Bitnomial Secures CFTC Green Light for US Prediction Markets

Regulators just opened a new door—and a crypto-native exchange is walking right through it.

The Nod That Changes the Game

Forget vague promises of "future innovation." The Commodity Futures Trading Commission handed Bitnomial a formal thumbs-up to operate prediction markets for U.S. customers. This isn't a pilot or a sandbox. It's a license to run a new kind of financial venue where contracts settle based on real-world events.

Why Traders Should Care

This cuts through the regulatory fog that's kept these markets offshore or in legal limbo. Suddenly, hedging against election outcomes, weather events, or corporate earnings isn't a theoretical crypto use case—it's a compliant product. Bitnomial bypasses the traditional finance gatekeepers, offering a direct, exchange-traded alternative to over-the-counter bets and murky offshore platforms.

The move signals a maturing infrastructure. It proves a crypto firm can navigate the CFTC's rulebook and emerge with a fully-regulated offering. That builds legitimacy far beyond what any marketing white paper could achieve.

The Bigger Picture

Watch for other exchanges to follow. This approval sets a precedent, creating a template for merging crypto's efficiency with traditional market oversight. It pulls a niche, often speculative corner of crypto squarely into the realm of structured finance—for better or worse.

The finance old guard might scoff, calling it glorified gambling. But then again, they said the same thing about stock options once upon a time. This is how new asset classes are born: not with a bang, but with a regulatory filing.

New CFTC Approval Expands Bitnomial's US Product Line

The current regulatory award is preceded by another recent accomplishment. Bitnomial was also authorized to run a CFTC-regulated spot trading facility. Together, these two events FORM a complete and robust trading infrastructure for the US market that complies with all regulations. Trading at the retail level is not in the hands of the clearinghouse that acts as an infrastructure provider. It provides the necessary facilities for the approved collaborators to perform their functions in the areas of margin and settlement. Among the most exciting features is the one that enables the conversion of collateral into digital assets or US dollars.

With such a working model, the company renders a substantial service to the local market. Through Bitnomial's authorized clearing network, partners may introduce the crypto market their products and services. The approval represents an innovation in the industry. It is a provision of the essential tech and regulatory backbone for various uncharted contracts. The company’s focus on infrastructure instead of competition with the field may still be a gradual process before we see new products faster and in different areas.

The Growing Landscape of Regulated US Prediction Markets

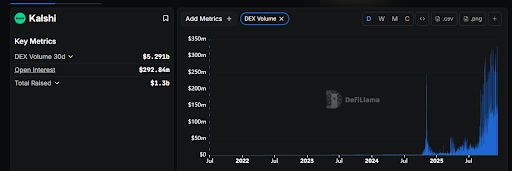

The coming of Bitnomial means this financial niche is getting mature. There has been considerable growth and regulatory acknowledgment for prediction platforms. Service Kalshi, for example, has recently generated billions in transaction volume. Besides, Polymarket obtained its own approval for an intermediated model last November. All these achievements point to the supervisory perspective shifting in Washington.

Source: DefiLlama

The transformation of this industry is going from scrutiny to structured governance. At that time, authorities examining these markets were worried they might be serving American users improperly. Recently, authorizations indicate that a framework for compliant operation is being developed. This regulatory clarity is essential for the entrance of institutional participants and capital. It offers the legality required for the sector to develop further and become stable.

Bitnomial's latest approval is located right on the path of this validation journey. One of the clear advantages that comes with being registered as an exchange and clearinghouse is its position. The company has the capability to put in place its current compliance and risk management measures. Such an integrated method may actually pave the way for other players to do likewise in the prediction market.