Spur Protocol Presale Surges: Final Week Rush Before December 19 Launch

The countdown clock is ticking—and capital is flooding in. Spur Protocol's presale has shifted into overdrive, with investor interest accelerating as its December 19 exchange listing date draws near. The momentum isn't just hype; it's a measurable surge in commitment for a project positioning itself at the crossroads of DeFi and structured finance.

Why the Last-Minute Frenzy?

It's classic presale psychology meeting tangible utility. Projects that demonstrate gathering steam in their final days often trigger a FOMO effect, attracting latecomers who fear missing the pre-listing price. For Spur, this isn't just about a token generation event. Its proposed framework aims to automate complex yield strategies—the kind that usually require a hedge fund's spreadsheet and a compliance team. The protocol promises to bundle these into accessible, on-chain products. Think of it as trying to democratize the tools that let traditional finance (TradFi) guys take two-and-twenty fees for pressing 'rebalance.'

The Mechanics Behind the Momentum

Driving the interest is a value proposition built on automation and accessibility. The protocol isn't creating new assets but new methods to manage and optimize them. By encoding specific financial logic into smart contracts, it seeks to let users deploy strategies around yield farming, liquidity provisioning, and risk management without constant manual intervention. It's a pitch that resonates in a market tired of watching gains evaporate during sleep cycles or market dumps. The presale structure itself, with its hard cap and clear listing timeline, acts as a built-in scarcity engine, compressing demand into a finite window.

A Calculated Gamble Before the Bell Rings

Every presale is a bet on execution. Investors now piling in are wagering that the team can translate this pre-launch energy into a functional, secure protocol post-December 19. They're buying the narrative that automated, structured DeFi products are the next logical step for the space—moving beyond simple swapping and lending into more sophisticated capital allocation. Of course, in crypto, 'sophisticated' is often just a polite word for 'untested at scale.' The real test begins when the token hits the open market and the protocol faces its first real-world volatility and economic attacks.

The final week of a presale always separates the curious from the convinced. For Spur Protocol, the rising momentum suggests a growing cohort believes the project's mechanics might just work—or, at the very least, that the listing pop will be worth the ride. After all, in modern finance, sometimes the most reliable strategy is simply getting in before the other guy.

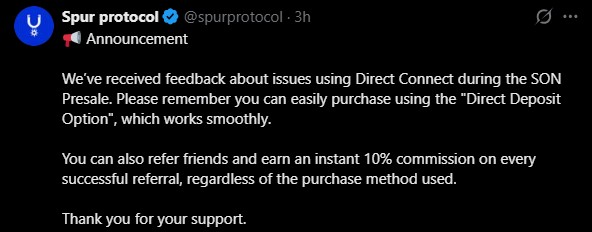

The network, through the updated message, states that the Direction Connect option works smoothly and the users can purchase tokens easily through it. They are also liable to earn an instant 10% commission on every successful referral.

Spur Protocol Presale Gaining Rapid Traction

Launched on just a day before yesterday, December 10, the Spur Protocol Presale has already mentioned its ending date in 5 days, showing a potential hike. Adding the fuel, it already sold 287,625 tokens out of 8,333,333 pre-sale outlay in just two days of launch at onchain space. Current scenario looks:

Pre-sale ends: In 5 Days

Accepted Currency: BNB

Minimum Buy: 300 $SON

1 $SON: 0.0000337 BNB

You can use SOL and other accepted crypto coins for purchase in the Direct Deposit section.

The ongoing pre-sale clearly presents the interest it has among the communities and the market.

Why the Token Is Gaining Attention

Unlike many short-term presale launches, Spur Protocol highlights long-term utility behind the $SON. The project focuses on solving real Web3 challenges, starting with education accessibility and fair coin distribution.

$SON is designed to support staking, community rewards, governance voting, tipping, coupons, and cross-platform usage across dApps and decentralized exchanges. A capped supply of 1 billion tokens and a deflationary model aim to support scarcity over time.

Adding the trust level, the platform has published a security audit report, which is accessible directly from the token information section. Transparency around contract details, total supply, and token distribution is emphasized throughout the pre-sale interface.

What’s Next After the Spur Protocol Presale: Listing

As the Spur Protocol Presale approaches its final stage, attention is now shifting to what comes next for the project. The immediate focus is on the $SON token listing on December 19, 2025, when trading is expected to begin across confirmed exchanges: MEXC, BingX, SpurSwap, and PancakeSwap

After listing, the team plans to activate key ecosystem features. Users expect further updates on governance participation, cross-chain functionality, and ecosystem partnerships.

For now, as the sale countdown enters its final phase, interest is likely to remain focused on how the project executes its vision after listing.

This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before participating in any token sale or crypto investment.