Spur Protocol Listing Date: Jan 8 Confirmed or Shift Amid Presale Frenzy?

Mark your calendars—or maybe don't. Spur Protocol's public debut is slated for January 8, a date now etched in crypto lore but shadowed by whispers of a potential shift. The countdown is on, fueled by a presale that's already captured the market's speculative zeal.

The Presale Pressure Cooker

Behind the official date lies the real engine: the presale. It's the classic crypto dance—limited access, escalating demand, and the inevitable FOMO that makes traditional IPOs look like sleepy auctions. The protocol's promise to streamline DeFi operations isn't just attracting users; it's magnetizing capital looking for the next pre-listing pop.

Why January 8 Matters

In crypto, a launch date is more than a schedule—it's a statement. Hitting the January 8 target signals operational readiness and market confidence. Missing it? That sparks the dreaded 'delay' narrative, a word that can bleed value faster than a smart contract exploit. The team is betting their credibility on this timestamp.

The Whisper Network's Take

For every confirmed date, there's a counter-rumor. Chatrooms and alpha groups are buzzing with scenarios—a tactical delay to extend presale momentum, or a swift launch to capitalize on current market heat. It's the kind of speculation that keeps trading desks on edge, proving yet again that in crypto, the narrative often trades harder than the asset itself.

What's Really at Stake

Beyond the date, Spur Protocol is pitching a solution for a fragmented DeFi landscape. The promise is aggregation and efficiency—cutting through the clutter of multiple dashboards and approvals. If it delivers, the launch could be a genuine utility play. If it stumbles, it joins the graveyard of protocols that confused hype with infrastructure.

So, will January 8 hold? In a world where 'code is law' but marketing is king, only the block timestamp will tell. Just remember—in crypto, a launch date is sometimes the most volatile derivative of all.

Spur Presale End Date Today: Team Shifts Focus to TGE and Listing

The ending date for the presale is a significant event. Based on official statistics, a total of 607,898.61 tokens out of a possible 8,333,333 tokens was sold during a Spur protocol presale at a price of $0.03.

The team has explicitly clarified that the presale will not go past its scheduled date. Rather, focus is now shifting to other forthcoming events, including the generation and listing of tokens. Nevertheless, the team has clarified that any postponement will be officially communicated.

Will the Spur Protocol Listing Date be January 8?

As of press time, documents on this website indicate a possible launch on January 8. However, this information has not been released on official social network channels.

In fact, a community notification over official X (formerly Twitter) indicated there WOULD soon be updates on the prospective delays. The best part here: this clearly indicates the project may not have a January 8th launch.

Confirmed platforms so far include Coinstore, MEXC, BingX, SpurSwap, and PancakeSwap, with more exchanges expected. Market watchers believe talks with larger platforms like Binance, KuCoin, Bitget, OKX, could be one reason behind a potential delay.

The SON Token Listing Timeline and Market Rivals

The next window for listing, if it does not take place in early January, would be it is planned for February.

This would put it in direct competition with a number of notable launches, such as BlockDAG Project, which has a presale deadline of January 26 and an expected listing date of late February.

Such overlap may impact early momentum, so execution timing becomes an essential element for the updates in the coming few weeks.

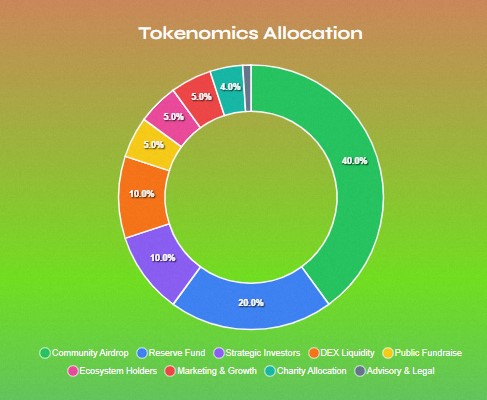

Spur Protocol Tokenomics and SON Price Prediction

The total supply is fixed at 1 billion tokens, with specific allocation details for incentives, liquidity, investors, reserves, and public sales. The tokenomics is as follows:

40%: Community incentives, airdrop and future events

20%: Project future reserve

10%: Current and future Investors

10%: Spur DEX liquidity

5%: Marketing and promotion

5%: For Project Public Sales

5%: Distributed to early supporters of the protocol that hold PoG badges

4%: Gradually injected into charity works and organizations

1%: Covers advisory and legal costs

The team has not confirmed a launch valuation yet. Market analysis around Spur Protocol listing date and price suggests a wide range, with estimates between $0.08 and $0.50 at launch. Some projections point to short-term volatility and longer-term upside upto $5, depending on adoption, making SON token price prediction highly sensitive to market conditions.

Conclusion

The important factor that has emerged as a trigger point in this situation, now that the presale has concluded, and its time for Spur Protocol listing date. Although February 2026 seems to be a far more realistic option, January 8 has become a point of uncertainty.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.