Fed Opens Floodgates: Banks Get Green Light to Enter Crypto Markets

The financial landscape just shifted. The Federal Reserve has quietly rewritten the rulebook, granting traditional banks a long-awaited pass to the crypto arena. No more watching from the sidelines—the old guard is now officially in the game.

The New Playbook

For years, banks treated crypto like a forbidden fruit—tempting but off-limits. That era is over. The Fed's policy pivot scraps the regulatory handcuffs, allowing institutions to custody digital assets, facilitate trades, and integrate blockchain services directly into their offerings. It's not a tentative nod; it's a full-throated invitation to build.

Why This Changes Everything

This isn't about a few banks dabbling in Bitcoin. It's about liquidity, legitimacy, and infrastructure. Imagine pension funds allocating to digital assets through their trusted custodians. Picture your checking account seamlessly interacting with decentralized finance protocols. The wall between TradFi and DeFi just got a demolition order.

The institutional money—previously peeking through the fence—now has a wide-open gate. Analysts predict a capital influx measured in the hundreds of billions once compliance departments finish their paperwork. The 'wild west' narrative? Officially retired by the most powerful financial regulator on the planet.

A Cynical Footnote

Of course, Wall Street only embraces disruption once it's finished building a toll booth on the road. The very institutions that spent a decade dismissing crypto as a 'fraud' are now racing to monetize it. The irony is thicker than a legacy bank's fee schedule.

The market won't be the same. Volatility might get a new, sophisticated manager. Mainstream adoption just got fast-tracked. The Fed didn't just open a door—it kicked down the wall. The only question left is how fast the suits can run.

With this change, the Federal Reserve signaled a clear shift in how US regulators view digital assets.

Under the previous provision, banks were presumed not to be allowed to hold digital assets, issue stablecoins, or launch crypto products. It effectively discouraged state member bank from offering services beyond what national banks were allowed.

Now, in its updated 2025 statement, the Fed acknowledged that its understanding of innovative products and services has matured. As a result, the previous framework was deemed no longer appropriate and formally withdrawn.

However, policy analysts view this update as a controlled experiment rather than a full regulatory green light for cryptocurrency banking.

What the New Federal Reserve Crypto Policy Allows

The revised Fed crypto policy introduces a key distinction between insured and uninsured state member banks.

The earlier provision played a central role in the central bank’s rejection of Custodia Bank’s application for a Fed Master Account. Custodia, an uninsured Wyoming-chartered bank focused on digital assets, operates with 100% reserves.

Under the new policy framework, Custodia and similar institutions may now seek approval to engage in activities that were previously blocked, potentially reshaping their future operations.

However, banks with FDIC deposit insurance will continue to face strict limits under Section 24 of the Federal Deposit Insurance Act.

Vice Chair for Supervision Michelle W. Bowman said the new policy aims to support responsible innovation while ensuring the banking sector remains safe, sound, and modern.

Why the Federal Reserve Is Changing Its Policy Now

The shift comes as innovative financial products rapidly evolve worldwide. The US crypto market itself generated over $1.35 billion in revenue in 2024 and is projected to nearly double by 2030 (Grand View Research). Even the US government now holds around 325,000 Bitcoin worth nearly $36 billion, showing rising digital asset exposure.

The US has adopted a more openly pro-crypto stance, especially under President Donald Trump’s leadership. Its recent development includes the GENIUS Act, CBDC laws, and more. Several agencies have eased restrictions, scrapped aggressive enforcement-only approaches, and issued clearer guidance for digital assets.

With this, the Fed stated that its understanding of innovative financial products has also evolved. Since 2023, the cryptocurrency market, regulatory frameworks, and risk controls have matured significantly.

How the Policy Impacts the Current Market

The Federal Reserve crypto policy update comes at a critical moment for the industry. After years of uncertainty following the FTX collapse, banks are once again being viewed as potential stabilizers rather than risks.

Bank involvement can improve liquidity, strengthen compliance, and attract institutional investors who previously stayed away from crypto-only platforms.

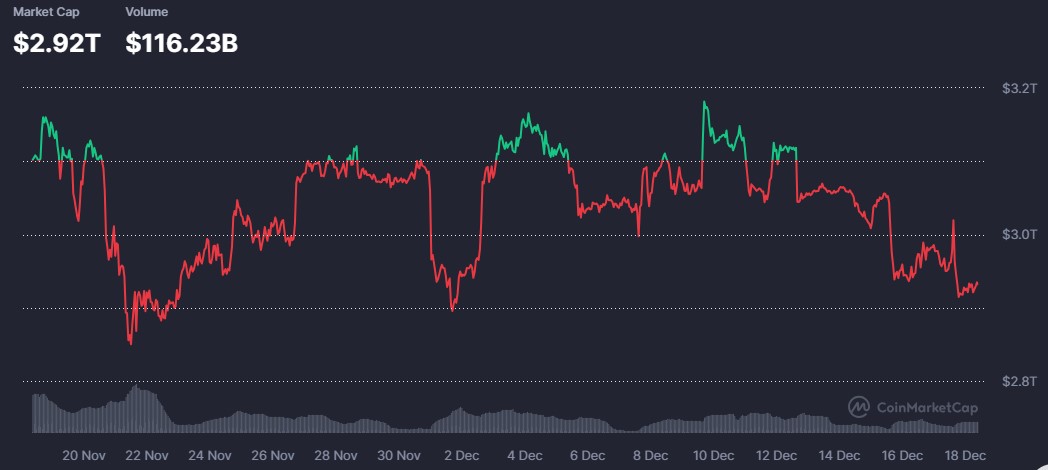

Currently the broader market is showing a volatile movement as it is down 0.74% today, with bitcoin hovering around $86,816 (up 0.42%) and ethereum at $2,833 (down 3.06%).

With bank bringing trusted systems and regulatory experience, crypto markets could see more structured and stable participation. For everyday crypto users, this could eventually mean safer access via regulated banks.

However, risks remain. Digital assets prices are still volatile, and banks will need strong safeguards to manage exposure responsibly.

Conclusion: Could It Trigger Global Shift

Globally, US regulatory decisions often influence how other countries shape their crypto policies. By allowing banks to cautiously re-enter the cryptocurrency space, the Federal Reserve sends a signal that digital assets are becoming a permanent part of the financial system.

This shift could encourage other regulators to MOVE away from outright restrictions and toward balanced frameworks that support innovation while managing risk. As the US becomes more crypto-friendly, global markets may follow a similar path.