Global Liquidity Surge Ignites Crypto Bull Run, Defying Market Volatility

Money floods the system. Digital assets surge. The math is brutally simple.

The Liquidity Engine Revs

Central banks aren't whispering anymore—they're shouting with balance sheets. That tidal wave of fresh capital isn't just lapping at traditional shores; it's crashing into crypto markets, lifting all boats despite the choppy surface. Forget the daily price jitters. The underlying current has shifted, powered by a global hunt for yield that bypasses sclerotic old-world finance.

Decoupling from Fear

Watch the charts. Correlations with shaky equities are fraying. Bitcoin and major altcoins are starting to dance to their own tune—a tune funded by sheer monetary expansion. This isn't speculation; it's capital reallocation on a grand scale, with smart money building positions while the headlines scream uncertainty. They're betting the house that liquidity trumps sentiment every time. (It usually does, much to the chagrin of fund managers charging 2-and-20 for mediocre returns.)

The New Paradigm

The playbook is being rewritten in real-time. Digital assets are no longer just a risky bet; they're becoming a logical destination in a world drowning in cheap money. Volatility becomes the entry fee, not the exit sign. The surge is here. The only question left is who's positioned to ride it.

While BTC’s price dipped amid regulatory caution and institutional hedging, broader cash inflows now signal a powerful long-term catalyst building in the background.

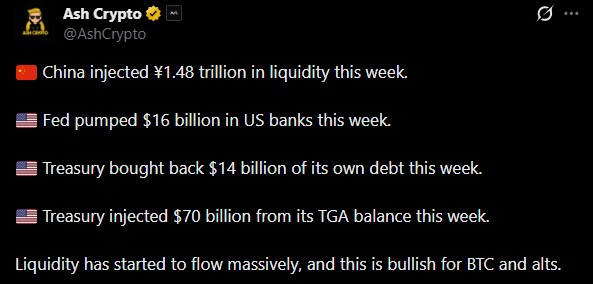

China, the Fed, and U.S. Treasury Flood Markets With Fresh Global Cash Injections

The world’s largest economies injected a combined trillions in capital, easing financial conditions and strengthening risk-on assets.

(around $209 USD) through its MLF operations, treasury trading, cash management, and reverse repo activities. Even though the reverse-repo cycle recorded a net withdrawal,the overall market flows footprint grew significantly.

At the same time,added $13.5 billion into the banking system in its second-largest repo operation since the COVID-19 crisis. More importantly, the Fed officially ended Quantitative Tightening on December 1 after draining $2.4 trillion since 2022, a major policy shift towards easier monetary expansion conditions.

Adding to the global liquidity surge,conducted the largest debt buyback in American history, repurchasing $14.5 billion in a single week while injecting an additional $70 billion from its TGA account. Such moves are designed to stabilise funding conditions but also Ripple outward into broader around the globe markets.

Together these steps reflect a clear shift toward expanding Global Liquidity, a macro signal that typically strengthens demand for risk assets– but how? Let’s understand.

How Global Liquidity Influences Cryptocurrency Markets

Because crypto is one of the most liquidity-sensitive asset classes, these macro injections generally strengthen its long-term trajectory, even if short-term volatility persists.

More liquidity = More capital flowing into risk assets such as Bitcoin and altcoins as seen in 2013, 2017, and 2020–21 cycles.

Lower funding stress encourages institutions to re-enter high-beta assets.

End of Quantitative Tightening (QT) removes a major capital drain, typically marking the beginning of multi-year crypto bull cycles.

Debt buybacks and repo injections lower borrowing costs, indirectly improving crypto market depth.

Capital Supply Effect on Broader Crypto Market

Despite the cash inflows surge, bitcoin fell 2.05% to $89,537 within 24 hours, while the broader market dipped nearly 2.09%. The decline came from a combination of technical and regulatory pressures:

China’s securities regulator (CSRC) tightened crypto risk monitoring, triggering risk-off flows.

A major institutional strategy moved $1.44B into cash, signalling hedging ahead of market volatility.

BTC slipped below key moving averages ($90.5K–$93.6K), activating automated sell orders.

Talking about the broader altcoin market, the CMC Altcoin Season Index remains at 21/100, signalling that Bitcoin still dominates capital inflows. Once BTC stabilises under expanding global liquidity, capital typically rotates into altcoins, often sparking a stronger altcoin season.

Global Liquidity Suggests a Multi-Year Crypto Upside Cycle

The simultaneous monetary expansion across China, the Federal reserve, and the U.S. Treasury indicates a shift toward easier financial conditions worldwide. Historically, periods of rising Liquidity support major rallies in Bitcoin and strong altcoin market expansion.

As monetary conditions ease and worldwide cash supply grows, crypto markets – especially Bitcoin, tend to experience:

Higher institutional inflows

Increased trading volumes

Stronger risk appetite

Improved market supply and price support

Although short-term volatility persists due to regulatory shocks, technical triggers, and institutional hedging, the underlying macro picture looks progressively bullish.