XRP, DOGE, SOL Crash Hard—But Here’s the One Signal That Could Trigger an Altcoin Season Comeback

Crypto markets got steamrolled this week—XRP, Dogecoin, and Solana led the bloodbath as traders scrambled for exits. But don’t write off altcoins just yet.

The make-or-break factor?

Liquidity. If Bitcoin stabilizes and capital starts rotating back into riskier plays, the altcoin pump could reignite overnight. Traders are watching for that pivot like hawks.

The cynical take:

Wall Street’s ‘risk-on’ algorithms will probably front-run retail anyway—classic finance theater. Meanwhile, leverage flushes out weak hands, setting the stage for the next speculative frenzy. Stay sharp.

When altcoin season?

The sharp sell-off of the past few days came after weeks heavy capital rotation into smaller tokens, fueling talks of a full-blown altcoin season. That period, sometimes dubbed alt season, occurs when riskier, smaller tokens outperform bitcoin, the leading crypto, for a sustained period.

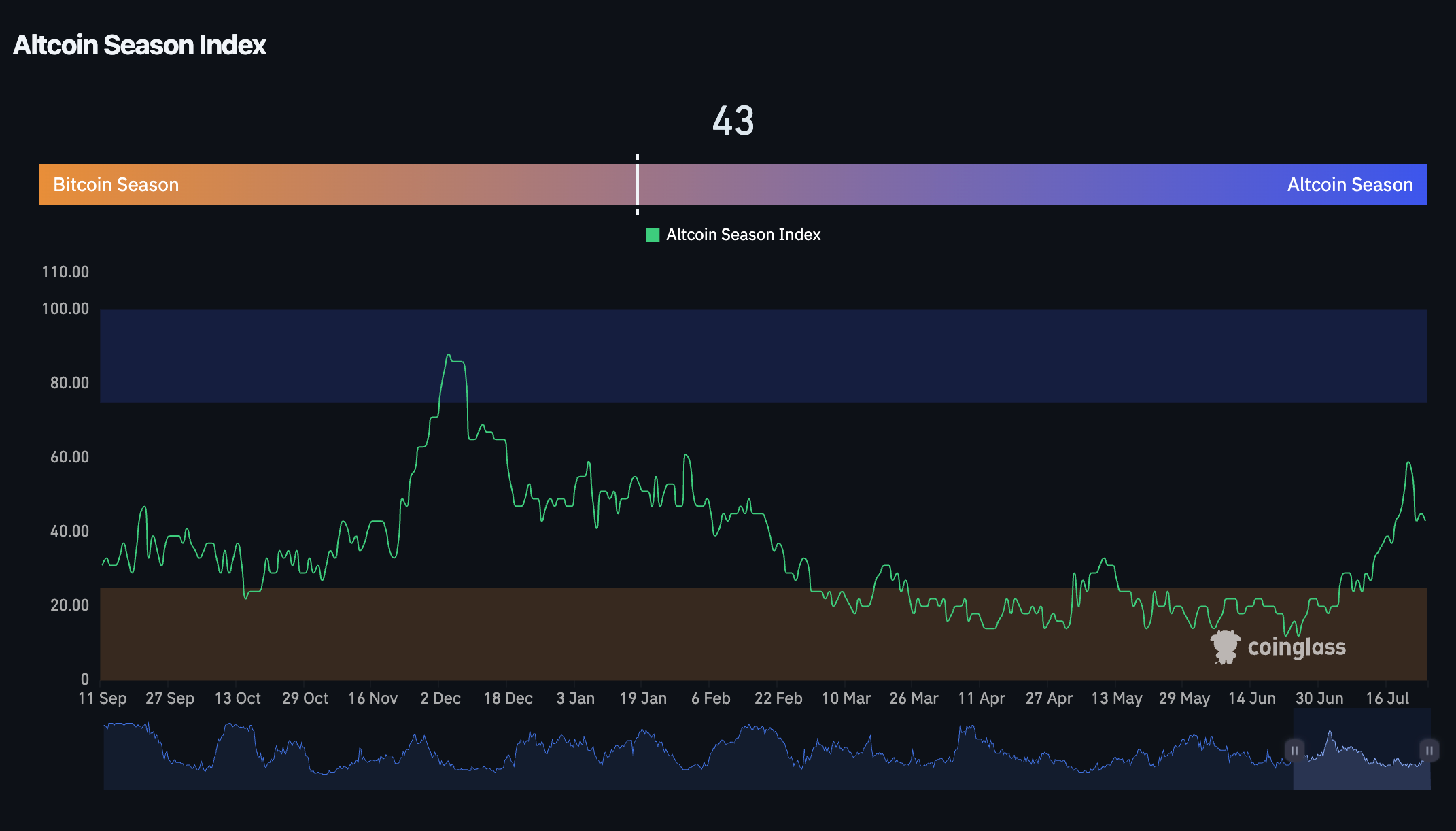

CoinGlass' Alcoin Season Index, which measures the altcoin market's outperformance versus BTC on a scale of 0 to 100, cooled off to 41 on Friday from Monday's 59, the strongest reading since the late January speculative frenzy around President Trump's inauguration.

Still, the total altcoin market (except stablecoins) saw a rapid appreciation, nearly doubling in value since April, David Duong, head of research at Coinbase, said in a Friday report.

For this week's pullback, traders taking on excessive leverage on altcoin bets were to blame, the report pointed out.

The Altcoin Open-Interest Dominance metric, which compares the amount of dollars tied up in altcoin derivatives contracts to bitcoin's, soared to 1.6, a level that has preceded previous market shake-outs, the report noted. A decrease in the ratio WOULD suggest a healthy leverage reset for the altcoin market, otherwise more shakeouts are expected, Duong wrote.

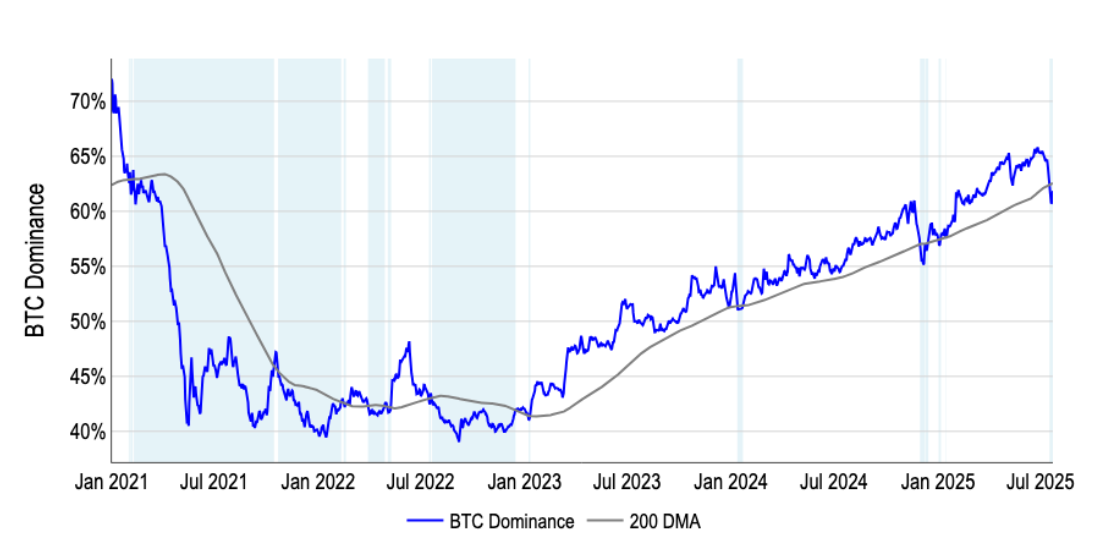

For an extended altcoin season, investors should keep an eye on the Bitcoin Dominance, which measures BTC's share of the total crypto market capitalization. The metric has broken below the 200-day moving average for the first time since a brief period in January 2025, the report noted.

"A sustained MOVE under the 200-DMA could validate the 'alt season' narrative and have historically preceded multi-week stretches of altcoin outperformance (like in 2021)," Duong wrote.

However, traders might be better off waiting for more consecutive sessions closing below the level before piling into altcoin bets for a more "prudent positioning," he added.