Bitlight Price Plummets: What Triggered the 74% $LIGHT Crash in 24 Hours?

Bitlight's native token $LIGHT just got dimmer—fast. A brutal 74% single-day wipeout sent shockwaves through crypto circles, leaving holders scrambling for answers and exit strategies.

The Anatomy of a Flash Crash

This wasn't a gentle correction; it was a cliff dive. The sell-off sliced through support levels like a hot knife through butter, erasing months of gains in a matter of hours. Trading volumes spiked as panic set in, creating a classic liquidity death spiral where selling begets more selling.

Behind the Numbers: Unpacking the Pressure

While the headline figure—74%—tells the story of the damage, the real narrative is in the catalysts. Market veterans are dissecting the usual suspects: Was it a coordinated whale dump? A cascade of leveraged long positions getting liquidated? Or did a critical protocol flaw or partnership rumor spook the market? In crypto, the trigger is often less important than the tinder-dry sentiment it ignites.

A Volatility Reality Check

The episode serves as a stark reminder of the asset class's raw, unvarnished volatility. For every moonshot narrative, there's a gravity check waiting in the wings. It's the financial market equivalent of extreme sports—thrilling returns are always paired with breathtaking risk.

Navigating the Aftermath

Now, the community watches for signs of stabilization or a dead-cat bounce. Will developers step in with reassuring commits or roadmap updates? Or will $LIGHT join the graveyard of tokens that never recovered their all-time high glory? In the grand casino of decentralized finance, sometimes the house wins—and sometimes the house is just a cleverly disguised smart contract draining your wallet.

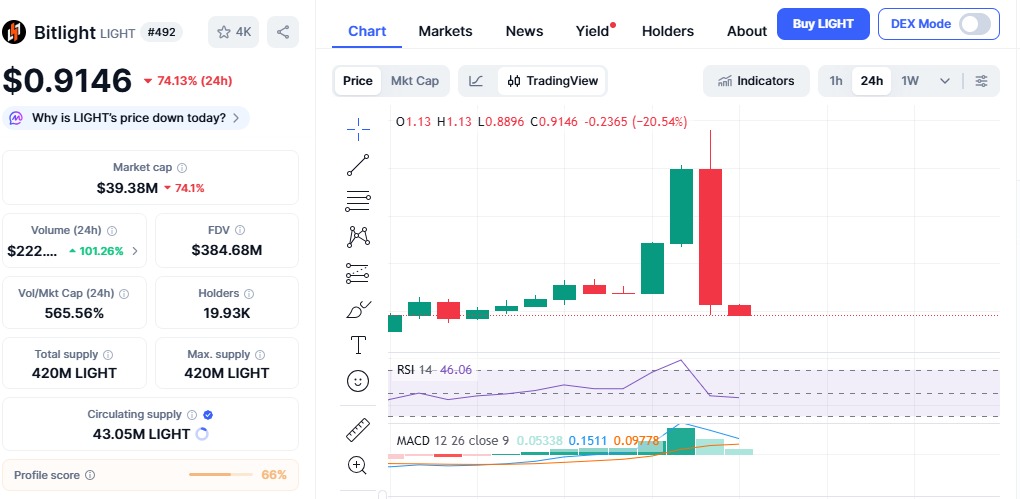

Bitlight Price Today

As per the CoinMarketCap, it is currently trading near $0.91, based on market information. The token broke through multiple major support levels in a short period of time.

With the nearly 400% three-day increase, the sales momentum gained pace rapidly. As soon as the market value dropped below $1.48, the liquidations began, pushing the drop even further.

Source: CMC

Technical indicators confirm weakness:

RSI is close to the value of 45 and showing no oversold bounce yet

The MACD turned negative, indicating bearish momentum.

Price was not able to hold the support zones post 400% Bitlight rally

If it cannot maintain above $0.56, there may be another fall.

Bitlight Price Crash: Analysis of the On-Chain Data

Information from the blockchain tracking data further supports the observations.

According to the Lookonchain data, 5 wallets transferred 8.84 million LIGHT tokens worth $8.2 million to Bitget in just 7 hours.

Source: Lookonchain

More troubling, however, was the observation by Onchainschool.pro that a wallet affiliated with team funds transferred $6.4 million in LIGHT to Bitget only six hours prior to the flash crash, although this was preceded by a transfer of $2.4 million two days ago to the same exchange.

Large money inflows can increase selling pressure, especially when market liquidity is low.

LIGHT Liquidations Surge to $16 Million

During this period, LIGHT liquidations hit a 24-hour figure of $16.17 million, second only to Bitcoin and Ethereum.

This explains that Leveraged investors were highly positioned on the long side. As the prices went downward, the forced sales created a ripple effect, causing an acceleration of the price crash.

Why Profit-Taking Hit LIGHT Hard

Low supply is one of the reasons for the price crash. Only 10% of a total of 420 million has been released.

Low-float tokens tend to be very active in both directions. When early buyers decided to take profits after the rally, there was not enough demand to absorb the selling pressure.

BitLight Price Prediction: What's Next?

, the risk is high.

Bearish scenario: The price might fall below $0.56, resulting in further drops.

Stabilization zone: $0.53–$0.60

Recovery attempt: It’s only possible if the price manages to recover $1.20 with strong

, Project's bitcoin DeFi and Lightning Network remains a promising story. But trust and transparency are going to be very important factors in the case of the Bitlight.

Conclusion

The price crash serves as a reminder that it is not wise to risk much in rapid price movements. Influx of exchange money, leverage, and small order books all added up to extremely high volatility levels, and traders must remain cautious in such situations.

This article is for information purposes only and not a financial advice, crypto can be highly volatile, always do your own research before investing.