Solana Steals the Spotlight as Fed Rate Cut Nears: Crypto Daybook Americas

Solana's surging as the Fed's rate cut looms—while traditional finance scrambles to keep up.

Market Momentum Shifts

Solana's outperforming major cryptos, riding the wave of anticipated monetary easing. Its ecosystem's buzzing with activity—developers are building, traders are flipping, and the network's handling transactions at breakneck speed.

Fed's Influence on Crypto

Rate cuts typically weaken the dollar, pushing investors toward alternative assets. Crypto's benefiting, and Solana's positioned to capture more of that flow. It's not just speculation—real usage is driving this rally.

Traditional Finance's Lag

Banks are still debating whether crypto's a threat or an opportunity—meanwhile, decentralized networks are eating their lunch. They'll probably launch a 'blockchain task force' right after Solana hits another ATH.

Looking Ahead

Solana's momentum isn't slowing down. With the Fed's move, expect more capital to flood into high-performance chains—and traditional finance to keep playing catch-up.

What to Watch

- Crypto

- Sept. 16, 12 p.m.: Solana Live event on X. Guests include Pump.fun co-founder Alon Cohen and Kyle Samani, chairman of Forward Industries (FORD) and the managing partner of Multicoin Capital.

- Macro

- Sept. 16, 8 a.m.: Brazil July unemployment rate Est. 5.7%.

- Sept. 16, 8:30 a.m.: Canada August headline CPI YoY Est. 2%, MoM Est. 0%; core YoY Est. N/A (Prev. 2.6%), MoM Est. N/A (Prev. 0.1%).

- Sept. 16, 8:30 a.m.: U.S. August retail sales YoY Est. N/A (Prev. 3.9%), MoM Est. 0.3%.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting so unlocked portions persist after burns. Voting ends Sept. 16.

- Sept. 16: Aster Network to host a community call.

- Sept. 18, 6 a.m.: Mantle to host Mantle State of Mind, a monthly downhill series.

- Sept. 16, 12 p.m.: Kava to host a community Ask Me Anything (AMA) session.

- Unlocks

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating supply worth $45.92 million.

- Token Launches

- Sept. 16: Merlin (MRLN) to be listed on Binance Alpha, MEXC, BitMart, Gate.io, and others.

Conferences

- Day 2 of 7: Budapest Blockchain Week 2025 (Budapest, Hungary)

- Day 1 of 2: Real-World Asset Summit (New York)

Token Talk

By Oliver Knight

- As the crypto market stays within a tight range after a brief peak and trough on Monday, one token is running its own race: IMX is up 15% in the past 24 hours with daily trading volume doubling to $144 million.

- The rise lifted IMX, the native token of Web3 gaming platform Immutable, to a five-month high.

- Bullish sentiment around Immutable can be attributed to an SEC probe that was dropped earlier this year and general optimism around the gaming sector. Gaming is estimated to reach $200 billion in revenue this year with further growth forecast in 2026 alongside the release of Rockstar Gaming's Grand Theft Auto 6.

- Immutable is well positioned to capitalize on that growth after teaming up with gaming giant Ubisoft on the next iteration of Might and Magic Fates in April.

- Blockchain technology could have a key role to play in gaming if trends shift toward in-game ownership of items, which could see the implementation of non-fungible tokens (NFTs) within a game that could then be collected or sold on for crypto tokens.

- IMX is currently trading at $0.736 having broken out of a key level of resistance. It will likely come back to test $0.70 as support before potentially moving higher, provided trading volume can sustain at these levels.

Derivatives Positioning

- Most major cryptocurrencies, including BTC and ETH, continued to experience capital outflows from futures, leading to a decline in open interest.

- AVAX stands out with OI rising over 14% as the token's market cap looks to climb above $13 billion for the first time since Feb. 2.

- Solana OI has reached a record high of over 70 million SOL, with positive funding rates pointing to bullish capital inflows.

- On the CME, OI in solana futures pulled back to 7.63 million SOL from the record 8.12 million SOL on Sept. 12. Still, the three-month annualized premium holds well above 15%, offering an attractive yield for carry traders.

- BTC CME OI continues to improve, but overall positioning remains light relative to ether and SOL futures.

- On Deribit, the bias for BTC and ETH put options continues to ease across all tenors as traders anticipate Fed rate cuts. SOL and XRP options remain biased bullish.

- On OTC network Paradigm, block flows featured BTC calendar spreads and shorting of call and put options.

Market Movements

- BTC is unchanged from 4 p.m. ET Monday at $115,500.55 (24hrs: +0.54%)

- ETH is unchanged at $4,513.45 (24hrs: -0.49%)

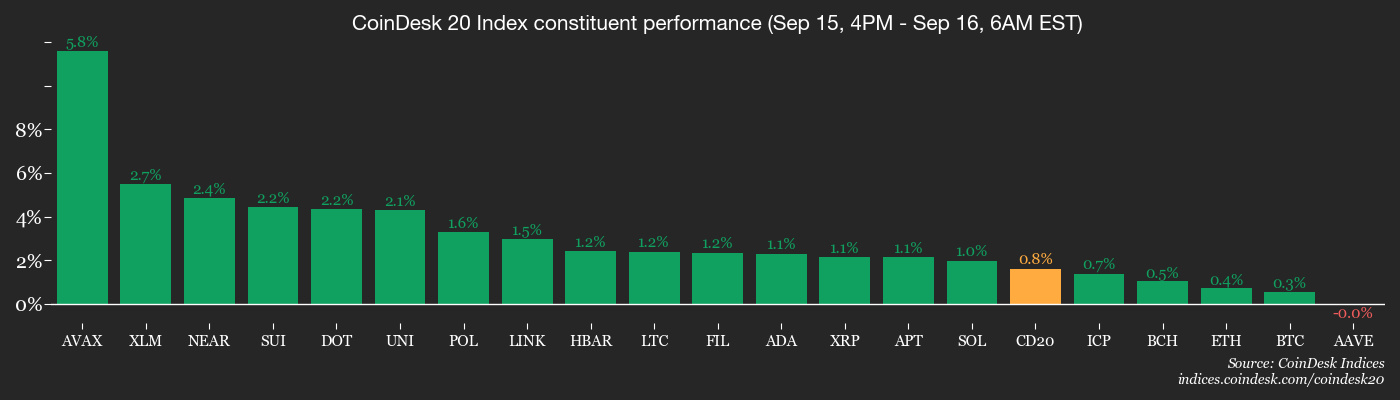

- CoinDesk 20 is up 0.48% at 4,271.28 (24hrs: +0.71%)

- Ether CESR Composite Staking Rate is up 5 bps at 2.87%

- BTC funding rate is at 0.0059% (6.4616% annualized) on Binance

- DXY is down 0.32% at 96.99

- Gold futures are up 0.42% at $3,734.70

- Silver futures are up 0.53% at $43.19

- Nikkei 225 closed up 0.3% at 44,902.27

- Hang Seng closed unchanged at 26,438.51

- FTSE is down 0.22% at 9,256.41

- Euro Stoxx 50 is unchanged at 5,437.55

- DJIA closed on Monday up 0.11% at 45,883.45

- S&P 500 closed up 0.47% at 6,615.28

- Nasdaq Composite closed up 0.94% at 22,348.75

- S&P/TSX Composite closed up 0.5% at 29,431.02

- S&P 40 Latin America closed up 1.64% at 2,904.55

- U.S. 10-Year Treasury rate is unchanged at 4.037%

- E-mini S&P 500 futures are up 0.19% at 6,633.75

- E-mini Nasdaq-100 futures are up 0.29% at 24,380.00

- E-mini Dow Jones Industrial Average Index are unchanged at 45,902.00

Bitcoin Stats

- BTC Dominance: 58.11% (unchanged)

- Ether to bitcoin ratio: 0.03907 (-0.36%)

- Hashrate (seven-day moving average): 1,025 EH/s

- Hashprice (spot): $53.98

- Total Fees: 4.41 BTC / $508,109

- CME Futures Open Interest: 140,975 BTC

- BTC priced in gold: 31.2 oz

- BTC vs gold market cap: 8.82%

Technical Analysis

- The monthly chart shows that BTC is again probing the trendline connecting the previous bull market peaks.

- Bulls failed to establish a foothold above that trendline in July and August.

- A third straight failure could really embolden sellers, potentially yielding a deeper drop.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $327.02 (+1.23%), +0.27% at $327.91

- Circle (CRCL): closed at $134.05 (+6.97%), unchanged in pre-market

- Galaxy Digital (GLXY): closed at $30.77 (+3.6%), +0.58% at $30.95

- Bullish (BLSH): closed at $51.08 (-1.47%), +0.59% at $51.38

- MARA Holdings (MARA): closed at $16.24 (-0.43%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $16.68 (+4.97%), +1.08% at $16.86

- Core Scientific (CORZ): closed at $16.32 (+2.9%), +0.37% at $16.38

- CleanSpark (CLSK): closed at $10.29 (-0.58%), +0.1% at $10.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $38.73 (+3.78%), +1.96% at $39.49

- Exodus Movement (EXOD): closed at $27.88 (-1.69%), -1.94% at $27.34

- Strategy (MSTR): closed at $327.79 (-1.1%), +0.34% at $328.89

- Semler Scientific (SMLR): closed at $28.39 (-2.74%)

- SharpLink Gaming (SBET): closed at $16.79 (-5.14%), +0.54% at $16.88

- Upexi (UPXI): closed at $6.33 (-6.29%), +0.95% at $6.39

- Lite Strategy (LITS): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $259.9 million

- Cumulative net flows: $57.05 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: $359.7 million

- Cumulative net flows: $13.74 billion

- Total ETH holdings ~6.53 million

Source: Farside Investors

While You Were Sleeping

- Gold Uptrend Intact, but Due for Correction Before Topping $4,000 in 2026 (Reuters): Gold has surged 40% in 2025, outpacing the S&P 500. Analysts warn it looks overbought and may decline before targeting $4,000 next year.

- Coinbase Policy Chief Pushes Back on Bank Warnings That Stablecoins Threaten Deposits (CoinDesk): Coinbase’s Faryar Shirzad said concerns of stablecoin deposit flight are myths, claiming banks are really defending profits from an outdated payments system.

- King Charles Rolls Out the Red Carpet to Woo Trump (The Wall Street Journal): U.K. Prime Minister Keir Starmer is using royal pageantry to sway Trump on tariffs and European security, while the visit will showcase new U.S.-U.K. cooperation in technology and energy.

- Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets (CoinDesk): The Deutsche Börse subsidiary launched AnchorNote in Switzerland, letting institutions trade digital assets across venues while keeping them in custody to cut counterparty risk and improve capital efficiency.