Ethereum’s DeFi Future on L2s? Liquidity & Innovation Scream Yes

Layer-2 networks aren't just scaling Ethereum—they're rewriting the DeFi rulebook entirely.

Liquidity Migration Accelerates

Billions in TVL flood L2 ecosystems as users ditch mainnet gas fees. Arbitrum, Optimism, and emerging players capture value that once belonged exclusively to Ethereum L1.

Innovation Unleashed

Developers build faster, cheaper, and more ambitiously on L2s. Experimental protocols—too costly on mainnet—now thrive, pushing DeFi beyond simple swaps into complex financial primitives.

Traditional Finance Watches—And Squirms

Bankers still call crypto a bubble while L2s quietly assemble the infrastructure to bypass them entirely. The irony? They'll probably try to buy their way in later at a premium.

The verdict? L2s aren't just Ethereum's future—they're DeFi's present. Mainnet becomes the settlement layer; L2s become everything else.

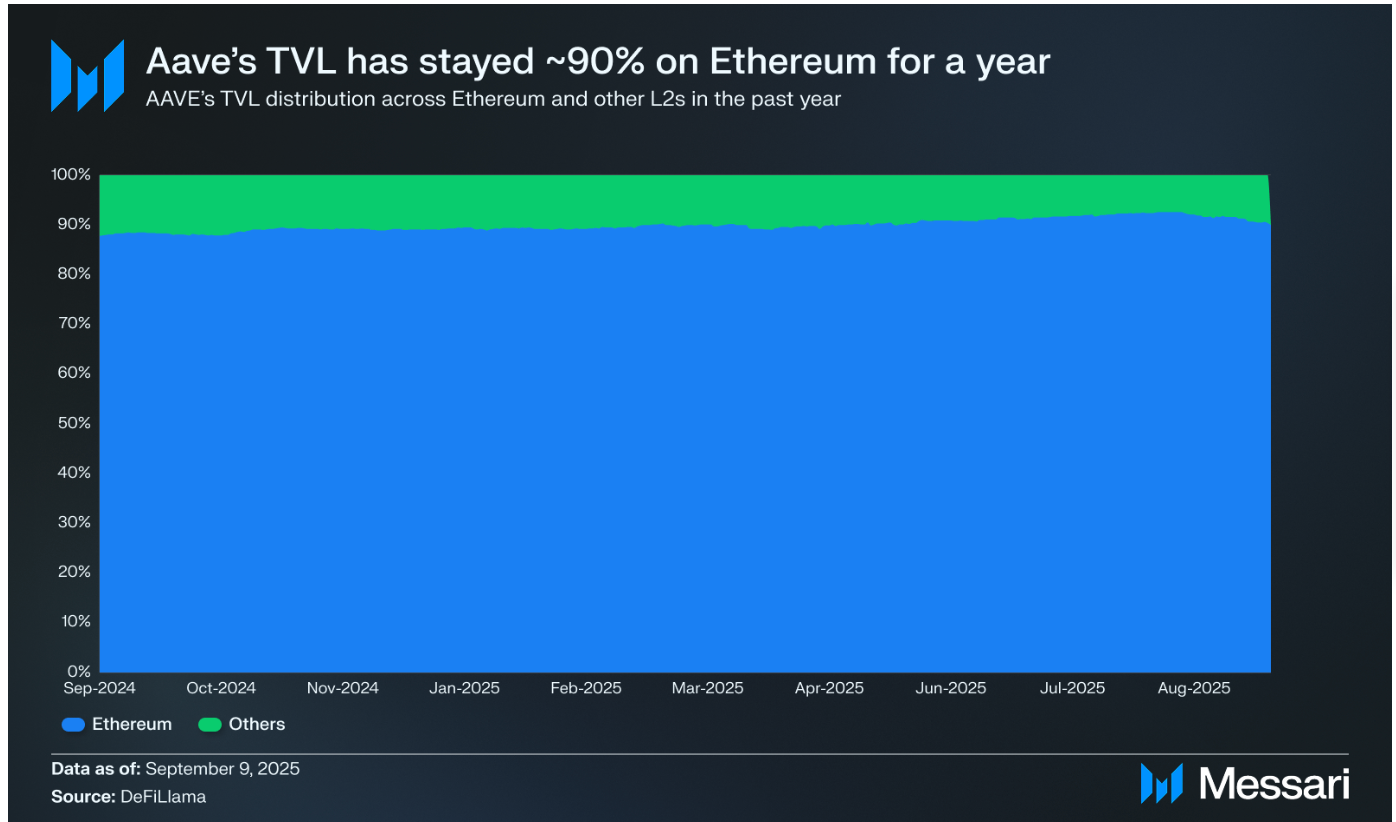

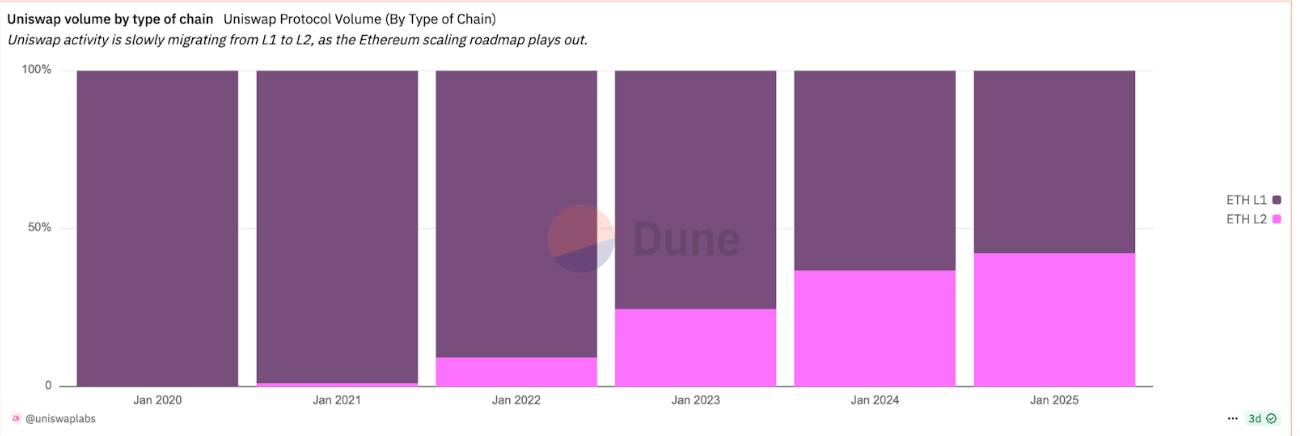

Interestingly, while L2s are capturing more activity, flagship DeFi protocols like AAVE and Uniswap still lean heavily on mainnet. Aave has consistently kept about 90% of its TVL on Ethereum. With Uniswap however, there’s been an incremental shift towards L2 activity.

Another factor accelerating L2 adoption is user experience. Wallets, bridges and fiat on-ramps increasingly steer newcomers directly to L2s, Hou said. Ultimately, the data suggests the L1 vs. L2 debate isn’t zero-sum.

As of September 2025, about a third of L2 TVL still comes bridged from Ethereum, another third is natively minted, and the rest comes via external bridges.

“This mix shows that while Ethereum remains a key source of liquidity, L2s are also developing their own native ecosystems and attracting cross-chain assets,” Hou said.

Ethereum thus as a base layer appears to be cementing itself as the secure settlement engine for global finance, while rollups like Arbitrum and Base are emerging as execution layers for fast, cheap and creative DeFi applications.

“Most payments I make use something like Zelle or PayPal… but when I bought my home, I used a wire. That’s somewhat parallel to what’s happening between Ethereum layer one and layer twos,” Warner of Offchain Labs said.