Gary Gensler’s Crypto Stance: Bitcoin Stands Apart as Altcoins Remain in Speculative Territory

Bitcoin carves a distinct path while the rest of the crypto market navigates regulatory gray areas.

The Bitcoin Exception

In the eyes of the SEC's top cop, Bitcoin operates in a different league. Its decentralized nature and established history grant it a perceived legitimacy that thousands of other digital tokens simply can't claim. It's the original—and for regulators, often the only—crypto asset that doesn't immediately scream 'investment contract.'

The Altcoin Arena: Speculation Central

Step outside of Bitcoin, and the landscape shifts. Here, Gary Gensler sees a wild west of speculative ventures. Most altcoins, in the regulatory view, walk and talk like securities. Their development teams, marketing promises, and expected profits from the efforts of others place them squarely in the SEC's crosshairs—even if formal filings are nowhere in sight. It's a market fueled more by hype cycles and community fervor than by proven utility or cash flow, a fact not lost on Wall Street veterans who've seen this movie before (just with different ticker symbols).

The Regulatory Reality Check

The message from the top is clear: the 'come one, come all' era for crypto issuance is over. The SEC isn't backing down from its mission to apply decades-old securities law to this new digital frontier. For projects launching tokens, the path forward involves compliance or confrontation. For investors, it's a stark reminder that outsized returns often come with unadvertised risks—including the chance that the regulator might just decide your favorite altcoin was an unregistered security all along.

Bitcoin leads. The rest speculate, innovate, and occasionally, await their day in court. In the high-stakes game of crypto, the house—the regulatory establishment—still writes most of the rules.

Source: X (formerly Twitter)

Bitcoin vs Altcoins – Why Gensler Sees a Big Difference

He noted that BTC is different from the rest because of its structure, decentralization, and proven history. The behavior of altcoins is different; they MOVE sharply based on hype, speculation, and fast-changing narratives.

Memecoins like PEPE, FLOKI, and Trump rise mainly on trends and never fundamentals.

Many new tokens launch without real products, only whitepapers.

Several altcoins lose more than 80–90% after bull market peaks.

This increasing gap between Bitcoin and the rest of the market has fueled discussions around the Gary Gensler Crypto perspective.

Major altcoins like Ethereum, Solana, BNB, Cardano, Chainlink, Litecoin, and XRP offer strong utility and large communities. Many altcoins gained ETF approvals-a sign that investors trust them-but are still more volatile than BTC.

Altcoin Season Fades: Bitcoin Dominates Again

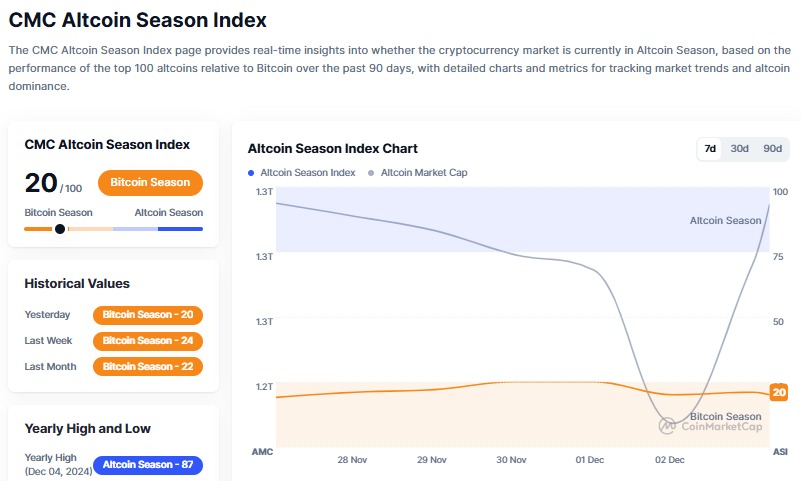

Current market indicators support his warning.

59.09% (+0.33% in 24h)

20/100 → “Bitcoin Season”

Source: X (formerly Twitter)

This means investors are choosing BTC over altcoins, showing a “risk-off” mood in the market.

Even strong institutional events are not helping altcoins recover.

Grayscale’s new Chainlink ETF recorded $89.6M inflows

XRP ETF momentum has built over $756M cumulative inflows

Yet, these inflows are not lifting the broader altcoin sector. The first digital asset continues to lead.

Gary Recalls His SEC Tenure: Major Enforcement, ETF Era

His comments also reflect his term as SEC Chair from 2021 to 2025. During that period, the SEC:

Took action against several digital assets platforms

Increased focus on investor protection

Eventually approved spot BTC ETFs, which now hold billions

He said this was expected because financial markets naturally move toward centralization. Even though digital currency started as a decentralized idea, it is slowly blending with traditional finance.

Is Crypto Political? Gensler Says No

When asked if crypto has become a political issue after the U.S. elections, Gensler avoided political comments. He said the main focus should remain on keeping U.S. capital markets safe, not on party politics.

His neutral tone adds more weight to the Gary Gensler Crypto debate.

A Clear Message for Investors

Gensler’s latest comments deliver a simple warning:

Bitcoin may behave like a commodity, but the rest of the crypto market remains highly speculative.