Japan’s Massive US Bond Sell-Off Sparks Debt Crisis Fears: Is a 30% Bitcoin Plunge Next?

Tokyo's treasury exodus sends shockwaves through global markets. As Japan offloads US debt at a historic clip, traditional finance braces for impact. But the real question echoes in crypto circles: will Bitcoin be the next casualty?

The Flight to Safety—Or Something Else?

This isn't just portfolio rebalancing. It's a strategic retreat from the world's bedrock asset. When a major holder like Japan cuts exposure, it doesn't just signal a loss of confidence—it screams it. The move exposes the fragile scaffolding of sovereign debt, a system built on trust that's now visibly cracking.

Bitcoin in the Crosshairs

Conventional wisdom says a liquidity crunch hits everything. Risky assets get sold first to cover losses elsewhere. That puts digital gold directly in the firing line. A 30% drop? For a market that treats volatility like a morning coffee, it's a plausible—if painful—scenario. The correlation game gets ugly when traditional levers break.

The Counter-Narrative: Digital Haven

But here's the twist. What if the smart money sees this coming? Bitcoin was born from financial distrust. A sovereign debt crisis is its origin story playing out in real-time. While bonds tumble, a decentralized, hard-capped asset starts looking less like a risk and more like the only lifeboat not tied to a sinking ship. Some whales might be selling to buy the dip they're helping to create—a classic Wall Street play, just with a digital twist.

The Verdict: Stress Test for a New Era

This isn't about predicting a single price swing. It's a live-fire test for Bitcoin's core thesis. Can it decouple when it matters? The next few weeks will separate narrative from reality. Either crypto gets dragged down with the old system, or it proves it was never really part of it to begin with. One cynical take? The same banks warning of crypto risk are up to their necks in the government debt causing the panic—talk about a conflict of interest.

Buckle up. The great unraveling might just be crypto's proving ground.

Japan Sell-Off US Bonds: Is $530M Stocks Enough To Fix The Economy

The country's decision to sell $530 billion in U.S. treasury bonds is one of the largest financial moves in recent history. They are trying to fix the debt crisis by bringing money back home.

Just a few hours earlier, the Bank of Japan interest rate decision came, which increased by 25 basis points (0.25%). For the past 30 years, the government kept rates at zero or even negative.

Because of this, the 10-year yield for Japanese Government Bonds (JGB) has jumped to 2%, the highest since the dot-com bubble in 1999. This MOVE basically ends the "carry trade"—where people borrowed cheap money to invest in expensive things elsewhere.

The Ripple Effect: Yen Weakness and Debt Crisis Are Growing

Even with the Bank of Japan rate hike, the Japanese Yen has become very weak. Right now, $1 is worth about 161.50 Yen. This is much higher than the 150 level we saw earlier in 2025.

According to Robin Brooks , Chief FX Strategist, this weak Yen is a "scary" sign of country debt crisis. According to Brooks, the country needs to:

-

Cut government spending.

-

Raise taxes.

-

Sell off government assets to stop the Yen from crashing further.

If they don't fix this debt problem, the Yen weakness WOULD go even worse, causing trouble for the whole country’s economy.

What Does This Sell-Off Mean for the Crypto Market?

While the world watches the unfolding economic drama, crypto investors are also on edge. When the $530M Japan sell-off of US bonds officially implements, it pulls "easy money" out of the world.

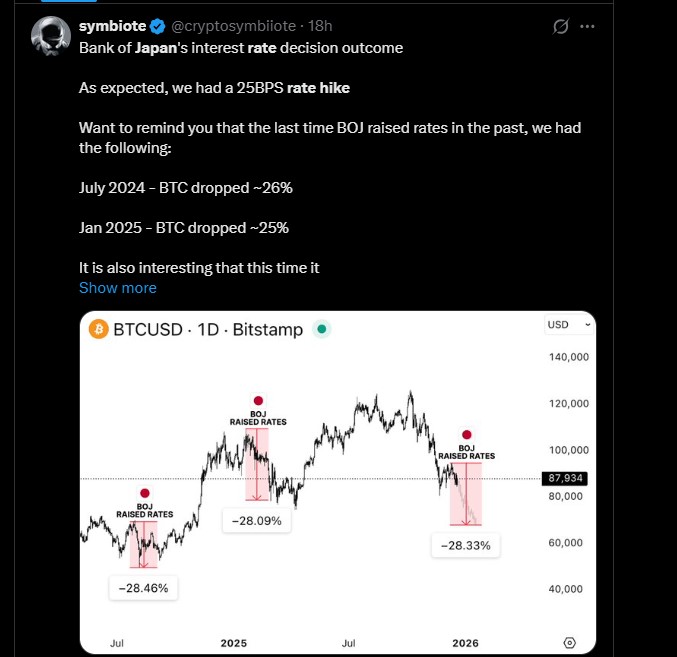

This usually makes the crypto market drop. Financial Experts like Symbiote say, past rate hikes by the BoJ in 2024 and 2025 led to significant drops in Bitcoin (BTC) prices, approximately 26% in July 2024 and 25% in January 2025.

Now, with the BoJ raising rates to 0.75%, the highest since 1995, there’s a possibility that $BTC could experience a similar drop.

Ethereum and Bitcoin Price Prediction: Why it Might Drop

Right now, as per CoinMarketCap chart, it is trading around $88,219, reflecting a slight increase of 0.12% in the last 24 hours.

-

Support: The most important safety floor is at $87,000. If it falls below this, the price could crash to $80,000 or even $70,000.

-

Resistance: $90,000.

-

The Prediction: Symbiote believes Bitcoin could drop by 30% soon. In the short term, it might hit $80,000–$85,000. However, if things settle down, it could eventually reach $100,000 in the long run.

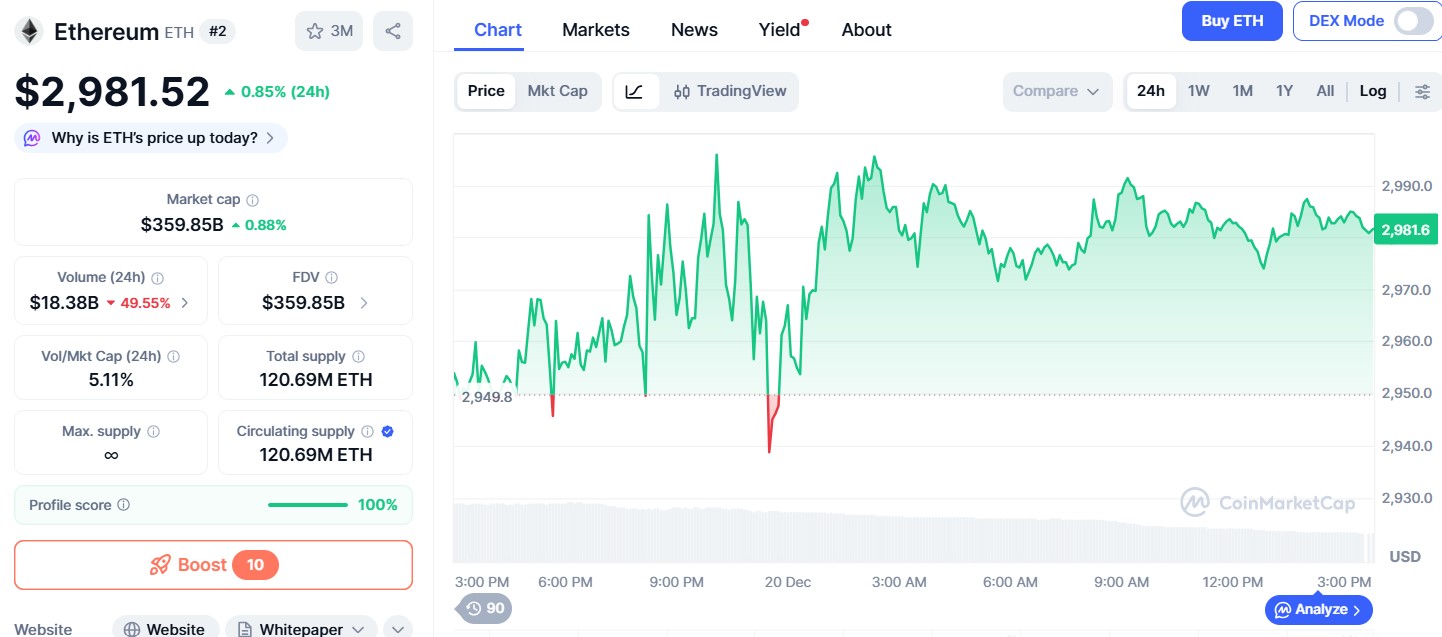

$ETH is currently priced at $2,981 reflecting a slight increase of 0.12% in the last 24 hours. While it surged a little today, it is still under pressure from the potential Japan sell-off US bonds news and rate hike.

-

Support: Its safety floor is at $2,900. If things get worse, it might dip to $2,700.

-

Resistance: It needs to break $3,000 to opt for a bullish trend.

-

The Prediction: Coingabbar’s top crypto analysts believe, $ETH might drop to $2,750 in the short term. But its long-term future depends on the global economy getting stable again.

Conclusion

In short, the Japan sell-off of U.S. bonds and the rate hike mean that the crypto market might stay "red" for a while. Bitcoin and ethereum are both at risky levels.

If they break their safety floors at $87,000 and $2,900, prices could drop much further. For now, it is best for traders to be careful and keep an eye on Japan’s debt crisis.

Disclaimer: This article is for information only and is not financial advice. Investing in crypto is risky. Always talk to a professional before making any investment decision.