity was removed

The price crashed

Money was lost

Trust disappeared

Whether planned or not, the impact felt the same as a Rugpull.

What Investors Should Learn?

This case is a strong reminder:

Always watch liquidity movements

Check wallet concentration

Be careful with celebrity-backed tokens

Trust blockchain data more than promises

Hype fades fast, but losses stay.

Final Thoughts

One wallet action erased millions in value within minutes. For investors, this is another lesson: transparency and responsibility matter more than fame or hype.