Spur Protocol Listing Price: What to Expect as SON Presale Ends?

The SON presale curtain falls—now the real show begins. All eyes lock on Spur Protocol's listing price as the market holds its breath.

The Presale Hangover

Presale euphoria fades fast. The transition from private capital to public markets separates momentum from substance. Every project faces the moment of truth when its token hits an open order book.

Listing Day Dynamics

Initial price discovery cuts through the hype. It's a brutal, real-time audit of demand versus inflated expectations. Early backers eye exits, while new entrants gauge if the valuation makes sense—or if it's another case of greater fool theory in action.

Beyond the Opening Bell

The first candle tells a story, but not the whole book. Sustained volume and holder distribution matter more than a fleeting pump. Protocols that build utility outlast those chasing a quick flip.

The market's about to deliver its verdict on Spur. Let's see if the protocol's tech matches its traders' ambition.

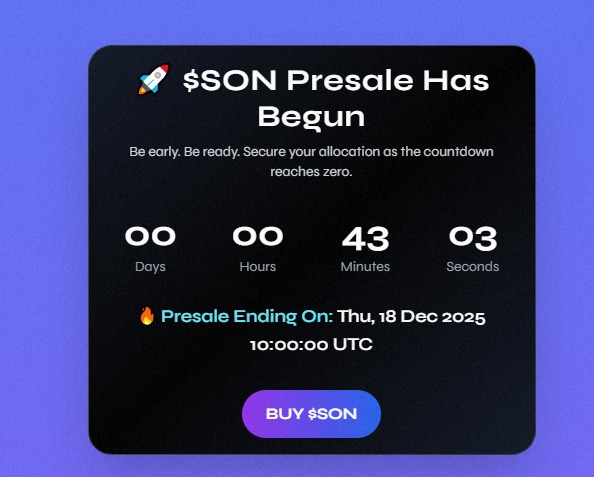

Presale is Almost Over

The SON token is now available on presale for $0.03. As only an hour remains, a large number of tokens have been sold, indicating interest from the community at an even pace. The maximum supply of SON tokens is capped at 1 billion tokens, which WOULD prevent inflation during the launch.

Source: SpurProtocol Official Website

While TGE will indeed take place on December 19, 2025, the listing date on an exchange is not fully clear yet. Many anticipate that it will indeed be listed in December 2025, but there's also a good chance that it could get pushed into early 2026, pending the need for further time to complete exchange agreements.

So far, the project has confirmed listings on MEXC, BingX, SpurSwap, and PancakeSwap. Now, investors will be waiting for any major exchange announcements, which may strongly influence the price of listing of the Spur Protocol.

Tokenomics and Supply Allocation

The Spur Protocol tokenomics is such that it would help in long-term growth. Around 40% of the tokens are kept for community airdrops, which helps attract users, while another 20% is kept in a reserve fund for future development. 10% goes to Strategic Investors and DEX Liquidity each, while the rest are divided among marketing, ecosystem holders, charity allocation, and advisory needs.

This balanced setup minimizes the risk of heavy selling right after the launch.

Partnerships Add Momentum

The project has just announced its partnership with GainsPad for the IDO's public sale. This will allow users to stake $GAINS in advance, bringing along a better buzz and participation in an IDO.

The Spur Protocol ICO is live on the AIDICA Launchpad. With a target raise of $100,000 at a valuation of $40 million fully diluted, half of the tokens unlock at TGE. Meanwhile, the rest follow a gradual vesting schedule. Investors also get a 72-hour refund option after listing, thereby lowering early risks.

Spur Protocol Listing Price Prediction

The Spur Protocol listing price prediction,

Base Case: Might range between $0.05 and $0.10 reflecting steady demand and current exchange plans.

Bullish Case: If adoption rockets in 2026, then prices between $0.20 and $0.50 are on the cards, with $1 as a long-term target if the project delivers real users.

Bearish case: If liquidity is weak, SON may trade near $0.03–$0.05, close to presale levels.

Final Thoughts

As the presale comes to an end and TGE looms, the next set of announcements will be instrumental in determining where the Spur Protocol Listing Price finally settles.

This article is for informational purposes only, kindly do your own research before investing in crypto markets.