India’s Crypto TDS Hits ₹1100 Crore: Is the Boom Just Getting Started?

India's crypto market just dropped a billion-rupee reality check—and the numbers are screaming adoption.

The Taxman's Unexpected Bull Signal

Forget the whispers of a slowdown. When a government collects ₹1100 crore in Tax Deducted at Source from crypto transactions, it's not tracking a niche hobby—it's measuring a financial revolution. That figure represents millions of trades, a tidal wave of retail and institutional capital flowing through digital asset exchanges. It's the sound of a market too big to ignore.

Regulation as Adoption Fuel

Conventional wisdom says strict rules stifle growth. India's 1% TDS, implemented to bring transparency, did the opposite—it legitimized the entire ecosystem. Compliance creates clarity. Clarity attracts capital. The sheer volume of taxable transactions proves investors aren't spooked; they're diving in, paperwork and all. It's a masterclass in how frameworks don't cage markets—they give them a floor to build on.

Beyond the Headline Number

That ₹1100 crore is a lagging indicator. It reflects activity from months ago. The real story is what happened next: exchanges streamlining compliance, users adapting to new norms, and innovation accelerating *because* of the rules, not in spite of them. The market didn't contract; it matured. It evolved from a speculative fringe into a documented, reportable pillar of modern finance—much to the chagrin of traditional bankers still trying to block-chain their own legacy systems.

The Verdict: Boom or Bust?

Boom. Unequivocally. A tax collection this massive isn't a symptom of a fading trend; it's the heartbeat of a thriving market. It signals deep, sustained engagement from a nation of tech-savvy investors. While pundits in air-conditioned offices debate 'crypto winter,' on the ground, India is building—transaction by transaction, rupee by rupee. The TDS story isn't about a government taking a cut; it's about a market earning its stripes. And at ₹1100 crore and counting, those stripes look a lot like tiger stripes.

What’s The News?

India’s cryptocurrency ecosystem continues to expand despite regulatory uncertainty, as fresh government data reveals nearly ₹1,100 cr. collected as Tax Deducted at Source in three years, highlighting significant trading activity and rising taxpayer participation.

Cryptocurrency TDS Collection Crosses ₹1,096 Crore in Financial Year 2023–25

India’s Ministry of Finance has confirmed that exchanges collected ₹1,096 crore in Tax Deducted at Source over the last three financial years.

This huge number indicates the ongoing rate of trading in virtual digital assets (VDAs), even with the introduction of tough taxation regulations in 2022.

Section 194S under the Finance Act 2022 provides that a 1% TDS is to be deducted on all transactions- regardless of the type of platform used, whether an Indian or foreign one that serves Indian customers.

This has enabled the government to monitor real-time cryptocurrency activity across exchanges and collect taxes.

Source: WiseAdvice X

Year-Wise Breakdown Shows Strong Growth in FY-25

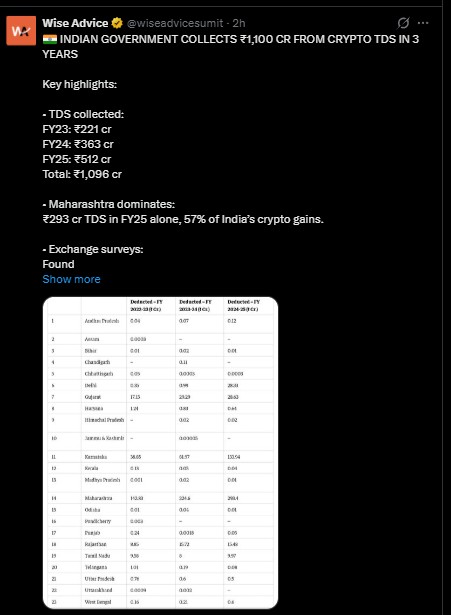

The data shared in Lok Sabha by Pankaj Chaudhary, Minister of State for Finance, shows a steady year-on-year rise in TDS collections (in crore)

FY 2022–23: ₹221.27

FY 2023–24: ₹362.70

FY 2024–25: ₹511.83

The increase from ₹363 crore to nearly ₹512 cr. represents a 41% year-on-year jump, reinforcing that cryptocurrency participation is rising even as taxation remains high.

Maharashtra Accounts for 60% of India’s Crypto TDS

The discovery of the government that stands out is the leading role of Maharashtra, which has provided the highest percentage of collection of crypto Tax. Exchanges in the state collected (figures in Crore)

₹142.83 in FY23

₹224.60 in FY24

₹293.40 in FY25

This totals nearly ₹661 crore over three years—around 60% of India’s overall crypto TDS. Maharashtra contributed 57% of the collections in the country in FY25 alone due to the active trading centers such as Mumbai and Pune.

The figures highlight that the crypto activity in India is concentrated in urban, financially powerful areas where more people invest and where digital financial infrastructure is more accessible.

Government Detects Major Non-Compliance and Undisclosed Income

Beyond this, the Ministry of Finance also flagged significant irregularities in the sector. Surveys and investigations conducted by tax authorities uncovered:

₹39.8 Cr. in TDS non-compliance

₹125.79 Cr. in undisclosed income from exchanges and intermediaries

A separate action revealed ₹888.82cr. in unreported earnings

Collectively, authorities detected over ₹1,000 cr. in undisclosed income related to VIRTUAL digital asset transactions. The government has been carrying out investigations on three large crypto exchanges and other various parties that are believed to be avoiding tax payments.

Regulatory Pressure to Intensify Supervision.

The government has required all Virtual Asset Service Providers (VASPs) to be registered at FIU-IND, including those based in foreign countries, to reduce illegal activity and enhance transparency. This measure will provide a more effective control over suspicious transactions, anti-money laundering compliance, and consumer safety.

Conclusion

The increasing volumes of crypto TDS collections in India, along with massive volumes of undisclosed income being uncovered, underscore a fast-growing yet highly regulated market that is still growing in spite of taxation and regulatory changes.

Disclosure: This article is informational and does not amount to financial advice.