RaveDAO Explodes 300% After Binance Alpha Listing - Market Stunned by Meteoric Rise

The crypto market just got a brutal reminder of Binance's king-making power. RaveDAO, a relatively obscure governance token, went supernova overnight following its surprise listing on Binance's Alpha platform. The price chart didn't just climb—it ripped vertical.

The Catalyst: Pure Exchange Alpha

Forget gradual adoption or protocol milestones. This pump had a single, unmistakable trigger: the Binance Alpha badge. The listing acted as a digital siren, pulling in a tidal wave of speculative capital from traders hunting for the next pre-major-listing moonshot. Liquidity flooded in, order books thinned, and the token entered a classic, volatility-fueled price discovery mode with only one direction: up.

Anatomy of a Frenzy

The mechanics were textbook exchange-driven mania. The initial surge triggered cascading liquidations on leveraged short positions, adding rocket fuel to the ascent. Social sentiment flipped from 'What's RaveDAO?' to 'FOMO NOW' in under an hour. Trading volumes spiked to multiples of their previous all-time highs, creating a self-reinforcing loop of attention and investment. It was a masterclass in how listing news alone can bypass years of supposed 'fundamental' growth.

A Harsh Spotlight on Market Psychology

This episode throws a harsh light on the crypto market's current priorities. A major exchange's endorsement often carries more immediate weight than technical whitepapers or developer activity. It's a liquidity game first, a technology contest second—a truth that makes idealists wince and traders rich. The frenzy also highlights the extreme asymmetry of information and access, where platform placement can dictate fortune.

While the RaveDAO party showcases the explosive potential of strategic exchange support, it also serves as a cynical reminder: in today's market, a Binance listing can do more for your tokenomics than a year of actual product development. The pump was spectacular, the statement was brutal. Now, the community watches to see if the project can build a foundation under this sky-high valuation—or if this was just another spectacular, fleeting flare in the crypto night.

Listing on Multiple Exchanges Caused $Rave’s Price Surge

The major reason for RaveDAO Price Surge is the huge and strategically planned exchange listing of RAVE. On December 12, 2025, RAVE was simultaneously listed on some major platforms.

The list includes Binance Alpha, Kraken, Bitget, Gate, MEXC, LBank, and Aster DEX. If a token is launched on multiple exchanges simultaneously, it is easier to buy and sell, thus increasing demand.

The RaveDAO Binance Alpha listing was especially significant. Binance Alpha offered users early access via Alpha Points, including support for an airdrop. This served as a great means to quickly reach a far broader audience.

Consequently, the amount of trade activity increased significantly. The 24-hour trade volume broke the $260 million barrier, which is a high activity level for a newly listed token.

Trading Rewards Added More Buying Pressure

Another major reason for the RaveDAO Price Surge is that Aster DEX has launched a trading rewards campaign worth $200,000.

The campaign rewarded traders involving the RAVE/USD1 pair, especially those who used buy orders. In order to take part, traders had to own a total of 444 tokens of ASTER. This tactic minimized fake trading activity.

This encouraged more people to buy $RAVE tokens instead of selling it. This meant that the price kept on increasing throughout the day. The campaign will run until December 26, which is a very significant date in this situation.

Partnerships Marketing Hype

The project also made headlines because of collaboration with World Liberty Financial (WLFI). The initiative launched a novel pair trade with the use of USD1, a stable currency pegged to WLFI.

This is because it has political ties with WLFI, thus creating short-term interest in the event, which, in turn, increased market excitement. Although USD1 is still a competitor to stable giants such as USDT and USDC, the event has managed to support the Price Surge.

What The Charts Are Showing

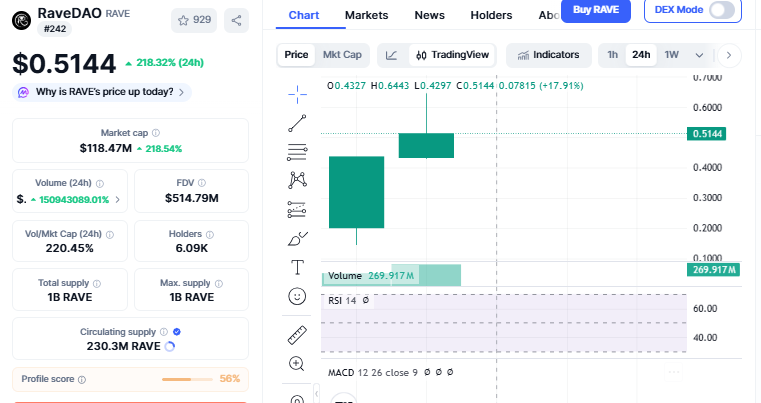

At the time of writing RAVE’s price is at $0.51, significantly exceeding the price range of $0.12 to $0.18 that is initially expected.

Source: CoinMarketCap

Market Cap: $118 million

RSI indicator: close to overbought level

This is a strong indication of buying, but it also indicates that the price might stall or go flat for a while.

RaveDAO Price Prediction: What May Follow?

If the buying interest holds strong, the price might rise to the $0.60 level in the short run as well. But when the trade rewards expire, the price might touch the support level of $0.48-$0.50.

The RaveDAO Price Surge is largely fueled by listing, incentivization, and hype. In the future, traders are advised to monitor trading activity, and market behavior post-incentivization campaign.

This article is for informational purposes only, do your own research before investing.