Crypto Carnage: $860M Wiped Out as ETH, BTC, XRP, DOGE Plunge 9%—Bullish Traders Rekt

Crypto markets just got a brutal reality check—liquidations surged as top assets nosedived overnight.

Blood in the streets: Ethereum, Bitcoin, XRP, and Dogecoin all tanked 9% in a synchronized smackdown. Leveraged longs got vaporized faster than a meme coin's utility.

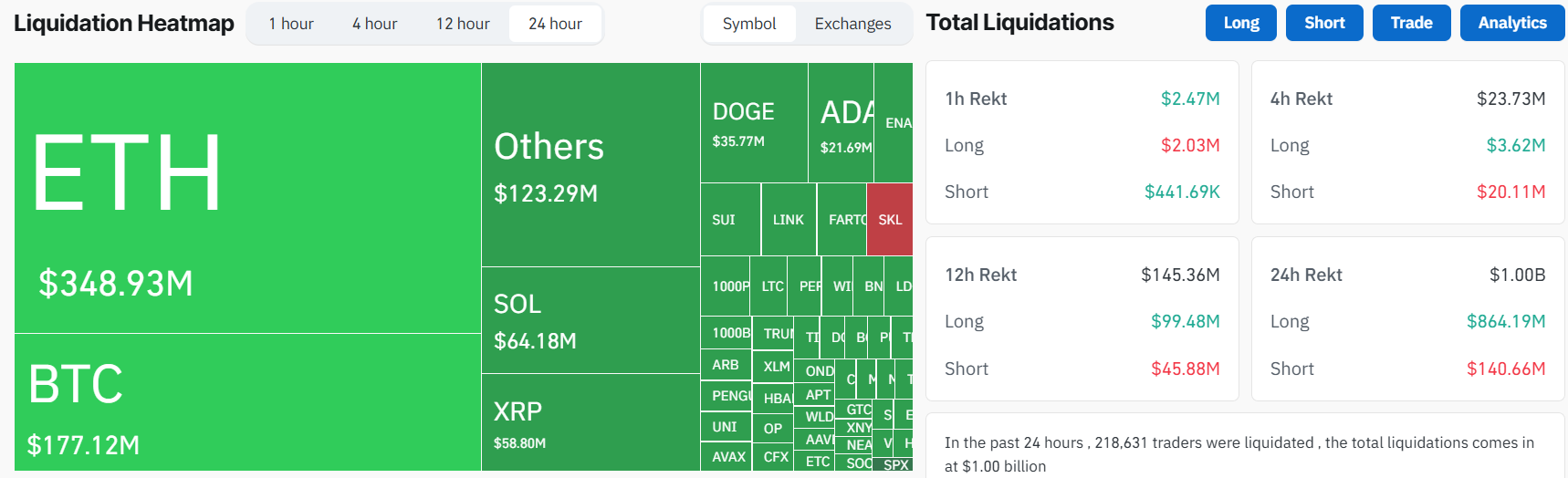

The reckoning: $860 million in bullish positions got forcibly closed. Turns out 'number go up' isn't an investment thesis—who knew?

Silver lining for degens: Double-digit dips mean fire sale prices... until the next margin call hits.

Bybit accounted for the largest share of the wipeout, at $421.9 million, with more than 92% of those losses stemming from overleveraged long positions. Binance followed with $249.9 million in liquidations, while OKX saw $125.1 million.

The largest single liquidation was an ETH-USDT perpetual swap worth $6.25 million on OKX.

Jeff Mei, COO at BTSE, said the inflation surprise “put the brakes on an incredible crypto rally this past week,” adding that markets are likely to “hover around their current levels until more positive guidance comes from the Fed.” He noted the ongoing “threat of inflation continues to persist and could impact the likelihood of rate cuts in September.”

Nick Ruck, director at LVRG Research, pointed to the broader macro pressure on crypto’s recent gains.

“This week in crypto saw BTC reaching a new all-time high but later impacted by macroeconomic tremors,” he said in a Telegram message. “Inflation surged much higher than expected, reinforcing fears of sticky inflation and delaying Fed rate-cut expectations."

"The sell-off underscores crypto’s growing sensitivity to macro liquidity shifts, with traders now eyeing labor metrics in early September for clues on the Fed’s next move. We’re optimistic that the market will rebound as the fundamental values of crypto driving the bull run remain in place," Ruck added.

Traders are now watching U.S. economic data releases and Fed commentary closely, with September shaping up as the next major inflection point for monetary policy.