OKX Explains OM Token Price Crash: What Happened and Who’s Responsible?

Another day, another crypto asset takes a nosedive—this time, it's OM's turn. The token's price chart just painted a picture that would make any trader's stomach drop.

Anatomy of a Plunge

So, what triggered the sell-off? The usual suspects lined up: a sudden surge in selling pressure met with thin liquidity, creating a perfect storm for the price. Large, timed transactions hit the order books, and the market structure simply couldn't absorb the shock.

The Blame Game Begins

Fingers are pointing in multiple directions. Was it coordinated profit-taking by early whales? An algorithmic trading glitch? Or perhaps just the market's ruthless efficiency at work—punishing over-leveraged positions with cold, digital precision. The search for a single responsible party often overlooks a simpler truth: in decentralized markets, accountability can be as fragmented as the ledger itself.

Exchange in the Spotlight

OKX, as the primary trading venue, finds itself explaining the mechanics of the move. Their role isn't to prevent volatility but to ensure the integrity of the trading engine during it. In these moments, an exchange's real test isn't marketing—it's infrastructure.

Lessons in a Volatile World

Episodes like this serve as a stark reminder: tokenomics on paper rarely survive first contact with a panicked market. It's the finance sector's oldest story—liquidity reveals its true value only when everyone wants out at the same time. The crash isn't an anomaly; it's a feature of the asset class, a brutal reminder that in crypto, gravity always wins—eventually.

OM Token Price Crash Explained: What's the News?

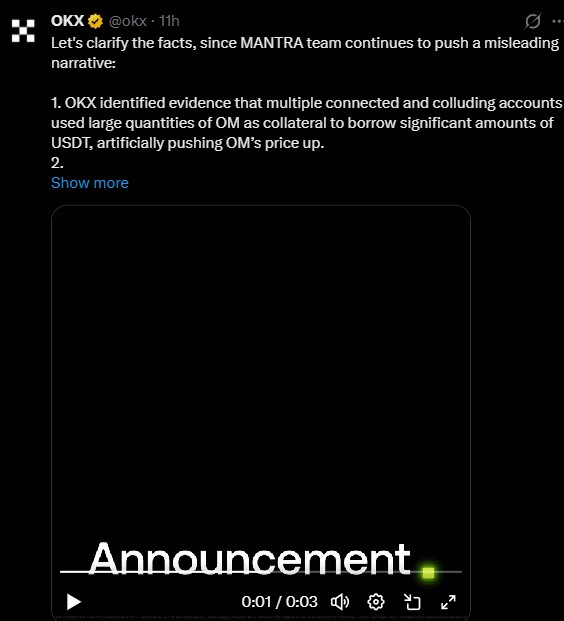

Cryptocurrency exchange OKX publicly discussed the April 2025 MANTRA ($OM) price crash, saying that the event was caused by a planned market manipulation attack involving several related accounts.

As reported, such accounts with abnormally high token holdings pledged to borrow large sums of USDT artificially pumped up the price of the token and then crashed.

OKX asserts that its internal risk systems identified the unusual activity at the earliest, and account holders were contacted and requested to take corrective actions. The exchange gained control of the accounts to contain risk when they supposedly declined to cooperate.

Although MANTRA token was liquidated only in a small part, the sudden price fall resulted in significant losses, which were completely covered by the Security Fund, worth $724 million as of Q3 2025.

Source: Official X

Since then, the exchange has provided full documentation and evidence to regulators and law enforcement agencies, and several legal actions are being undertaken. This announcement is made amid a new conflict between OKX and the MANTRA team before the tokens are to migrate their 1:1000 tokens later this month.

Reasons for the MANTRA ($OM) Price Crash

The exchange in its statement pointed out that the OM crash was not due to its actions but to the intentional manipulation.

The collaborating accounts had a disproportionate amount of the token supply, which casts grave doubts on the distribution and the origins of the token.

The exchange claimed that it was merely trying to contain risks and not to liquidate aggressively.

Very few holdings were sold, and the exchange took all the resulting losses to save users.

The Security Fund, which was observed, did not fail in its purpose in the crisis.

Third-party audits quoted indicate that off-exchange perpetual futures trading, rather than spot trading on the platform, caused almost 70% of the price fall, and thus, the exchange is further away from the crash itself.

Regulatory Scrutiny and Proceedings increase.

The platform ensured that regulators and other law enforcement bodies are currently investigating the evidence provided.

Several lawsuits concerning the tokens incident have been filed, although no particular jurisdiction parties were revealed.

The exchange accused the MANTRA team of not answering questions about the origin of big $OM holdings and publicly accusing OKX instead. According to the crypto exchange, such conduct was very unprofessional and emphasized that the main focus was on transparency and accountability.

Migration Dispute in OM Sparks Community Discussion.

The debate has re-emerged with MANTRA in readiness to migrate its 1:1000 tokens. On December 9, the CEO of MANTRA requested users to pull $OM off OKX, claiming false timelines and inconsistencies. OKX responded by restating its stand and citing the unresolved manipulation issues currently being investigated.

The Market reaction are highly polarized and emotionally colored. Some are accusing OKX of manipulability, absence of transparency, and accountability of its holdings in the FORM of MANTRA tokens

Others defend the position of OKX by referring to the risk management, the presence of regulators, and the Security Fund.

Final Wrap-Up

The crypto crash illustrates that there are persistent risks of token concentration, leverage abuse, and transparency, as regulators question centralized exchanges and project teams as legal and governance issues intensify.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. crypto assets are highly volatile, and you can lose your entire investment.