🚀 Bitcoin Whale Bets $23.7M on BTC Exploding to $200K Before New Year’s Eve

A crypto whale just went all-in—dropping a jaw-dropping $23.7 million on Bitcoin price options targeting a $200K moonshot by December 31st.

### The Ultimate Crypto Flex

While retail traders fret over gas fees, this whale’s move screams confidence—or reckless hubris. Either way, it’s the kind of volatility porn Wall Street secretly craves but won’t admit at dinner parties.

### Timing the Ticking Clock

With five months left, the bet hinges on a perfect storm: ETF inflows, halving aftershocks, and maybe a Elon Musk tweet. Because in crypto, fundamentals are optional.

### Finance’s Dirty Little Secret

Let’s be real—traditional investors pretend to hate this casino… while quietly stacking SATs. Happy hedging, degenerates.

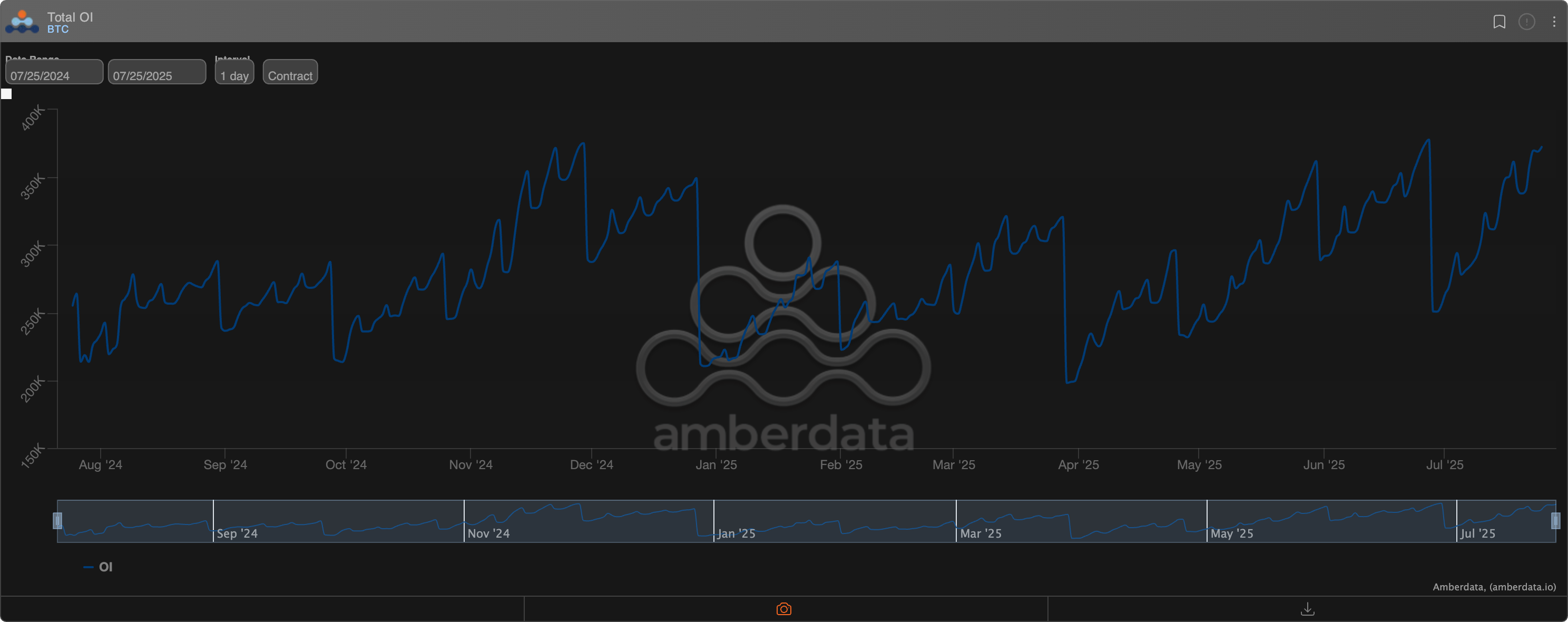

Record options activity

BTC's price rally and growing institutional interest in structured products, which involve volatility selling, have boosted activity in the options market.

On Deribit, which accounts for over 80% of the global options activity, the BTC options open interest, or the number of open options contracts, was 372,490 BTC as of writing – just shy of the record high of 377,892 set in June.

Meanwhile, open interest in ether options has hit a record high of 2,851,577 ETH, according to data source Amberdata. On Deribit, one options contract represents one BTC or ETH.