Peter Schiff Slams MSTR’s $50B Bitcoin Bet: ’Reckless’ Strategy or Genius Move?

Gold bug Peter Schiff just took another swing at MicroStrategy—and its massive Bitcoin bet is back in the crosshairs.

When $50 Billion Isn't Enough

Schiff's latest critique zeroes in on MicroStrategy's relentless Bitcoin accumulation strategy. The outspoken gold advocate argues the company's aggressive moves border on corporate recklessness—a massive, concentrated bet on a single volatile asset.

It's the classic clash of philosophies: digital gold versus the physical kind. Schiff sees speculation; MicroStrategy's Michael Saylor sees technological inevitability.

The Balance Sheet Gambit

MicroStrategy's approach isn't just buying—it's leveraging. The company has consistently used debt and equity offerings to fund its Bitcoin purchases, essentially betting shareholder capital on crypto's long-term appreciation.

Traditional finance types clutch their pearls. Crypto natives cheer the conviction. Meanwhile, that $50 billion position keeps growing—making MicroStrategy more a Bitcoin proxy than a software company.

Who's Really Winning?

Schiff's criticism comes with perfect timing—for someone. Gold's been flat while Bitcoin flirts with all-time highs. Yet his warnings about concentration risk aren't entirely wrong. Putting that much corporate treasure in one basket would give any sober CFO nightmares.

Then again, playing it safe rarely made anyone billions in this market. Sometimes the 'reckless' bet looks like genius in hindsight—and sometimes it just looks reckless. Just ask anyone who bought the top in 2021. Or 2017. Or 2013.

The Final Tally

Schiff versus Saylor isn't just personal—it's the fundamental divide in modern finance. Store value in millennia-old metal, or in seventeen-year-old code? Hedge against inflation with physical scarcity, or with digital scarcity?

One thing's certain: while traditional investors debate risk management, MicroStrategy keeps stacking sats. Because in crypto, sometimes the best risk management is simply being early—and staying early.

After all, Wall Street's been wrong about Bitcoin for fifteen years straight. What's one more gold bug's opinion against a $50 billion position?

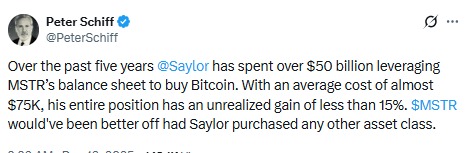

Peter Schiff vs the MSTR Bitcoin Strategy

Peter Schiff took to X to question Michael Saylor’s long-running MSTR BTC accumulation Strategy. According to Schiff, MicroStrategy has spent more than $48–50 billion buying BTC at an average cost close to $75,000.

Source: X (formerly Twitter)

Despite BTC’s long-term rise, he claims MSTR’s overall unrealized gain is less than 15%. His argument is simple: for such a huge capital commitment, the payoff looks small.

When asked how gold would have performed instead, he said profits would likely be “at least double, if not more.” The timing of the tweet is important. It came during a sharp crypto sell-off, when leverage-driven liquidations wiped out over $600 million in positions in a single day.

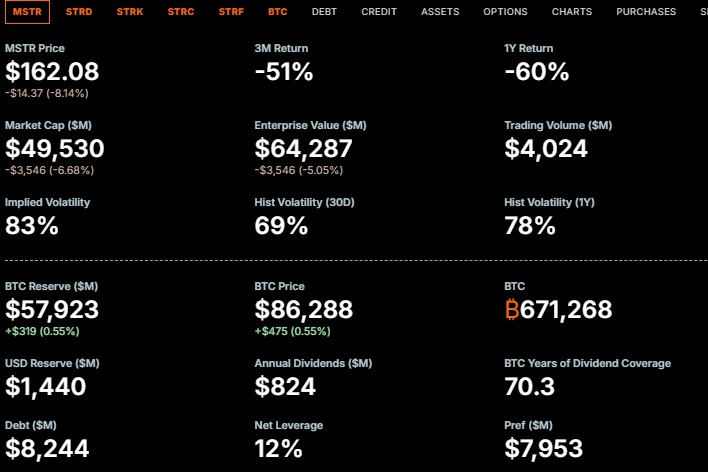

MicroStrategy Financial Details

Market data shows MicroStrategy stock under pressure. MSTR has fallen more than 60% over the past year, while volatility remains extremely high. Despite this, the company now holds about 671,268 coins, bought for roughly $50.3 billion. At current prices near $86,000, Bitcoin drop has narrowed unrealized gains, making Schiff’s criticism more visible during downturns.

Source: Strategy Website

Still, Saylor remains firm. In a recent update, he confirmed that Strategy acquired another 10,645 BTC for about $980 million at an average price NEAR $92,098. He also highlighted a BTC yield of 24.9% year-to-date, signaling continued confidence in the Michael Saylor's approach.

BTC vs Gold During Market Stress

The debate sharpens when the cryptocurrency is compared with gold. XAU/USD climbed to around $4,350, less than 1% below its all-time high. According to TradingView data, gold is up about 131% over the last five years. In contrast, bitcoin has gained roughly 344% over the same period, but with far greater swings.

During economic uncertainty, Gold benefits from falling yields and a weaker dollar. Digital asset, on the other hand, behaves more like a risk asset in the short term. This explains why Schiff’s focus is on unrealized gains rather than long-term charts. It’s volatility means timing matters more.

Silver Joins the Safe-Haven Rally

Silver is adding another LAYER to the argument. Prices recently held near $64, close to record levels, after a strong channel breakout. Silver is up over 100% in 2025, supported by ETF inflows and demand for hard assets. The silver–Bitcoin ratio has collapsed, showing capital rotation away from crypto toward metals.

Why Did Saylor Choose Crypto Asset?

Critics ask why Saylor chose BTC over stocks, bonds, or metals. Supporters say the MSTR Bitcoin Strategy is built on long-term scarcity, not short-term stability. Saylor believes it is digital property, not just a trade. Schiff disagrees, arguing corporate balance sheets need lower volatility and steadier returns.

There is no evidence Saylor “knows something hidden,” but his conviction sets MicroStrategy apart from traditional firms. The strategy magnifies gains in bull markets and pain during crashes.

Conclusion

The Microstrategy's approach is not failing, but it is being stress-tested. The crypto asset has outperformed gold over five years, yet short-term crashes shrink unrealized gains and fuel criticism. Gold and silver are shining in 2025, while cryptocurrency remains volatile. The real question is whether investors judge MicroStrategy on short-term swings or long-term conviction.