Coinbase’s Big Shift: Stocks Trading and Prediction Markets Go Live - The Crypto Giant’s Boldest Move Yet

Coinbase just dropped a bombshell—and it's not about Bitcoin. The crypto exchange heavyweight is stepping into the ring with traditional finance titans, launching stock trading and prediction markets in one sweeping move. Forget just buying crypto; now you can trade Tesla shares and bet on election outcomes from the same app. It's a full-spectrum financial assault.

The Platform Play: From Crypto Corner to Main Street

This isn't an expansion; it's an invasion. By integrating stocks, Coinbase isn't just adding a feature—it's building a moat. The strategy is clear: become the one-stop shop for every asset class a retail investor might want. Why leave the platform to buy stocks when you can do it right next to your Ethereum stash? It captures attention, capital, and crucially, custody.

Prediction Markets: Where Gambling Meets Governance

Then there's the real curveball: prediction markets. This is where crypto's ethos of decentralized information meets pure, speculative adrenaline. Users can now put money on real-world events—sports, politics, even tech earnings. It's a bold embrace of a controversial sector, framing speculation as 'crowdsourced forecasting.' Some will call it innovation; others, a sophisticated betting shop wrapped in tech jargon—a classic finance move, really.

Why This Changes Everything (For Them)

This pivot solves multiple problems at once. It diversifies revenue streams away from volatile crypto trading fees. It engages users during crypto bear markets. Most importantly, it leverages their existing, compliance-heavy infrastructure to offer services traditional brokers can't or won't touch easily. They're not just competing with Binance anymore; they're eyeing the customer bases of Robinhood and DraftKings.

The Regulatory Tightrope

Launching this duo is a regulatory high-wire act. Stock trading brings FINRA and SEC scrutiny to the party. Prediction markets? That's a legal gray area in many jurisdictions, often a hair's breadth from being considered unregulated gambling. Coinbase's bet is that its established compliance muscle and political lobbying heft will keep the regulators at bay—or at least negotiate a path forward. It's a risky wager on their own influence.

The Final Tally: A Unified Wallet for a Fractured World

Coinbase's 'big shift' is a declaration of ambition. It's no longer content being the on-ramp to crypto. It wants to be the entire financial highway—digital assets, traditional securities, and speculative contracts all under one roof. For users, it promises unprecedented convenience. For the industry, it signals that the biggest players are moving beyond niche status. For skeptics, it looks like a desperate grab for relevance in a crowded market. Whether it's genius or overreach, one thing's certain: the walls between crypto and everything else just got a lot thinner.

Source: Coinbase Official X

Source: Coinbase Official X

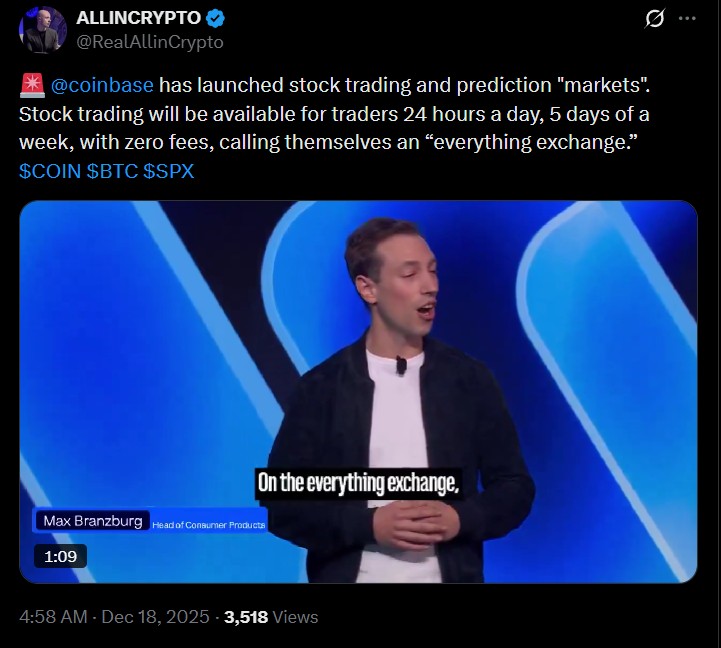

Crypto Exchange to Everything Exchange.

The platform announced that soon, U.S. users will be able to use zero-fee stock trading, 24/7, five days a week. It is the first direct entry into the retail equity trading arena by the company.

In addition to stocks, it is also launching prediction markets in an authorized collaboration with Kalshi.

The users will be able to trade on elections, sports, and macroeconomic outcomes directly on the Coinbase app.

CEO Brian Armstrong positioned the update as a larger vision to make the destination to trade everything, which is crypto, equities, futures, perpetuals, and outcome-based markets, all on a single interface.

Source: Official X

Source: Official X

Increasing the Desire for 24/7 Trading.

In 2025, prediction markets experienced a surge in growth, and the amount of money traded is said to be over $10 billion. These are nowadays not only considered as a speculative instrument, but also as a gauge of what people think in real time.

The exchange believes that the majority of users are in prediction markets to know what will come next and not necessarily to make money.

This intuitive need is in line with the objective of the platform of enhancing user interaction beyond the traditional forms of buy-and-hold investment.

In the case of markets, it means that the sentiment-based trading approach can be integrated with equities and crypto-assets to allow users to engage with a variety of assets in one application.

Source: X

Source: X

Build-Out Strategic Partnerships and Platforms.

Kalshi collaboration enables Coinbase to provide regulated event contracts, which is unlike crypto-native competitors such as Polymarket. Simultaneously, the platform is implementing a tokenization roadmap that WOULD eventually see traditional assets, such as equities, go on-chain.

The company is also launching APIs to businesses and developers in the areas of custody, payments, trading, and stablecoins, further supporting its position as financial infrastructure, not merely an exchange.

This plan puts Coinbase in a head-on collision with Robinhood, DraftKings-affiliated exchanges, and CME-supported programs that are moving into the prediction market.

Regulation, Competition, and Adoption.

Although there is a lot of excitement regarding the announcement, one of the major challenges is regulatory scrutiny, especially for prediction markets and event-based contracts in the U.S.

Should it succeed, the unified model can capture non-crypto users in the traditional financial sector by using its base of more than 100 million verified accounts. Nevertheless, it might be challenged by a rise in competition and the complexity of features in the coming months.

Conclusion

The update in December 2025 is a turning point in the development of this company. The company is a crypto, stock, and prediction market combination, making it a legitimate everything exchange, crossing the boundary between traditional finance and digital assets.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highlyvolatilee and you can lose your entire investment.