Marina Protocol Price Plummets as Heavy Sell-Off Hammers $BAY Token

Marina Protocol's $BAY token just hit an iceberg. A wave of heavy selling pressure has crashed through its charts, wiping out recent gains and leaving holders scrambling for lifeboats.

The Sell-Off Tsunami

It wasn't a gentle correction—it was a cascade. The charts show a classic capitulation pattern, with sell orders flooding the books faster than liquidity could absorb them. This kind of move doesn't happen in a vacuum; it's the market's brutal efficiency at work, re-pricing assets with zero sentiment.

Anatomy of a Flash Crash

Watch the order book thin out. Support levels that looked solid yesterday vaporized under the weight of the sell-off. This is the crypto market's version of a stress test, and right now, $BAY is failing it spectacularly. The price action tells a story of confidence shattered and exits prioritized.

Aftermath and Realignment

Now comes the cleanup. The protocol's fundamentals haven't changed overnight, but market perception has—and in crypto, that's often the only metric that matters in the short term. The community's reaction, developer communications, and any on-chain whale movements will dictate the next phase.

It's a stark reminder: in a market driven by narratives and momentum, even promising projects can get caught in a liquidity whirlpool. Sometimes, the most sophisticated decentralized finance (DeFi) mechanism is just a fancy way to watch numbers go down. The path forward requires more than just hoping for a bounce—it demands a reason for one.

Foundation Reacts to Large Wallet Transfers

One of the primary concerns today came from large on-chain movements related to the project's wallets. Not long after the Marina Protocol Price Crash had started, the Foundation issued an official note. They said that the transfers were just part of an internal restructuring plan.

Source: X (formerly Twitter)

They also said the tokens were not sold or liquidated and that all assets remain safe. Still, the timing created confusion, and many traders assumed a sell-off was happening. The clarification helped calm the community, but the price damage was already visible.

Selling Pressure After the Trading Competition

Another major reason contributing to today's drop is the Binance Alpha trading competition. During events like these, traders often sell their reward tokens once the campaign has ended. This is a normal pattern in the market.

After the event closed, the 24-hour trading volume of BAY fell by more than 90%. Due to less liquidity being left, even medium-sized sell orders were able to push the price down quickly. This added more fuel to the Marina Protocol Price Crash today and made it hard for buyers to hold support levels.

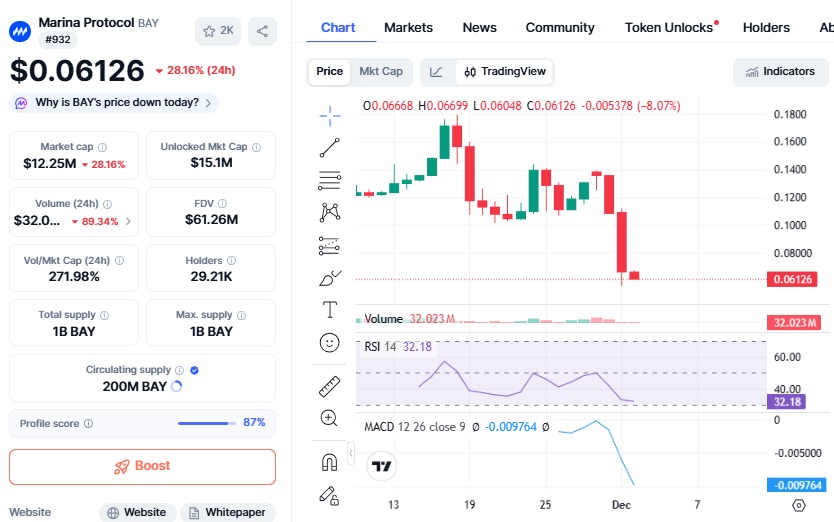

Technical Breakdown

The CMC chart data also shows that the drop was driven by technical weakness. BAY slipped below its key Fibonacci level and now trades near $0.061. The RSI is deep in oversold territory, showing strong selling pressure and tired buyers.

Source: CMC

Since there isn't any strong support until the lower psychological levels, the chart still looks fragile. This kept the Marina Protocol Price Crash going through the day, as many short-term traders moved out to avoid further losses.

Marina Protocol Price Prediction

In the short run, BAY may attempt to bounce towards $0.075 or $0.085 if buying returns. The only possible stronger recovery WOULD come if market sentiment sees a change. If the price falls further, the next area to watch is the $0.05 support level.

A large upside trigger could be a listing on Binance. If this happens, it will likely see far stronger demand and improved liquidity. This would go some way to reversing some of the decrease in price and take the price back above key levels.

Conclusion

The Marina Protocol Price Crash is a result of event-driven selling, technical weakness, and a fearful market. The explanation by the Foundation eased concerns, but traders now await whether the token can hold the next support zone. The next few days will be important, especially if new incentives or listings appear.

This article is for information and news purposes only, kindly do your own research before investing.