3 Days Until Santa Rally: Gold & Silver Hit ATHs - What’s Bitcoin’s Price Target?

Precious metals just stole the holiday spotlight. Gold and silver smashed through all-time highs, leaving Wall Street scrambling and traditional portfolios looking a little less shiny. The so-called 'Santa Rally'—that seasonal burst of market optimism—kicks off in 72 hours. All eyes now pivot to the digital vault.

The Big Question

Where does Bitcoin go from here? The flagship cryptocurrency isn't just competing with tech stocks anymore; it's trading blows with ancient stores of value on their best day ever. The narrative is shifting from 'digital gold' to 'what if it's just... better?'

Momentum Meets Macro

Institutional flows haven't slowed. If anything, the metals surge highlights a deep, system-wide hunt for hard assets—a hunt that now routinely includes Satoshis creation. Bitcoin's supply schedule doesn't bend for festive sentiment or Fed whispers. It just ticks along, immutable and predictable, a trait that's starting to look priceless in an era of financial engineering.

The Target Zone

Forget the gentle slope of hope. Traders are mapping parabolic moves, fueled by ETF inflows and a global dash for scarcity. Resistance levels from the last cycle are being discussed not as ceilings, but as potential stepping stones. The technicals scream momentum, but the real driver might be simpler: fear of missing out on the next leg up, while traditional finance is busy rebalancing its gold bars.

A Provocative Close

While gold bugs celebrate their new highs and analysts dust off inflation charts from the 1970s, Bitcoin's network hums in the background—settling value, bypassing banks, and doing it all without a single holiday market closure. The Santa Rally might deliver cheer, but the real gift could be a brutal lesson in analog vs. digital. After all, in finance, the future has a habit of arriving dressed as disruption—and right now, it's wearing a blockchain. (Let's be honest, if your 'safe haven' asset just hit a record, maybe the system isn't safe... just saying.)

Gold Silver All Time High: Will The BTC Price Follow The Rally?

Gold price rally and Silver ATH price today are not just showing signs of a short-term hype. They are breaking records due to strong macro pressure.

-

Gold Futures: It surged around $4,391.92 per ounce, marking an bullish gain of nearly 67% in 2025 alone.

-

Silver All Time High: It Shattered records on Monday, December 22, surging past $69.23 per ounce. It is officially entering the "price discovery phase" where no historical resistance exists to slow price action.

These moves indicate a macro-driven shift, where retail investors are focusing on SAFE assets rather than digital assets like $BTC.

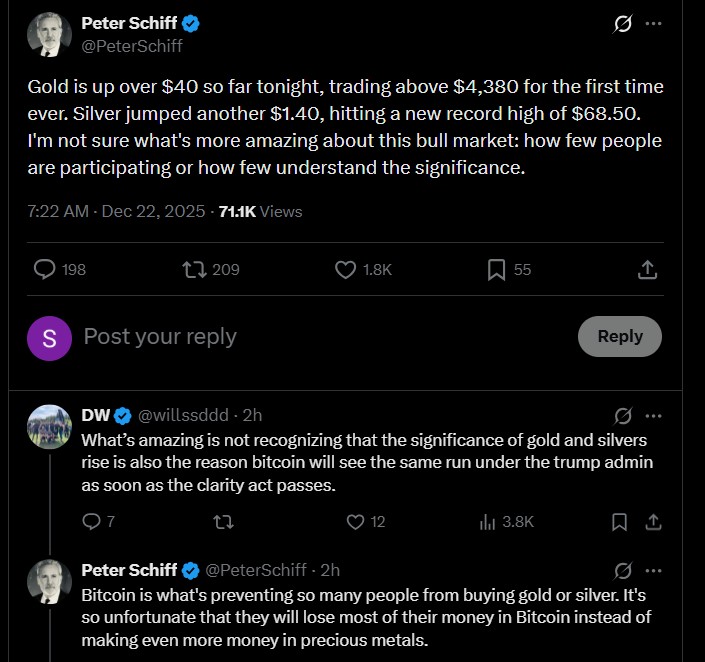

Famous chief economist Peter Schiff reacted strongly to the metals’ surge. He noted that the golden asset climbed over $40 in a single session, while another jumped to a record high NEAR $68.50.

"Peter Schiff BTC opinion: He also argues that Bitcoin is distracting investors away from hard assets. He warns that this rotation could result in losses for $BTC investors while they miss what he sees as a safer and more profitable cycle in gold and silver."

Silver ATH Price Today: What the Charts Are Clearly Signaling

As highlighted by The Kobeissi Letter, silver price is up more than 140% in 2025 and has printed eight consecutive green monthly candles, a rare historical pattern.

-

Historic Resistance: It has broken above old resistance zones from 1979 and 2011, meaning sellers are gone.

-

MACD & RSI: The MACD shows strong bullish momentum, while the RSI is above 75. It looks overbought, but in the long run, this shows strength.

-

Volume: Rising volume confirms real participation rather than thin liquidity pumps.

-

Key levels that traders new to watch include strong support at $65–$66, and resistance near $70.

Silver Price Prediction 2026: In the near-term, $70–$72 looks achievable, while a bullish run toward $75–$80 looks real as the January starts.

Gold Confirms a Long-Term Structural Bull Market

The gold price rally is also showing similar strength. The official TradingView chart reflects a setup of higher highs and higher lows.

-

The breakout zone at $4,300–$4,350 is now strong support.

-

The MACD stays above the signal line, and RSI above 70 reflects trend strength.

Gold Price Prediction 2026: In the short term, $4,500 is highly anticipated with an extension toward $4,700–$4,900 if Santa rally crypto 2025 starts.

Is $100K Bitcoin Price Target Possible After Hard-Assets Price Breakout?

While gold silver hit an all time high, $BTC is consolidating. The 4-hour TradingView price chart shows it is moving sideways around $88,000 - $89,000 after a sharp drop from its earlier attempt at $100,000.

Bitcoin found support near $82,000 - $84,000. Sellers are losing control, but buyers have not yet become aggressive.

-

MACD turning green shows momentum returning.

-

RSI near 57 means it is not overbought yet.

-

Support: $85K–$86K

-

Resistance: $90K–$92K

Key levels for the bitcoin price target remain clear: if it breaks above $92,000, then $BTC can breakout this week while targeting $98,000 to $100,000.

Expert Analysis: Ash Crypto, a famous crypto analyst summarized the situation bluntly: “Bitcoin is moving opposite to global M2 liquidity.”

According to him, this creates a binary setup, either liquidity tightens further and risk assets crash, or liquidity returns and $BTC explodes in 2026. This also aligns with current market behavior.

Bitcoin Price Prediction December 2025: What If Santa Rally Begins?

As per the latest analysis of Santa Rally crypto news, Bitcoin’s structure favors the upside. As we enter the final week of December, here are the clear targets

-

Immediate Target: $92,000–$95,000

-

Mid-term Target: $98,000–$102,000

-

Bull run: $105,000+

The crypto Santa Rally idea weakens if the token falls below $85,000, which WOULD likely keep price low rather than bullish.

Conclusion

Gold silver all time high signal DEEP macro stress and a shift toward hard assets. As per Coingabbar’s market experts, $BTC is not falling, it's waiting for a clear breakout phase. A break above $92,000 could unlock a delayed crypto rally toward $100,000, while a breakdown below $85,000 would favor caution.

For now, the market is watching two numbers and the bitcoin price target for next week depends on which one breaks first: $92K or $85K.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. cryptocurrency and commodity markets are highly volatile. Always DYOR before making investment decisions.