Stripe’s Crypto Expansion Accelerates with Valora Team Acquisition

Stripe just turbocharged its crypto ambitions—snapping up the team behind Valora, the mobile-first wallet built on Celo.

Why This Move Matters

It's not just an acquisition; it's a talent raid. Stripe bypasses the slow build, injecting its crypto division with developers who've already shipped a consumer-facing product. Think of it as buying the engine instead of building it from scratch.

The Bigger Play

This isn't about a single wallet. It's a clear signal that Stripe is moving beyond backend infrastructure and betting on real-world crypto adoption. The Valora team's experience with mainstream users is the missing piece Stripe needs to bridge the gap between merchants and digital assets.

What It Means for Finance

The old guard should be nervous. When a payments giant with Stripe's scale starts aggressively poaching crypto-native talent, the 'crypto winter' narrative starts to thaw. Traditional finance is about to get another lesson in moving fast—or getting left behind with their legacy systems and, let's be honest, painfully slow settlement times.

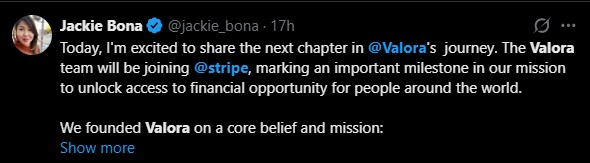

Valora founder Jackie Bona said her team WOULD join-in to “expand global access to financial systems,” while noting that the wallet app itself will return to its original steward, cLabs, for future development. Importantly, the acquisition includes talent but not the intellectual property, which will continue powering the storage independently.

This Stripe crypto expansion follows fresh increasing interest in digital assets, reflecting a clear shift from its earlier hesitations around digital assets. After pausing Bitcoin payments in 2018, the platform re-entered the space through stablecoins, wallets infrastructure, and faster blockchain-based settlement systems.

What Stripe Gains – And Why Stablecoins Are Central to Its Strategy

Valora, a self-custody mobile wallet built for stablecoins on the Celo blockchain, is known for sending digital assets as simple as sending a text message. The Stripe crypto expansion is now centered around stablecoins – programmable, fast, low-cost digital dollars that is believed to shape the future of global online payments.

In this case, the web3 wallet's developer deal strengthens the company’s growing ecosystem, which has already made key moves in 2024–2025, including:

Acquiring Bridge, a stablecoin infrastructure firm

Launching Open Issuance for custom stablecoin creation

Co-developing the payments-focused Layer-1 Tempo blockchain

Applying for a U.S. national bank charter

Acquiring wallet firm Privy

By integrating Valora’s expertise, the payment giant can accelerate its ambitions across three major areas:

The self-custody wallet's experience with M-Pesa, Tether, and emerging markets allows Stripe to expand into regions where traditional banking is limited.

The fintech firm aims to offer smooth on-ramps, off-ramps, and stablecoin accounts to millions of users and businesses.

With Open Issuance and Valora-expertise, Stripe aims to become the backend for global stablecoin creation and settlement.

Stablecoins, according to the fintech giant’s founders, represent a major “improvement in the basic usability of money.” For the platform's digital coin expansion, this acquisition is a technical and strategic milestone.

Effect on Digtial Asset Adoption – Opportunities and Risks

The Stripe crypto expansion through the acquiring of the web3 wallet developer's team, is being viewed as one of the strongest signals yet that mainstream fintech is preparing for large-scale stablecoin adoption.

Faster, cheaper cross-border payments with stablecoins

Improved user experience through Valora’s mobile-first design

Potential for mass crypto adoption across millions of the platform's merchants

Regulatory uncertainty around stablecoins in various countries

Technical scalability for global, real-time settlement

Merchant readiness and education

Still, the expansion marks a turning point. By combining its global financial network with Valora’s crypto-native engineering, the company positions itself at the frontier of next-generation digital payments.

This article is for informational purposes only and does not constitute financial advice. Crypto markets are volatile—always conduct your own research.