Bitcoin’s $89K Crash: Why It’s Falling Today & What Comes Next

Bitcoin just took a gut punch. The flagship cryptocurrency plunged through the $89,000 level, sending shockwaves through the market and vaporizing leveraged positions in its wake.

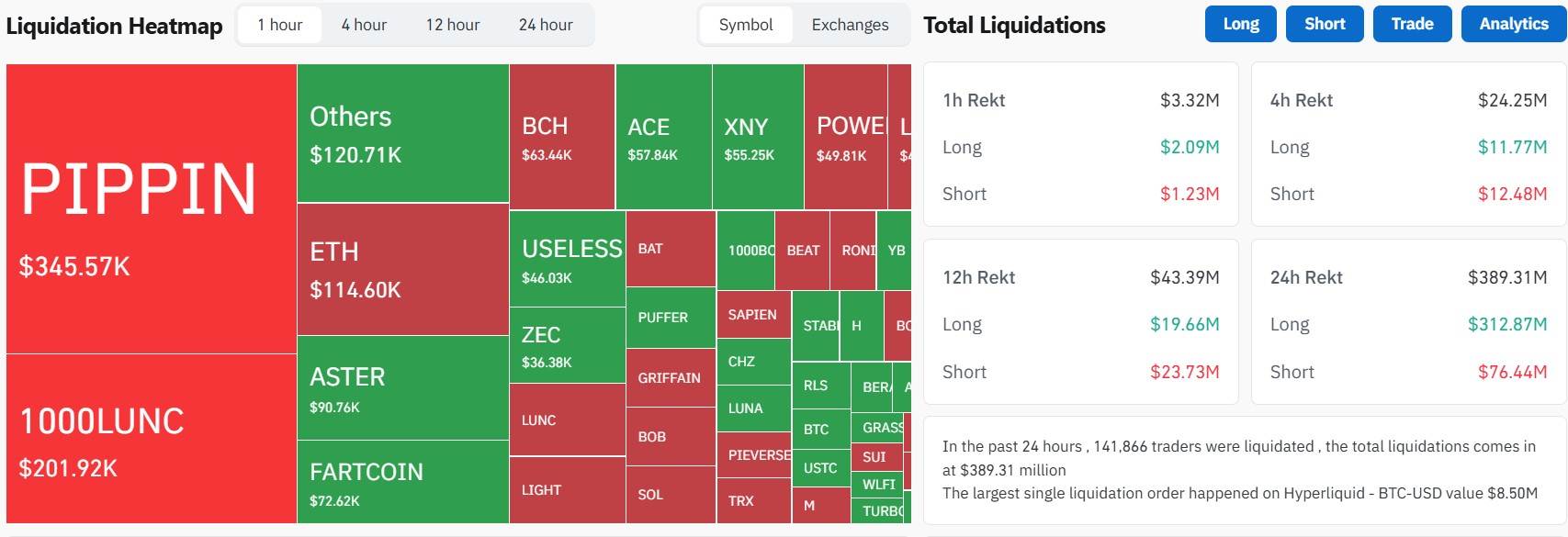

The Liquidation Cascade

This wasn't a gentle slide—it was a violent deleveraging event. A cascade of long liquidations triggered a classic crypto domino effect, where falling prices force more selling, accelerating the drop. The $89,000 mark, a key psychological and technical support zone, offered no resistance.

What's Driving the Sell-Off?

Pinpointing a single catalyst is tricky, but the usual suspects are lining up. Macro jitters around interest rates often spill into risk assets. Overheated leverage in the system created a powder keg, and something—a large wallet move, a negative headline—lit the fuse. It's a stark reminder that in crypto, gravity always wins eventually.

The Path Forward from $89K

So, what now? All eyes are on where Bitcoin finds its footing. The next major support levels become critical. Does institutional buying step in, or does retail panic deepen the rout? This shakeout separates the diamond hands from the weak hands—and sometimes, the over-leveraged funds from their assets in a move so fast even the high-frequency traders get a paper cut.

History shows these violent corrections are part of Bitcoin's DNA. They're brutal in the moment but often lay the foundation for the next leg up. Whether this is a healthy cleanse or the start of a deeper winter depends on what happens in the next 72 hours. Buckle up.

Technical Chart Breakdown: Bitcoin $BTC Price Crash Analysis

Before the actual fall, the Bitcoin crash was already giving “danger signs,” as seen in the TradingView chart. The Bollinger Bands were becoming very tight. This means the market was getting ready for a big move. Once the asset broke the middle line and then the lower line, the BTC price crash started quickly.

Since $92,000, the token shows that it is making lower highs again and again. This pattern clearly shows buyers are losing strength, and the price drop may continue for a short period.

MACD Turned Strongly Bearish: On December 5, the MACD showed a deep red signal as the line crossed sharply below the signal line. This confirmed heavy selling pressure. Even today, MACD is still below zero, which explains why is bitcoin crashing right now.

Support at $90,500 Broke: Once the token lost $90.5K, a smooth path opened toward $89K–$88.5K, which became today’s low.

All these signals combined to create a textbook technical breakdown, fueling fear sentiment across the market.

Market Fear: The Strong Reasons Behind Why Bitcoin Is Falling Today

Beyond the chart, there are several Bitcoin price drop reasons. Here are the major Bitcoin updates:

1.Extreme fear makes people sell in panic. The crypto fear index at 23 is one of the biggest reasons behind today’s 3% fall.

2.Coinglass data shows that 140,617 traders liquidated, which brings the total liquidations to $390.46 million.

The interesting part? The largest liquidation came at an $8.5M BTC order on Hyperliquid. These liquidations create chain reactions, leading to a bigger BTC price crash.

3.The SEC announced discussions on crypto surveillance and privacy, featuring Zcash founder Zooko Wilcox. This news increased fear and uncertainty, adding more pressure to the world’s largest cryptocurrency.

4.Rate cut odds are sitting at 82.3% for a 25 bps cut after U.S. PCE inflation data came at 2.8, and Core PCE came at 2.8%.

Will It Fall Below $80K? BTC Price Prediction for December

Crypto analyst Ethan said that if the asset keeps touching the same trendline and falling, it may drop below $80,000 before 2026.

Let’s see what the data says:

Short Term (1–2 Weeks): After analyzing why bitcoin is falling today, the technical chart, and major reasons, I believe the asset may fall again toward the $88,000–$84,000 zone.

Midterm (Dec End – Early 2026): If it keeps getting rejected from the trendline, then chances of falling to the $80,000 low may increase, aligning with what crypto analyst Ethan said.

Long Term (2026 Bull Phase): Even if the BTC price crash hits a $75,000–$80,000 downtrend, the long-term outlook stays bullish. Rate cuts, ETF inflows, and institutional demand can push it toward $110K–$130K in 2026.

Final Words

Today’s BTC price crash wasn’t random; it was the result of technical rejection, fear-driven liquidations, regulatory unease, and macro uncertainty hitting all at once.

The asset is still in a strong long-term uptrend, but the short-term path looks volatile. All eyes are now on the Dec. 10 Fed meeting and Dec. 15 SEC roundtable.

Disclaimer: This article is for educational purposes only, and it does not support any financial advice. Always do your own research before investing.