ED Exposes ₹2,300 Cr Crypto Ponzi Network in India - Another Massive Scam Uncovered

India's Enforcement Directorate just ripped the lid off another crypto-fueled financial nightmare. The numbers are staggering—₹2,300 crore vanished into a classic Ponzi scheme dressed in digital asset clothing.

The Anatomy of a Modern Scam

Forget complex DeFi jargon. This was old-school fraud with a crypto paint job. Promises of impossible returns, recruitment commissions, and the inevitable collapse when new money stopped flowing. The playbook hasn't changed in a century—only the marketing materials have.

Why Crypto Scams Keep Winning

They exploit the same human weaknesses: greed, fear of missing out, and trust in 'too good to be true' narratives. The technology is neutral, but the intentions behind it rarely are. Regulatory gaps become highways for bad actors, while legitimate builders face endless scrutiny. It's the financial world's oldest con—promise people free money, and they'll hand over real money every time.

The Bullish Reality Check

Here's the uncomfortable truth every crypto advocate needs to hear: these scandals don't discredit the technology—they highlight the desperate need for it. Transparent ledgers, immutable records, and decentralized verification are the exact antidotes to this poison. The irony? The tools to prevent these scams are being built in the same ecosystem the scammers exploit. Maybe the real Ponzi is the traditional financial system that keeps printing the money these frauds steal—now there's a cynical finance jab for you.

ED India News: Inside the ₹2,300 Crore Crypto Scam Network

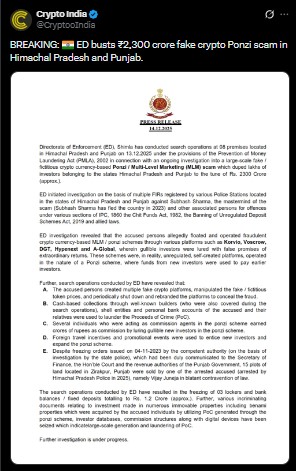

The Enforcement Directorate (ED) has launched a major crackdown on one of the biggest crypto scam India has seen in recent years. Investors across Punjab and Himachal Pradesh were cheated of nearly ₹2,300 crore, around $275 million, through fake platforms like Korvio, DGT, Voscrow, Hypenext, and A-Global.

The schemes promised “extraordinary returns” but were built on fictitious tokens with zero real value. According to ED report, the operation followed a classic Ponzi structure, where money from new investors was used to pay older members. The alleged mastermind, Subhash Sharma, reportedly fled in 2023.

ED conducted raids at eight locations under the Prevention of Money Laundering Act (PMLA), 2002. Assets worth ₹1.2 crore, around $145,000, were frozen, including bank balances, fixed deposits, and three lockers. Investigators also seized documents linked to benami properties, digital devices, and a full investor and commission database, confirming large-scale money laundering.

How the Crypto Ponzi Survived Without Regulation

The investigation revealed how the scam thrived due to weak oversight. Funds were collected through cash-based deals involving known builders, then routed through shell companies and personal accounts of accused persons and relatives. Commission agents earned crores by attracting investors using luxury events and foreign travel incentives.

One accused, Vijay Juneja, even sold 15 plots in Zirakpur despite official freezing orders, highlighting how enforcement gaps are exploited. These patterns show how theft cases in India grow faster when platforms remain unregulated and unchecked.

Global Crypto Support vs India’s Regulatory Gap

While crypto scam cases dominate news today, global confidence in the country remains strong. Binance Co-CEO Yi He recently confirmed it as one of Binance’s largest markets. She also pointed out that major stock-market players are rapidly entering digital assets, signaling a shift in global capital.

Binance CEO Richard Teng echoed this view, stating that the country could lead the adoption across the APAC region due to its massive economy and blockchain experimentation culture. Yet, what’s holding it back is clear regulation.

According to Chainalysis, India faces key concerns: a 30% tax on profits, 1% TDS on every transaction, uneven enforcement hurting Indian exchanges, and constantly evolving rules that delay investor confidence. Today, most Web3 funding comes from foreign VCs and global players, showing the absence of a strong local support ecosystem.

Conclusion

This crypto scam proves that growth without rules creates danger. It ranks first in digital asset adoption, yet unclear laws weaken trust and empower fraud. Strong regulation can protect investors, attract local innovation, and stop crypto scam networks from exploiting uncertainty. Clear rules are no longer optional—they are urgent.

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Investments are high-risk and speculative. Always do your own research (DYOR) before investing. Consult a qualified financial advisor if needed, and never invest money you cannot afford to lose.