Crypto Bloodbath Explained: The Real Reasons Behind Today’s BTC, ETH & SOL Crash

Digital asset markets are reeling. Bitcoin plunged below key psychological levels, Ethereum shed double-digit percentages, and Solana's rally reversed in a brutal selloff that painted charts crimson.

The Liquidity Squeeze

Market-wide leverage got torched. Over-leveraged long positions across major exchanges faced cascading liquidations, accelerating the downward spiral. It wasn't a single catalyst—it was a perfect storm of pressure meeting an overextended market.

Macro Headwinds Return

Traditional finance sneezes, crypto catches a cold. Shifting expectations around interest rates and risk assets triggered a flight to safety. Capital rotated out of speculative holdings, with crypto often first in line for the exit—a classic move that treats digital assets like the market's favorite volatility toy.

Network Stress Tests

Ethereum gas fees spiked during the volatility, highlighting persistent scalability debates. Solana's recent gains proved fragile, demonstrating how quickly momentum can reverse when sentiment shifts. The infrastructure narrative faced a reality check under pressure.

The Washout Before The Rally?

Every major bull run has its brutal corrections. This flush-out weak hands, resets derivatives markets, and establishes stronger foundations. History shows these drops, while painful, often create the healthiest entry points. The smart money watches for accumulation, not panic. After all, in crypto, the only thing more predictable than a crash is the army of analysts who saw it coming—right after it happened.

1. Fed Chair Confusion Creates Fear in the Industry

One big reason for today’s crypto market crash is the sudden change in who may become the next US Federal Reserve Chair.

According to the latest update shared by The Kobeissi Letter, Kevin Warsh is now the top favorite with a 48% chance, seen in the Polymarket market. This happened just hours after reports said that Hassett’s Fed Chair chances were blocked by people close to Trump.

This political shift has made investors worried, which is one of the strongest reasons behind why the crypto market is falling today.

2. FSOC Softens Its Cryptocurrency View, But Traders Feel Alone

The U.S. Financial Stability Oversight Council (FSOC) released its 2025 annual report and surprisingly reduced its warning on cryptocurrency assets and stablecoins.

FSOC said cryptocurrency is no longer an immediate systemic risk, and the GENIUS Act, which started in July, now gives a clear rulebook for stablecoins.

But ironically, this shift came during a major crypto market crash, making many investors feel unprotected. This feeling has added more fear during the ongoing Bitcoin, Ethereum, and solana crash.

3. Bitcoin and Ethereum Crash Intensifies Fear Index

Now, let’s look at the numbers behind the Bitcoin price drop and the ethereum crash:

BTC at the time of writing is standing at $85,813.10.

-

Last 24 hours: Down 4%

-

24H Volume: $44.12B, down 5.58%

-

Recent high: Nearly $89k on 15 December

The famous trader Merlijn reacted by saying: “BITCOIN DUMPED INTO EXTREME FEAR.”

ETH at the time of writing is starting at $2,931.83.

-

Last 24 hours: Down ~6%

-

24H Volume: $27.58B, up 49.22%

Even though ETH price is falling, the huge jump in trading volume may have a positive effect later. It shows traders are very active during this Crypto Market Crash.

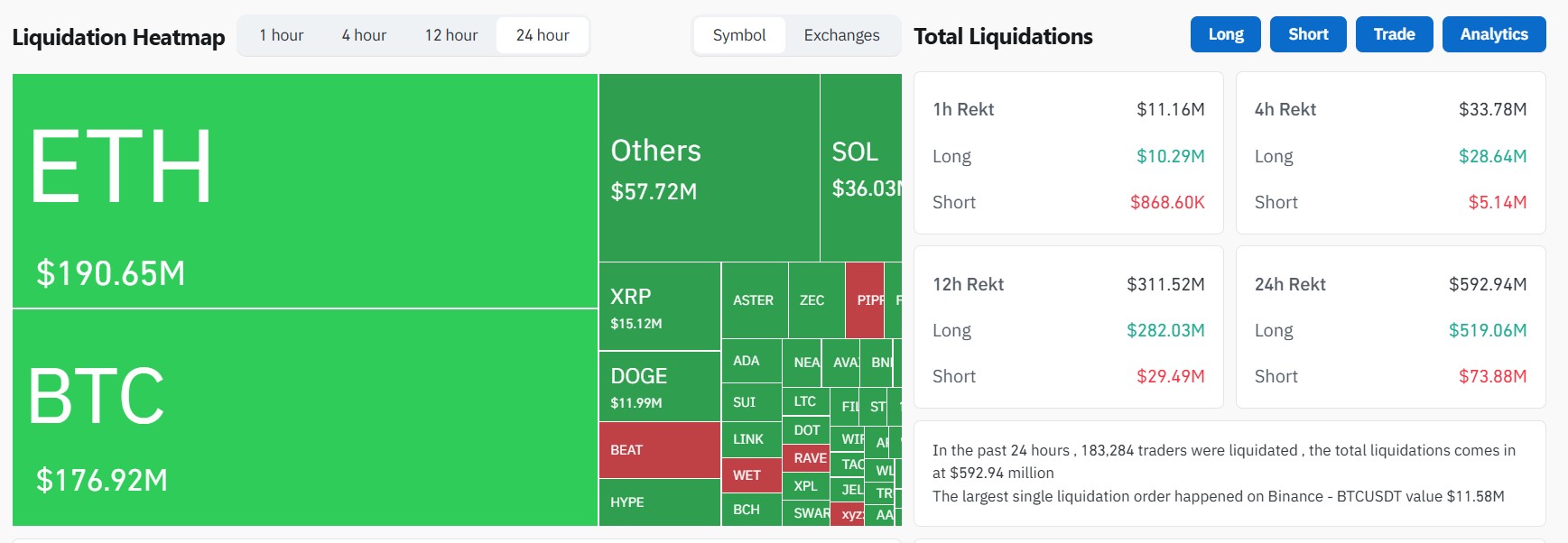

4. Massive Liquidation: $592 Million Wiped Out in 24 Hours

The latest bloodbath news shows that more than $592 million worth of positions were liquidated in just 24 hours. This heavy flush is one of the biggest reasons behind the crypto liquidation news today.

Most traders were expecting the market to rise, so they opened long positions. But when the industry suddenly fell, these positions were force-closed. This caused more selling pressure, which pushed prices down even faster.

5. Lack of Liquidity + Leverage = A Dangerous Mix

Right now, the industry is struggling with very low liquidity, and almost no support from industry makers. Traders keep opening longs, trying to catch the bottom, but this only creates new liquidity levels at lower prices. So the price keeps dropping again and again.

This is why the crypto fear index has fallen to Extreme Fear at 11. Order books are empty, so even small price drops become big falls.

This entire setup is exactly why the crash looks so strong today.

Conclusion: Will the Crypto Market Recover Or Will It Fall More?

Right now, analysts, influencers, and market experts are all surrounded by uncertainty. There are no clear signs of a trend reversal on the charts yet. Bitcoin is weak, liquidity is low, and big investors are not stepping in.

Being a cryptocurrency expert for a long time, when the industry hits maximum fear, it often creates strong bottoms. With the Santa Rally and Christmas season coming, the final days of December may decide everything.

If stability returns, the marketplace may recover. If fear increases, there may be more downside.

Disclaimer: This article is only for information, not financial advice. The cryptocurrency industry is highly risky. Please do your own research and take experts' help before investing.