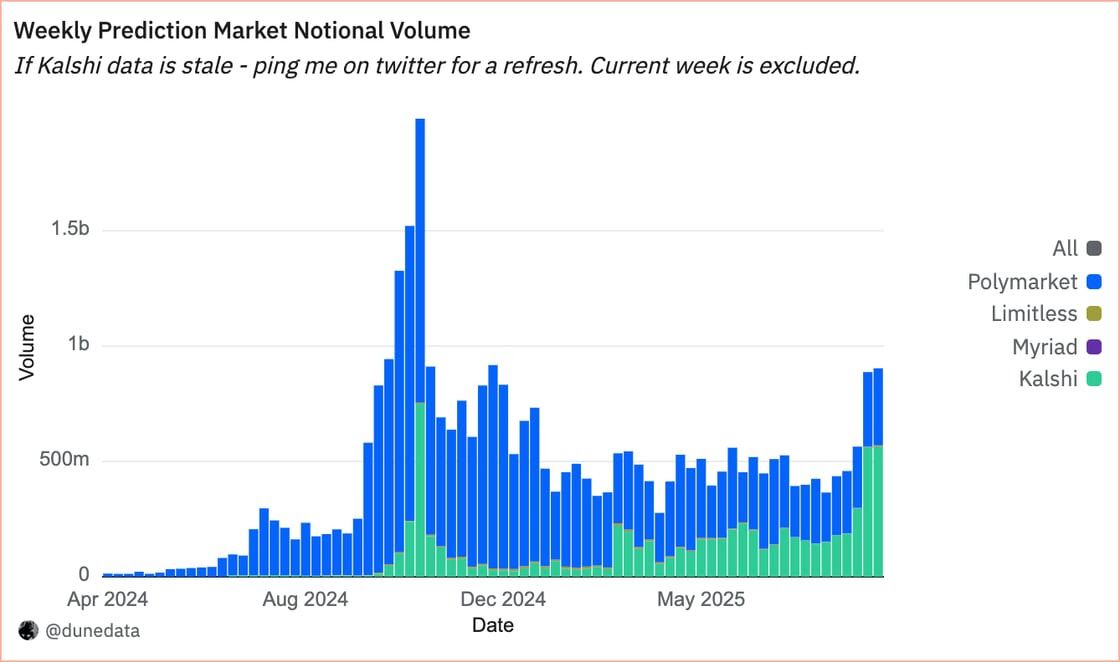

Kalshi Surges Past Polymarket in Prediction Market Volume as U.S. Trading Activity Explodes

Prediction markets just got a new volume king—and it's not who crypto insiders expected.

The U.S. regulatory advantage

Kalshi's stateside compliance framework is paying dividends while offshore rivals navigate regulatory gray areas. American traders are flooding in, driving volume numbers that leave Polymarket playing catch-up.

Market dynamics shift

When U.S. traders wake up, volume follows. Traditional finance might still scoff at 'gambling on world events'—but then again, they also thought 0% interest rates were temporary.

Platforms battle for dominance

It's not just about regulatory clarity—it's about capturing the growing appetite for event-based trading. Kalshi's surge proves that when given a compliant on-ramp, mainstream traders will bet on literally anything.

Prediction markets aren't just for crypto degens anymore—they're becoming a legitimate alternative data source. Even if Wall Street still thinks they're just fancy sportsbooks with better PR.

Its volume is beyond that of Polymarket, which stood at $430 million, and its average open interest of $164 million, which implies “sticker positions on Polymarket and faster turnover on Kalshi.”

Polymarket's longer-term markets, which often stretch over weeks or months, keep user funds locked in for longer periods, essentially.

This shows up in the open interest-to-volume ratio: Polymarket averaged 0.38, while Kalshi sat lower at 0.29. That suggests Kalshi's users are trading more often, while Polymarket's positions tend to sit.

Still, Polymarket is building out a greater position in the U.S. The platform has cleared its acquisition of QCX, a regulated derivatives exchange, to enter the country again.

It has also launched earnings-based markets with social investing platform Stocktwits, designed to let stockholders hedge earnings risk and analysts gauge market sentiment in real time.