Bitcoin Bleeds: How Liquidations and ETF Exodus Slammed BTC Price Today

Bitcoin's price took a sharp dive today, rattling traders and sparking a fresh wave of market anxiety. The sell-off wasn't a mystery—it was a classic one-two punch of forced selling and institutional cold feet.

The Liquidation Cascade

Leverage got smoked. A sudden price drop triggered a wave of automatic liquidations across major exchanges. Think of it as a domino effect: each forced sell order pushed the price lower, triggering the next batch of liquidations. It's the market's brutal way of resetting over-leveraged positions, and it happened fast.

The ETF Outflow Factor

While traders were getting liquidated, another pressure point emerged: spot Bitcoin ETFs. Data showed significant net outflows, meaning more money was pulled out of these funds than was put in. This isn't just 'paper' selling; it represents real institutional and retail capital walking out the door, adding sustained downward pressure on the underlying asset.

So, why the sudden exodus? Market sentiment is fickle. Sometimes it's a reaction to broader macro fears, other times it's just profit-taking after a run-up. Or perhaps, in a cynical twist, some fund managers decided to book their 'digital gold' profits to cover losses in their more traditional, crumbling brick-and-mortar portfolios. In the end, today's action was a stark reminder that in crypto's volatile arena, even the king isn't immune to a good old-fashioned shakeout.

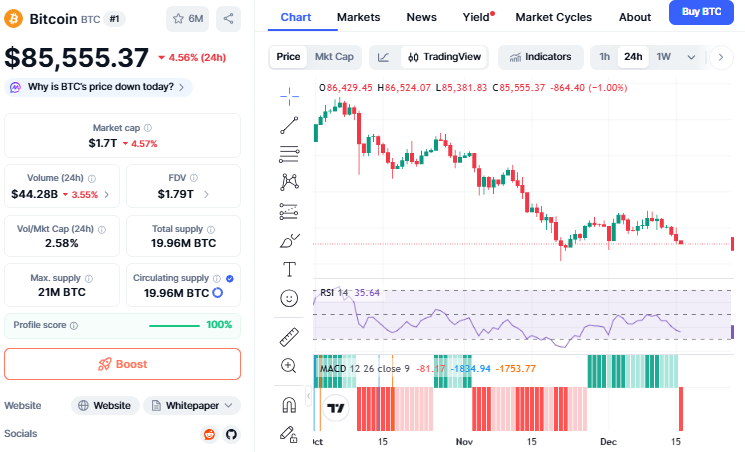

Source: Coinmarketcap

Heavy Liquidations Pushed BTC Lower

The primary cause for which Bitcoin crash presently is the massive liquidations occurring in the crypto market. As per the Coinglass liquidation data, within the previous 24 hours, there have been over $394 million worth of crypto-position liquidations.

These were mostly long positions, which means people were betting on a rise in price. But when the price began to drop, these positions were automatically closed by the exchanges. This created a sell-off, further pushing the price lower.

There were approximately $186 million BTC liquidations. It is evident that BTC and ethereum saw huge liquidations, which shows that leverage greatly contributed to this crash.

Technical Levels Broken, More Selling to Follow

From a chart perspective, BTC drop signals became stronger after the price fell below the important $90,000 level. This level had acted as support earlier.

Once it fell below this level, stop-loss orders were triggered. This pushed the prices down further. The RSI indicator indicates a weak momentum. This means that buyers are presently cautious.

Analysts predict that if it cannot retain itself close to $84,000, then the next major level of support could be found close to $80,000.

Global Markets Turn Risk-Off

Another reason why the cryptocurrency is dropping is weakness in global markets. Asian stock markets opened lower as investors waited for key U.S. economic data like jobs and inflation numbers.

In the U.S., stock indices also showed mild losses. The Nasdaq faced more pressure than the Dow, which usually signals risk aversion. Since BTC often moves with tech stocks, this cautious mood added pressure on crypto prices.

The crypto-related stocks also went down, indicating a risk avert attitude among investors. MicroStrategy down by 8.14%, Circle down by 9.60%, and Bitmine Immersion Technologies down by 11% compared to a volatile Coinbase.

Japan Interest Rate Decision Adds Pressure

Markets are also reacting to news from Japan. The Bank of Japan is expected to raise interest rates to 0.75%, the highest level in decades.

Higher interest rates usually reduce risk appetite. Along with this, news about the Bank of Japan ETF sale made investors more cautious. Even though the ETF selling will be gradual, it signals tighter financial conditions, which is negative for risk assets like bitcoin.

US BTC ETF Outflows Weigh on Price

According to Sosovalue, Spot ETFs also showed weakness. The U.S. market recorded a total net outflow of $357.69 million. Fidelity alone saw outflows of over $230 million.

When ETFs see outflows, spot buying pressure reduces. This makes it easier for bitcoin down moves to continue.

What Happens Next?

Bitcoin Price Prediction: In the short term, the price may remain volatile. Holding above $84,000 is important. If this level breaks, a deeper pullback is possible.

In the long run, analysts still believe bitcoin’s fundamentals remain strong. However, for now, caution remains high.

Bitcoin price crash is mainly due to liquidations, global uncertainty, and risk-off sentiment, not because this digital asset has lost its value.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.