Tokenized Gold Market Surpasses $2.5B as Precious Metal Nears Record Highs

Digital gold meets physical momentum as tokenized precious metal markets hit unprecedented scale.

Bullion Goes Blockchain

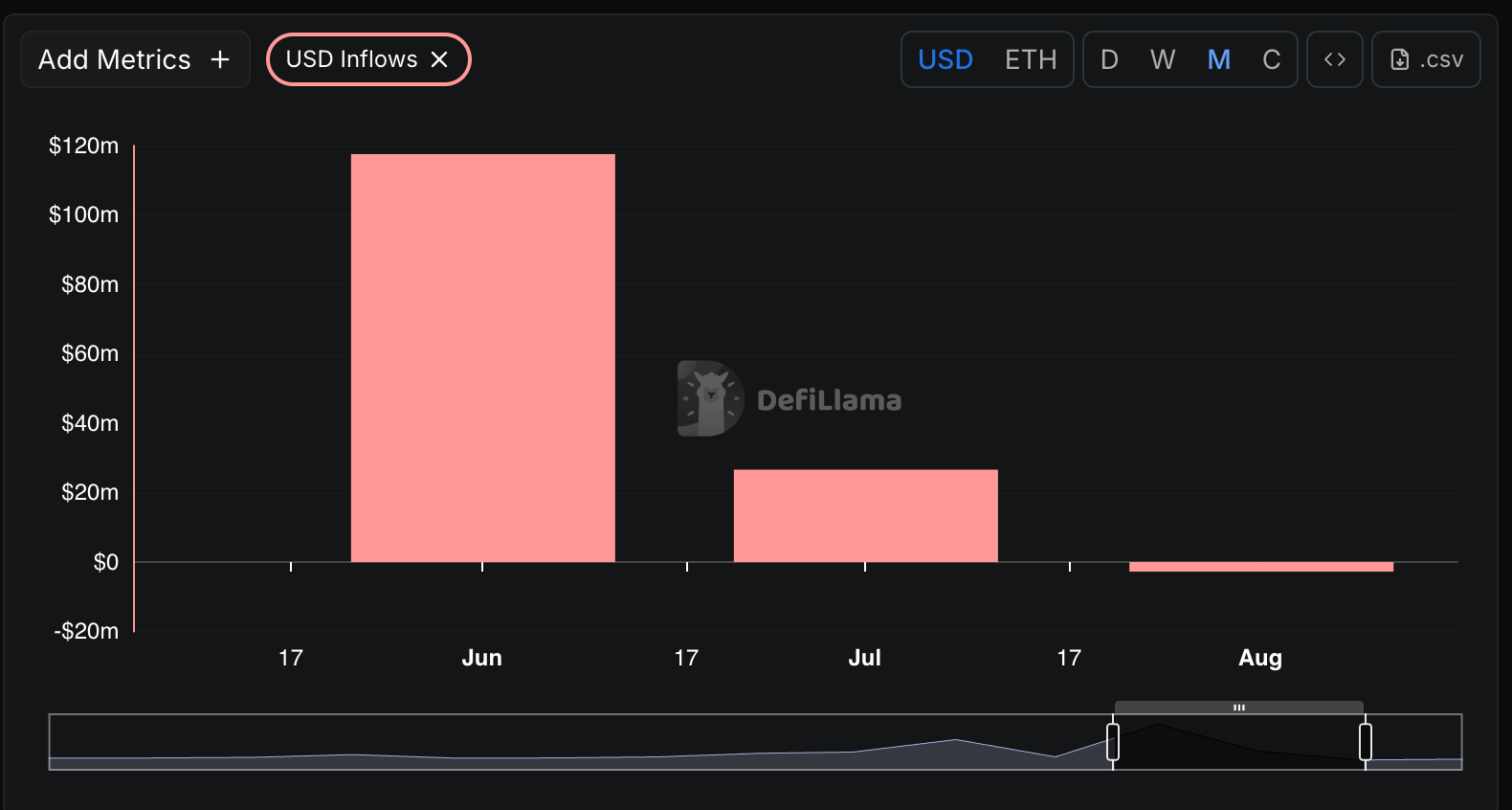

Tokenized gold products just smashed through the $2.5 billion barrier—proving even ancient store-of-value assets get crypto makeovers. While traditional finance still argues about gold ETFs, blockchain-based alternatives are quietly eating their lunch.

Precious Metal 2.0

Gold's march toward record highs fuels demand for digital exposure without vault storage headaches. Investors want the glitter without the physical baggage—24/7 trading, fractional ownership, and borderless transfers.

Traditional gold bugs might clutch their pearls, but smart money knows: if you're not tokenizing it, you're already behind. Another legacy finance model getting disrupted by digital efficiency.

Gold currently traded at around $3,470, just shy of the April 22 peak hit amidst the tariff tantrum.

The precious metal, which is widely considered as a SAFE haven asset during times of uncertainty, has been resurging lately, driven by a steepening U.S. Treasury yield curve.