Bitcoin Whales Are Moving: What This Means for Price Action in 2026

Large-scale Bitcoin holders are stirring—and their movements are sending ripples across the market.

The Whale Watch Is On

When the big players move, the ocean gets choppy. Recent on-chain data points to a surge in activity from Bitcoin whales—entities holding massive amounts of the original cryptocurrency. This isn't just routine portfolio shuffling; it's a signal that the market's most influential participants are positioning themselves for what comes next.

Decoding the Signals

Whale activity often precedes major price shifts. Accumulation can hint at bullish conviction, while distribution might suggest profit-taking or risk management ahead of potential turbulence. The key is context: Are they buying the dip or selling the rally? Right now, the tape shows both—creating a tense equilibrium that has traders on edge.

The Bull Case vs. The Bear Trap

Optimists see whale accumulation as a giant vote of confidence—a bet that institutional adoption and macroeconomic trends will push Bitcoin to new heights. The pessimists, meanwhile, point to persistent macroeconomic headwinds and regulatory shadows as reasons for caution. It's the classic crypto standoff: unwavering belief versus cold, hard risk assessment. Sometimes it feels like the only thing traditional finance and crypto agree on is charging outrageous fees.

What's Next for BTC?

The path forward hinges on who blinks first. Sustained whale buying could provide the foundation for the next leg up, absorbing sell-side pressure and stabilizing the floor. But if selling pressure mounts—from whales or elsewhere—key support levels will be tested. One thing's certain: in a market this volatile, sitting on the sidelines is its own form of risk. The whales aren't waiting, and neither should you.

This new group of institutional and well-funded investors is creating a buzz about the potential for the continuation of the rise of the coin. But can this demand propel BTC through the impending technical roadblocks?

Wall Street Giants Lower Bitcoin Price Targets Amid Bearish Sentiment

Although there is increasing institutional participation, many big investment banks are reducing their target prices for the crypto. Citi has reduced its 12-month forecast for the crypto to $143,000 from $181,000, while Standard Chartered has reduced its 2026 target by 50 percent to $150,000 from $300,000. Even Cathie Wood's Ark Invest has reduced its 2030 forecast for the crypto to $1.2 million from $1.5 million.

This dramatic drop in the targets of Bitcoin's price suggests a greater fear among key financial institutions.

Notably, however, amidst all these changes, another firm making predictions about the price of bitcoin is Tom Lee and his Fundstrat group, which is pegging the price of Bitcoin at $60K-$65K in the short-term future. The projection made by Lee seems quite optimistic compared to the views of other analysts.

Is Bitcoin Entering a Bear Market? Crypto Experts Weigh In

CryptoQuant has raised red flags, indicating that BTC can be entering the bear market stage. The company indicates that prices can drop to a low of $70K within the next 3-6 months, with the possibility of going even lower to $56K during the second half of 2026.

Although some market analysts regard the current price action as only a phase of consolidation, there are warnings of the approach of a bear market.

The MACD and RSI both indicate that there is bearish momentum in cryptocurrencies, and the failure to MOVE through key levels of resistance in BTC valuation may lead to further downside in the short term.

Bitcoin Price Outlook: What Investors Should Watch Next

Bitcoin’s price prediction is largely impacted by two significant events, namely the actions of whales and the latest developments in the regulation scene. The U.S. is heading towards more defined regulation in the cryptocurrency space, with the CFTC being charged with the regulation of Bitcoin under the Crypto Market Structure Bill. On the flip side, the enforcement stance of the SEC may soften.

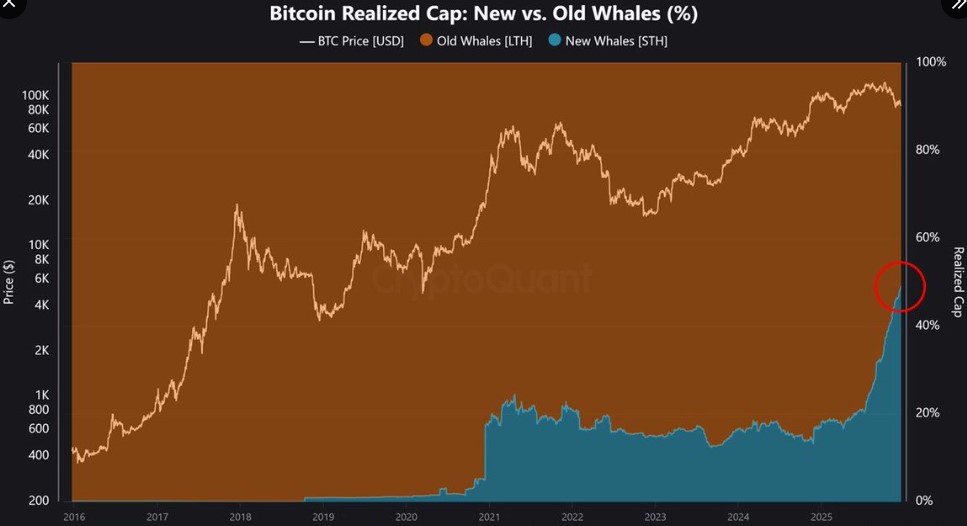

Despite the ongoing uncertainties, new whales are actively accumulating Bitcoins, contributing to an increase in the asset's realized cap. However, rising exchange deposits suggest that profit-taking is also on the horizon, which could apply downward pressure on prices in the NEAR term.

On a technical analysis front, critical support for the coin stands at $84.5K with a massive amount of over $35 billion at play at this level. A break below this critical support can cause a sudden drop to lower levels of $63K. For now, the course of BTC will depend upon whether it can sustain levels at these critical points or experience additional downward pressure from technical as well as macroeconomic settings.

This is for informational purposes only and not financial or investment advice. Crypto markets are volatile, do your own research before investing.