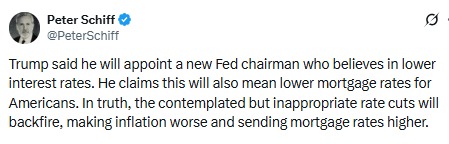

Why Trump’s Interest Rate Cut Promise Could Backfire on Homebuyers?

Promises are cheap. Rate cuts are complicated. A political pledge to slash borrowing costs might sound like a gift to the housing market—until you unpack the economic fine print.

The Short-Term Sugar Rush

Initial euphoria would hit. Mortgage rates dip, buyer inquiries spike, and real estate agents dust off their 'SOLD' signs. The market gets a jolt of adrenaline, fueled by the prospect of cheaper money. It's the classic political playbook: stimulate now, deal with consequences later.

The Inflation Boomerang

Here's where the plot twists. Artificially suppressed rates, untethered from economic data, are a classic recipe for overheating. Demand rockets while supply lags—sound familiar? It's the same dynamic that pushes asset bubbles from crypto to condos. The Fed's independence exists for a reason, a lesson often learned after the bubble pops and the bill comes due.

A Market on Steroids

Home prices, already stretched, get another shot of rocket fuel. First-time buyers, lured by lower monthly payments, find themselves in bidding wars that erase any interest savings. The affordability crisis doesn't get solved; it gets leveraged. The smart money—the kind that remembers 2008—starts eyeing the exits.

The Long Game of Stability

Sustainable growth isn't built on political promises. It's built on measured policies, transparent data, and institutions that don't bend to electoral cycles. A rate cut should be a tool, not a trophy. When monetary policy becomes a campaign slogan, everyone's investment—from a suburban split-level to a Bitcoin wallet—carries extra, unhedgeable risk.

In the end, the most cynical finance jab is also the oldest: there's no such thing as a free lunch. Someone always picks up the tab, and it's rarely the one making the promise.

Source: X (formerly Twitter)

How an Interest Rate Cut Really Works

An interest rate cut has a limited effect on short-term borrowing costs, such as the interest on overnight loans between banks. The president can influence indirectly by guiding the leadership of the Federal Reserve.

But mortgage rates don't rely on short-term rates. They're closely linked to long-term Treasury yields, specifically the yields on 10-year and 30-year bonds.

If markets believe that an cut is forced while inflation remains high, investors get nervous. They demand higher returns against future rsing prices. And that can push long-term bond yields up. As they do, mortgage rates normally rise instead of fall.

Why Mortgage Rates Could Go Higher

Several market experts point out a key risk. Forcing an interest rate cut during “sticky inflation” often leads to a higher term premium. This means lenders charge more for long-term loans. The U.S. dollar may weaken, inflation fears grow, and long-term interest rates MOVE higher.

A user asked if it should be raised instead, Peter replied, “Yes.” His point reflects a broader concern: lowering rates too early can damage trust in monetary policy. Once that trust is lost, mortgage rates can spike fast.

Trump says fed rate cut will help Americans by lowering mortgage prices and making homes more affordable. At first, this idea sounds good, especially for people struggling with high housing costs.

If rate cuts lead to higher inflation, lenders will raise mortgage rates to protect themselves. Homebuyers could end up paying more each month, not less. In this way, a policy meant to help buyers could actually make homes even more expensive.

Inflation Data Gaps Add More Uncertainty

Market stress is rising because key U.S. economic data is incomplete. The government shutdown delayed employment and inflation reports. There is no official unemployment rate for October, and the headline CPI was not released.

Investors fear uncertainty. If there is a lack of data, markets are usually going to assume the worst, and such is the case with increased volatility across stocks, bonds, and crypto.

The US CPI data will be important as inflation is proving sticky. The September CPI came in at 3%, and economists expect a slight increase to 3.1% as per CNBC reporting.

Impact on Markets, Crypto, and Safe Havens

Right now, markets are already nervous. Risk assets like crypto are highly volatile and bearish. The current crypto market cap is at $2.19 Trillion with a decrease of 1.7%. Bitcoin and the altcoins struggle as money moves out to safety assets. Prices of gold and silver have been going up, really quite indicative of some sort of risk-off behavior.

If a federal reserve cut ignites fears of price rise, crypto markets could see some short-term selling pressure. Higher longer-term yields are deleterious for liquidity, and this especially hurts speculative assets. Meanwhile, gold may continue its current uprise as investors seek hedge against price increase.

What This Means

Trump’s interest rate cut promise sounds positive on the surface, but markets care more about living-costs control than political goals. If cuts are seen as reckless, the result could be higher mortgage, unstable markets, and deeper pressure on risk assets.

In the end, an interest rate cut only works when inflation is under control. Without that, the cure may become the problem itself.

This article is for informational purposes only, do your own research before investing.