Michael Saylor Doubles Down: How He’s Rewriting Crypto’s Yield Curve Playbook in 2025

MicroStrategy's bitcoin maximalist is at it again—constructing his own financial gravity while Wall Street watches.

Yield curve? More like yield swerve.

Saylor's stacking sats like the Fed prints dollars, turning treasury bonds into punchlines. Who needs 10-year notes when you've got a 10,000% asset?

(Cue the obligatory 'this time is different' from traditional finance dinosaurs.)

According to a Fidelity alert on X, the deal is 28 million shares priced at $90 each, totaling over $2.52 billion. This represents a dramatic increase from the original $500 million goal announced just days earlier and underscores the company’s continued ambition to aggressively expand its Bitcoin BTC holdings.

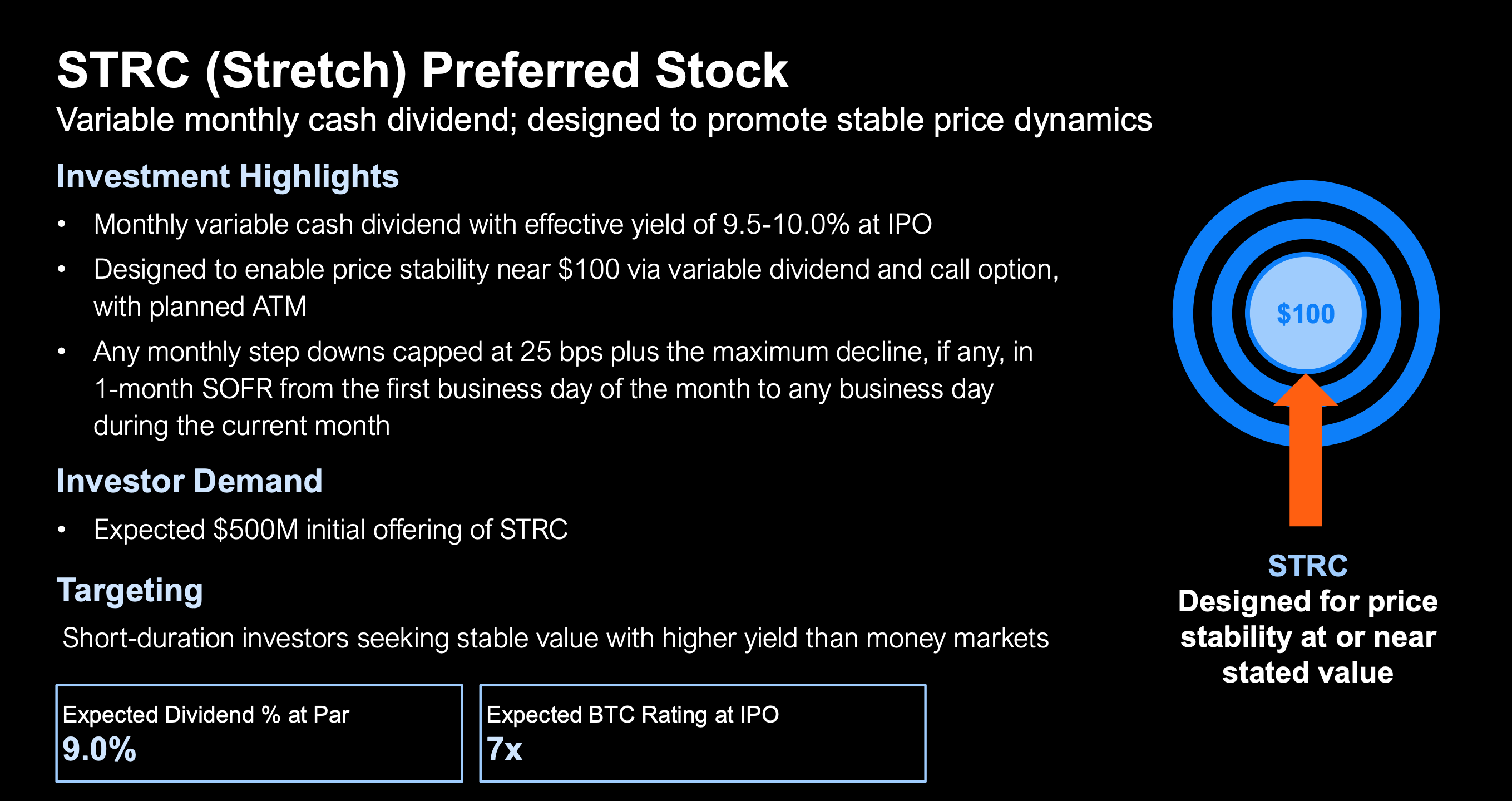

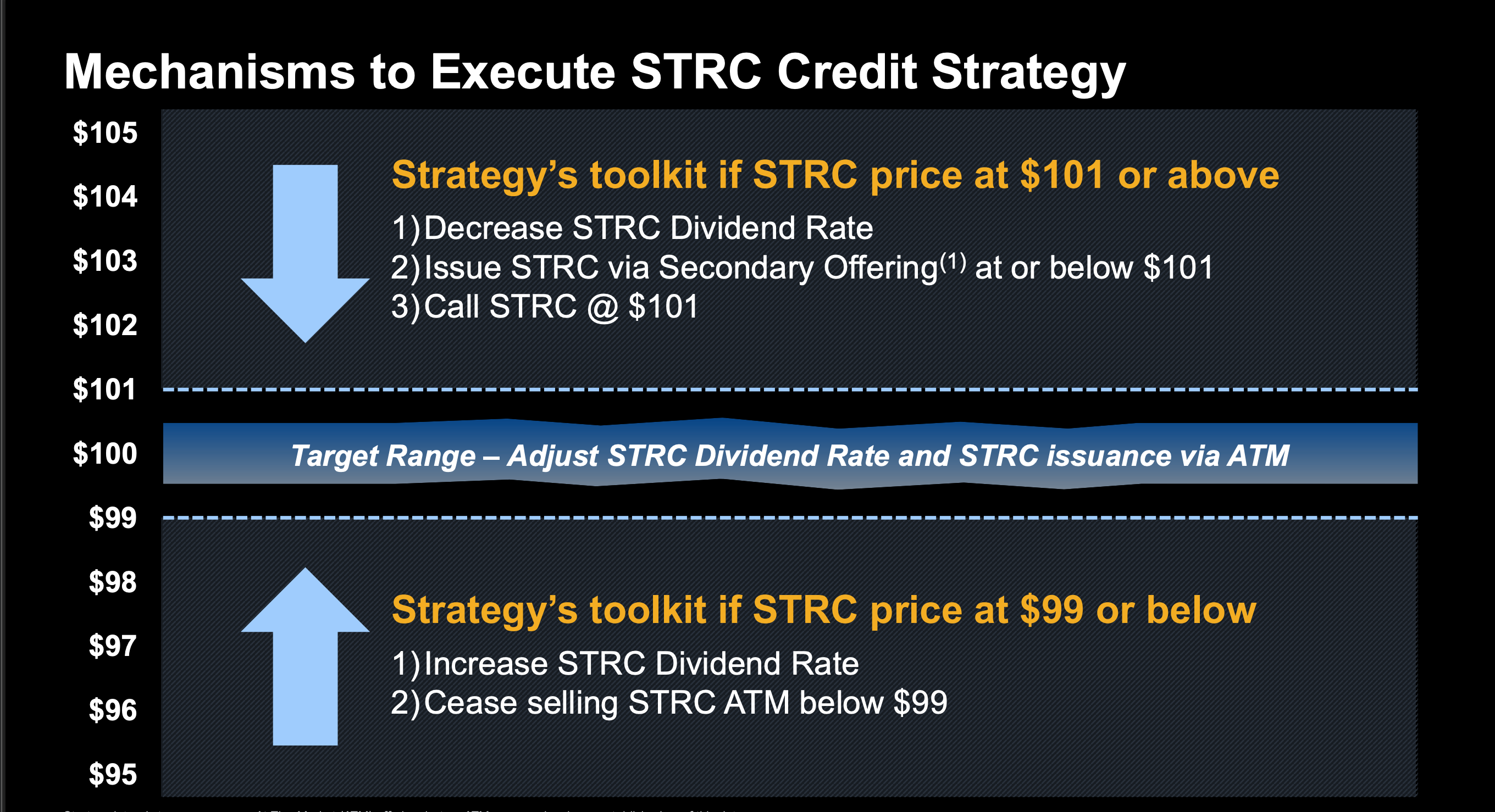

STRC is a senior, perpetual preferred stock offering a variable monthly dividend designed to appeal to yield-seeking investors who want stability NEAR par value. At the time of the offering, STRC carried an effective yield of 9.5%–10.0% paid monthly. It contains mechanisms to maintain a trading range close to $100, including adjustable dividend rates, secondary issuance windows and call options above par.

The toolkit includes raising dividends and halting sales when STRC trades below $99, or issuing new shares and calling the stock if it rises above $101. These levers are designed to create a self-correcting system that promotes market stability while offering attractive returns in the current interest-rate environment.

Any step-downs in the dividend are capped at 25 basis points plus the maximum decline in the one-month secured overnight financing rate (SOFR) over the period.

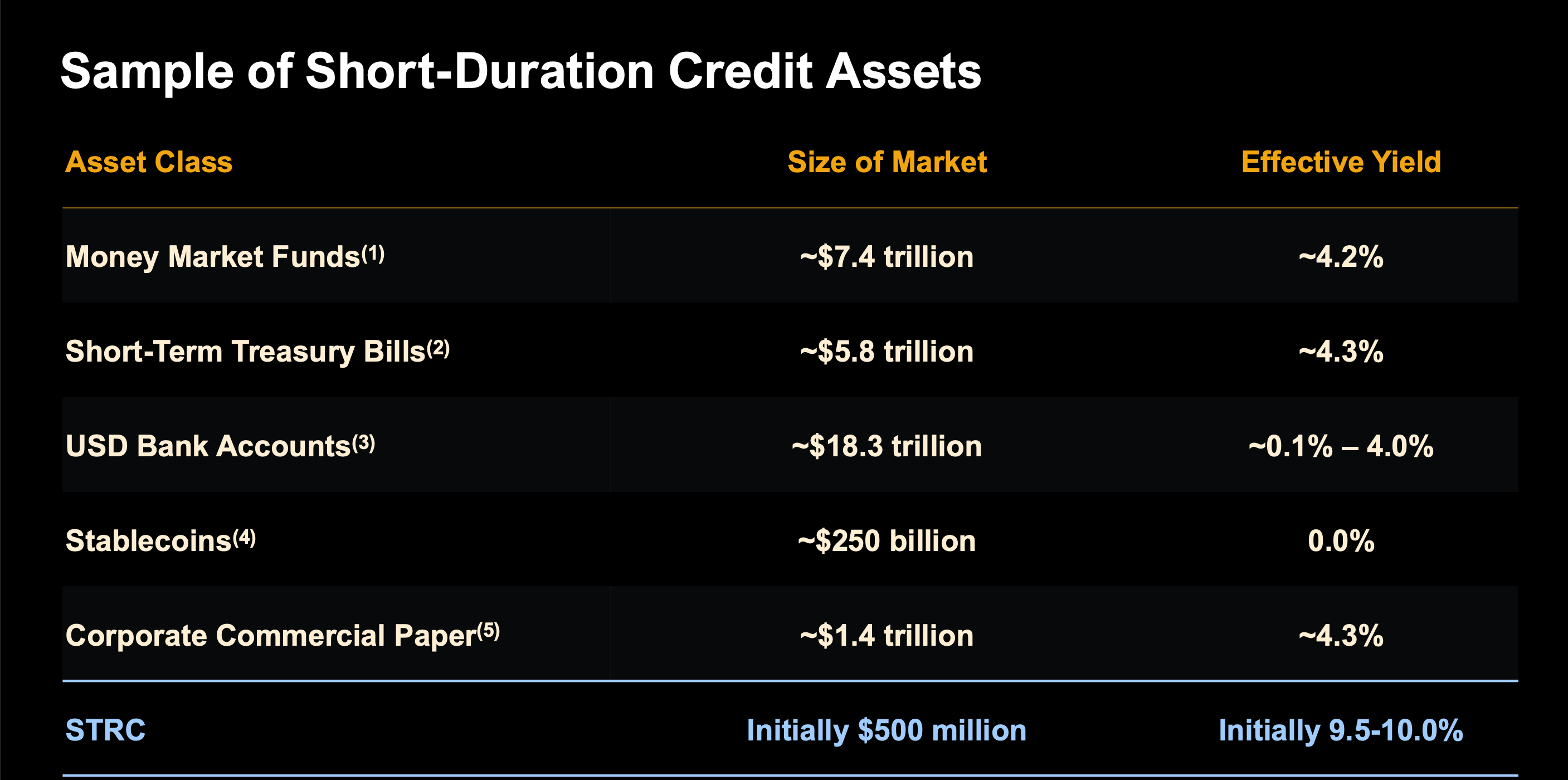

Compared with conventional short-duration credit options, STRC stands out, offering more than double the 4% available from money market funds and Treasury bills. It is targeting investors looking for higher yield without significant price volatility, positioning it competitively against traditional instruments like commercial paper and bank deposits.